Former Bank of England Governor Mark Carney ditched me for Bridgewater Associates founder Ray Dalio as European Central Bank President Christine Lagarde walked past in the Congress Centre at the World Economic Forum’s annual meeting in Davos, Switzerland.

And somehow that was only the second-most surreal thing to happen to me this week.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

The badgeless

The narrative

A very nice gentleman I met in Davos told me there were about 2,500 official delegates at the World Economic Forum (WEF) this year, and about 3,500 people from the crypto industry on the Promenade outside the main event.

Why it matters

The crypto industry’s attendance at the meeting and the side events outside were meant to be a signal. Crypto, as an industry, should be taken seriously. However, the point of setting up a “house” in Davos on the famed Promenade outside the main WEF meeting is to get your name out there – to show that you have a real brand. It’s not to secure a quick return on investment. As the crypto market continues in its latest bear market (amid broader economic turmoil), the question is what sort of return this actually looks like.

Breaking it down

Crypto has arrived.

Two days in a row, on the train back to my AirBnB after panels at the WEF annual meeting, I met people who are involved in the crypto industry. Attendees who ventured outside of the Congress Centre, where the main panels were held, came face to face with posters and advertisements from different crypto companies. Panelists in various sessions brought up crypto unprompted. I went to a dinner hosted by an entity that has nothing to do with crypto and met someone who invested in certain cryptocurrencies years ago (and he was the second crypto investor I met at dinners!).

Clearly this industry is on people’s minds in some way, shape or form. The question is whether the crypto presence was worth it.

Industry participants paid massively for the privilege of splashing their banners across various buildings. No one shared any specific figures but it’s Davos. In a normal year, companies are competing with financial giants and lauded tech firms. This year, Accenture, SalesForce, Meta (formerly Facebook) and surveillance firm Palantir all set up facilities.

The rescheduling of Davos to May seems to have really thrown things off. Numerous people told me that this year’s event was much smaller than normal. It certainly ended very abruptly, with the security gates blocking off the Congress Centre taken down very quickly by early afternoon Thursday, despite the fact that in theory the event was still underway.

In other words, it’s possible, even plausible, that the crypto industry was able to take advantage of a gap in normal sponsorships to get a foot in the door, so to speak. It’s far too early to know whether they’ll be able to repeat this during a normal WEF meeting (the next one will be Jan. 15-20, 2023). Matthew Blake, head of the future of financial and monetary systems at the WEF, told me that the annual meeting wouldn’t have any crypto panels if there wasn’t interest from multiple parties.

“Everything that we do from a thematic and research basis has a multi-stakeholder property to it,” Blake said. “That’s kind of core to how we operate. And the answer is absolutely, I mean, I think one of the key areas where we’ve seen keen interest from central banks around the world is in the [central bank digital currency] space … We’re doing interviews around the world with members of parliament, you know, central banking authorities, ministers of finance, and so on. I think there’s a combination of like trying to understand the evolution of this space and staying on top of it.”

Even central bankers and finance regulators – though not necessarily welcoming crypto with open arms – are at least tolerating the sector.

The International Monetary Fund’s managing director, Kristalina Georgieva, told a panel discussing central bank digital currencies “not to pull out of” the cryptocurrency sector, adding that it is important to “separate apples from oranges and bananas.”

Others were more explicitly pro-regulation

Here are some thoughts on how the CoinDesk team approached this year’s event, and what we can or should do next year.

First off, I overestimated our access to reliable internet. A few of you pinged on Telegram but those messages usually came in hours later and didn’t load when the notifications came in. So that was definitely a bit of an unwelcome surprise.

I definitely started planning a bit late, considering how much happened during the week.

Still, given all the uncertainties and setbacks, I’m really proud of the team we sent. On the reporting side, we had myself, Sandali Handagama and Helene Braun, both of whom I think excelled (more of their coverage is coming in the next week).

I also didn’t realize just how nonstop the whole thing would be. While I expected it to be a bit chaotic, this felt far more like Consensus 2018 than Consensus 2019 (the real mid-Gs here know what I’m talking about). Still, to be clear, I think this was both a fun and productive time.

Speaking of which…

Consensus 2022

CoinDesk will be in Austin, Texas June 9-12 for Consensus 2022, the long-awaited return of our IRL event after two years of virtual forums. It’ll be exciting!

On Friday, June 10, I’ll moderate a one-on-one discussion with Deputy Treasury Secretary Adewale Adeyemo. If you would like to ask a question, email [email protected] with your query. I’ll ask the best ones on stage.

We’ll also have a panel discussion with a team from the Federal Reserve focused on innovation and the U.S. central bank’s role. You can send your questions for the Fed officials to [email protected] as well.

Some other interesting panels:

-

Commodity Futures Trading Commission Chair Rostin Behnam and former CFTC Commissioner Dawn Stump will take part in a fireside chat with CoinDesk Chief Content Officer Michael Casey.

-

We’ll have a digital dollar debate with Dante Disparte, Rohan Grey and Caitlin Long, moderated by Forkast News’ Angie Lau.

-

We’ll have a lawmaker town hall featuring a handful of U.S. senators and congresspeople, moderated by CoinDesk’s Jesse Hamilton.

Hope to see you in Austin!

Biden’s rule

Changing of the guard

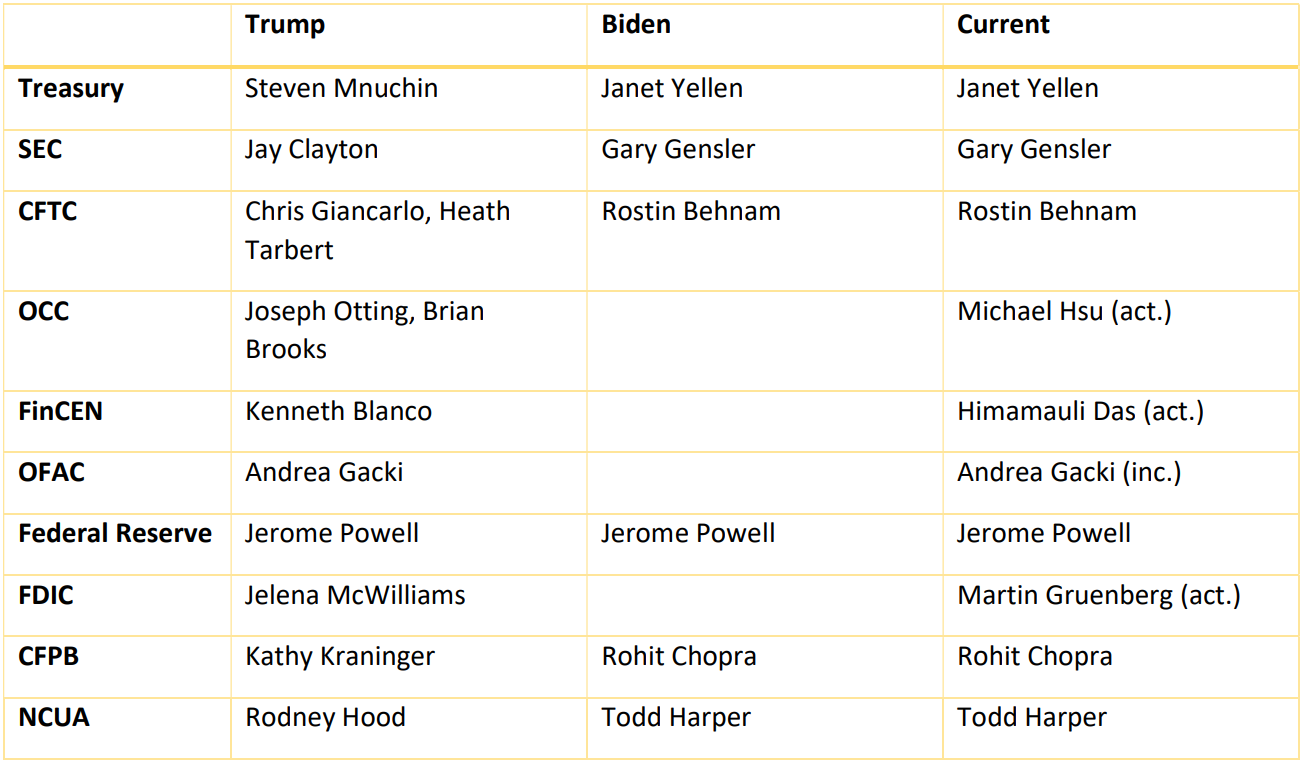

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

I’m going to be honest, I have no idea if anything happened this week. I promise to catch up before Tuesday, though.

Elsewhere:

-

At Davos, Crypto Is No Longer on the Outside: Our first dispatch from the World Economic Forum’s annual meeting, taking a look at just how much the industry has embedded itself this year.

-

Mastercard CEO Teases CBDC Panel: SWIFT May Not Exist in 5 Years: This was a weird one. Was Michael Miebach joking? Who knows. Sure, why not, let’s go with that.

Outside CoinDesk:

-

(Associated Press) Being incredibly serious for a minute: News broke a few nights ago that a lone gunman had gone into a school and shot over a dozen children and two teachers. As of this writing, 19 children and two adult teachers were killed. It’s heartbreaking and infuriating, and genuinely insane this can happen nearly 10 years after the Sandy Hook shooting in Connecticut. The AP has a reported timeline on the sequence of events.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!

Read more about

Save a Seat Now

BTC$28,665.43

BTC$28,665.43

2.94%

ETH$1,732.03

ETH$1,732.03

5.37%

BNB$301.24

BNB$301.24

3.21%

XRP$0.384184

XRP$0.384184

3.05%

SOL$41.43

SOL$41.43

6.35%

View All Prices

Sign up for Money Reimagined, our weekly newsletter exploring the transformation of value in the digital age.