The crypto market is still trying to move forward after the FTX stock market crash. Widespread losses have partially eroded confidence in the crypto market. A few assets registered increased selling pressure. Despite the market downturn, several altcoins stand out and show the potential to regain their previous highs. Here are the coins to watch, according to crypto analyst Paul L.

The first altcoin on the list: Litecoin (LTC)

Litecoin (LTC) has registered increased buying pressure with the coin token at a point surpassing the market cap cryptocurrency Shiba Inu (SHIB). Although LTC has long been called “boring”, cryptocoin.com As we reported, the token’s latest gains are less than a year away from the halving. As of November 23, more than $1 billion flowed into LTC in one day as the asset recorded its highest price in a year against Bitcoin (BTC). Notably, the recent price action has copied the recovery trend of previous months into the halving, as the asset is targeting the $100 level. In this case, the next LTC halving is scheduled for August 2023.

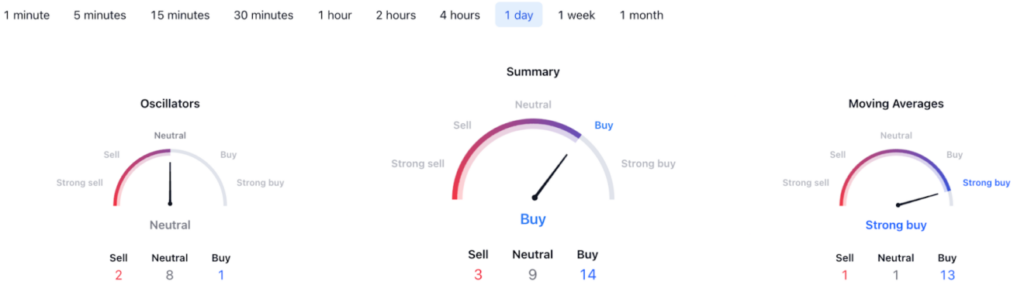

Currently, Litecoin is trading at $77 and is expanding its recent gains after hitting its monthly high of $82. Crypto trading expert Rekt Capital stated that for LTC to recover further, the asset must stay above $67. Also, LTC technical analysis looks bullish with a summary going to “buy” at 14 with moving averages supporting a “strong buy” at 13 on TradingView daily indicators. On the other hand, oscillators remain “neutral” at eight.

Prospects for Dogecoin (DOGE)

The meme cryptocurrency has been on the bullish trend line amid positive news about the token recently. In particular, the rally came as the DOGE community took action to bring more benefits to the asset. As reported by Finbold, Ethereum (ETH) co-founder Vitalik Buterin and Tesla CEO Elon Musk are reportedly planning to get together and work to raise Dogecoin.

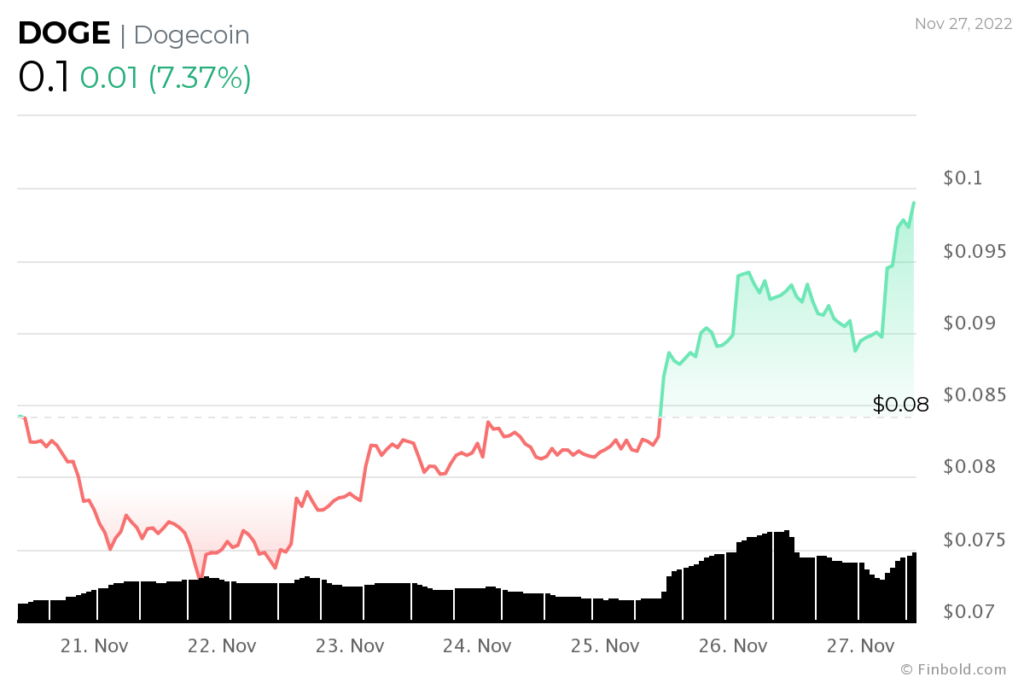

Indeed, Musk has been a firm supporter of DOGE with his tweets about the asset that led to the price rally. At the same time, since Musk bought Twitter, speculation has surfaced about DOGE’s possible integration with the social media platform. Currently, DOGE was trading at $0.10, up about 7% in the last 24 hours. The increase followed continued buying pressure, with DOGE registering a market cap of $12.9 billion.

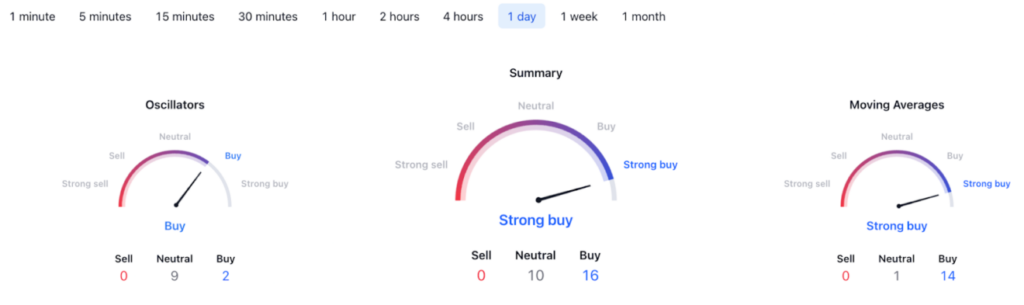

At the same time, the Dogecoin community remains bullish on the prospects of the asset as it targets the $1 level. According to an earlier report, the community’s bullish trend is illustrated by DOGE investors being among the least stressed crypto holders amid sustained bearish conditions. From a technical analysis perspective, DOGE is bullish with a summary standing at ‘buy’ at 15 points on the daily indicators. The moving averages point to a “strong buy” at 13.

There are many developments for the popular altcoin Cardano (ADA)

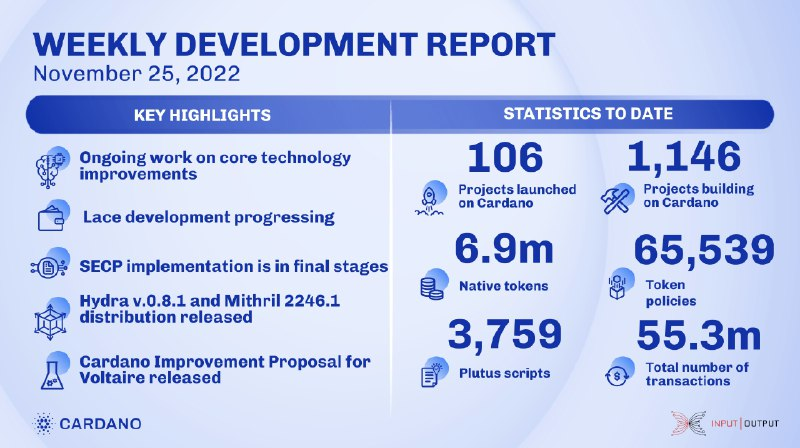

Cardano’s (ADA) prospects are mainly linked to the network’s continuous evolution string. Some of the developments focus on improving the Lace wallet development, which is the core technology of the network, among others. At the same time, more than 1,000 projects have been built on the network and 106 projects have been launched in Cardano.

Part of the network’s growth has seen ADA wallets exceed 3.7 million, hitting over 100,000 in November alone. At the same time, Cardano records more than 55 million transactions, while the smart contract feature has more than 3,700 plutus scripts. In line with this, Cardano also launched the Plutus DApp resource page for developers.

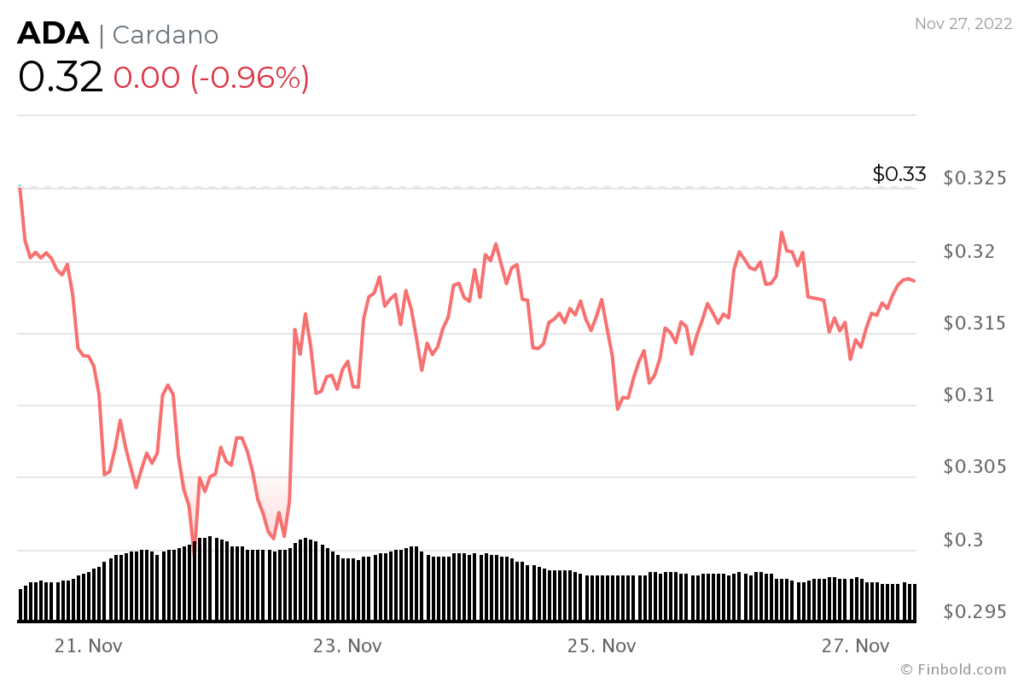

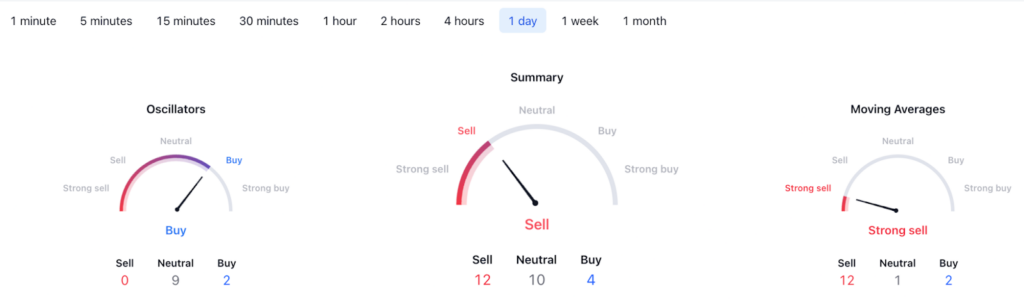

Overall, network development is expected to act as a critical catalyst for ADA’s possible price rally. Meanwhile, ADA is changing hands at $0.32, losing about 4% weekly. Also, the ADA technical analysis continues its predominantly bearish trend, with the summary of daily indicators going to “sell” at 12 and moving averages to “strong sell” at 12. However, the oscillators are going “bought”.

Altcoin project of Huobi exchange: Huobi Token

Huobi Token (HT) is on a bullish trajectory challenging the overall market price action. Huobi cryptocurrency exchange’s native token is posting weekly gains of 58%, while the daily chart shows a 4% rally. The price is trading at $7.14. Also, continued buying pressure has resulted in HT reaching a market capitalization of approximately $1.09 billion.

It is worth noting that the HT rally accelerated after About Capital Management announced that it had acquired Huobi Global. Under the deal, About Capital will control a majority stake in the firm. At the same time, Justin Sun, the founder of the blockchain DAO system Tron, is preparing to join the firm as a consultant. Notably, the bullish around HT is exhibited with a “buy” at 15 in technical analysis, while the moving averages suggest a “strong buy” at 13.

Chainlink (LINK) is also on the list

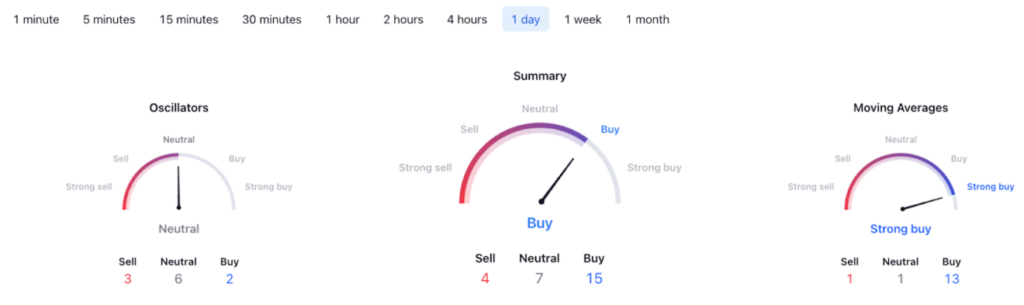

After starting the week with uncertainty and turbulence, LINK price rebounded and recorded sustained buying pressure resulting in over 15% weekly growth. Indeed, the entity has recorded increased network activity as active addresses soar to new heights. The gains come after Chainlink announced a number of partnerships and integrations with platforms, including Cask Protocol and Shamba Network.

Additionally, Chainlink has taken advantage of the recent FTX crypto exchange fallout by choosing to offer proof-of-reserve services for troubled business entities. Although this feature was launched almost two years ago, it has gained popularity recently as crypto exchanges have become the center of attention for sharing proof of reserve. Currently, LINK is trading at $7.15, up almost 4% in the last 24 hours, with a market cap of around $3.6 billion. Based on the recent price action, cryptocurrency trading expert Michaël van de Poppe stated that LINK should sustain resistance around $7.05 and line up to hit $8.50.

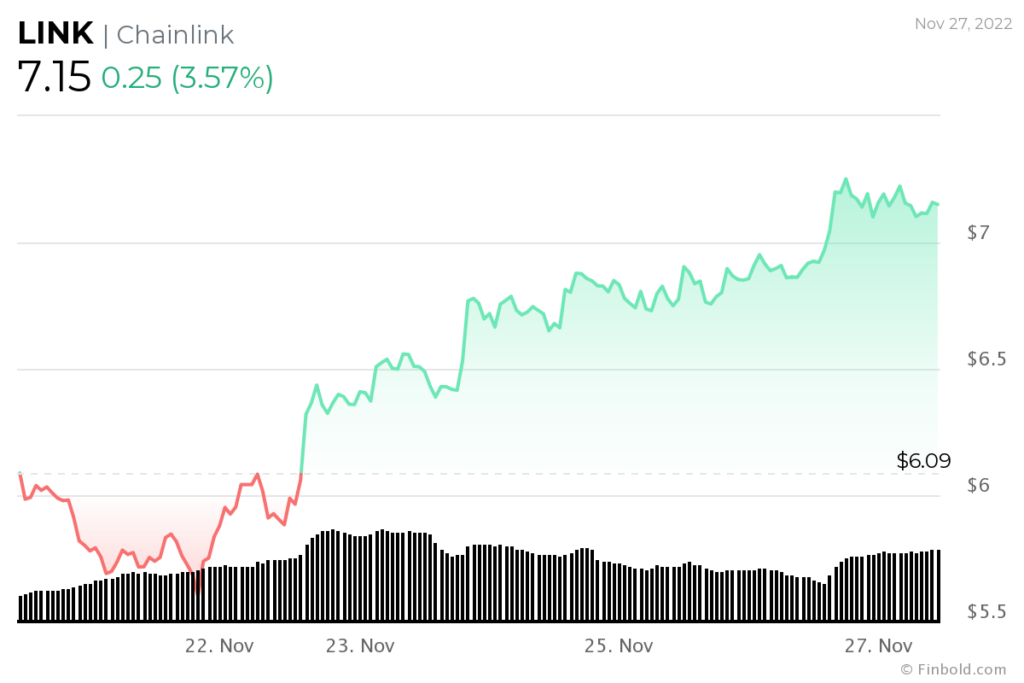

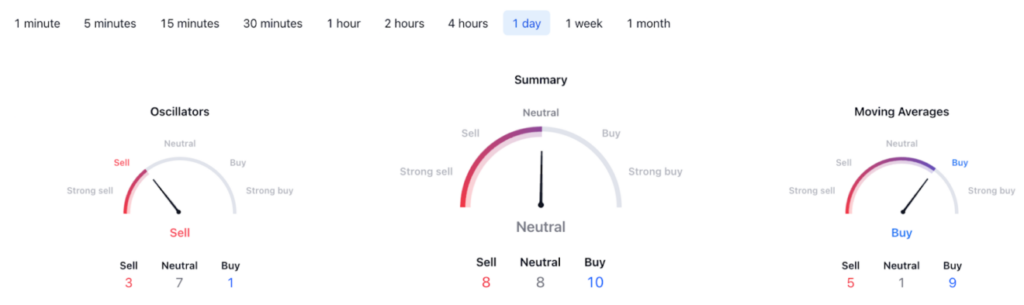

Also, a summary of Chainlink technical analysis suggests neutrality at eight, while the moving averages are at the “buy” level at nine. Oscillators are at the “three” level on the daily indicators. This indicates sales. Overall, the gains of the highlighted altcoins help the crypto market turn a new leaf after the FTX crisis. The future of the market is also at the mercy of ongoing macroeconomic factors.

Expectations for MATIC

Finally, there is the Polygon (MATIC) interpretation. The price is not promising any bullish momentum anytime soon as the EMA-100 continues to be rejected at the $0.88 level. MATIC is trading at $0.85. If it fails to trade above $0.88, it could soon enter a bearish consolidation. A break below the 23.6% Fib retracement might force the MATIC to retest the support level at $0.77.

If Polygon breaks below $0.77, it could trade near the critical price level of $0.68. However, while the RSI is trading around 46, it is attempting to enter a buy zone and MATIC could head towards the $0.87-0.9 resistance zone, where the Bollinger band’s upper boundary at $1.1 could target.