Millions of dollars worth of altcoins will be unlocked in 2023. This could lead to a significant sell-off as investors sell off risky assets during a long bear market. Many crypto projects, including Sweatcoin and metaverse-focused Yuga Labs, are still feeling the effects of the collapse of major crypto firms across a large part of the crypto market. However, it will circulate additional tokens based on a “claim” scheme in 2023. Here are the altcoins that will enter the market and the probability of seeing sales…

Claim program for altcoins

Projects lock their native tokens into special “entitlement” contracts to ensure controlled release of their tokens on predetermined dates. A claim program also reassures investors that the creators of the project are committed to achieving the project’s ultimate goal.

While a token release increases a token’s market value, investors often sell their new tokens during tough macroeconomic conditions, resulting in price drops. Price data surrounding previous token releases often provides insight into the implications of future releases. According to analyst David Thomas, it is not unreasonable to expect a drop for altcoins to be unlocked.

326 million SWEATs will enter the market

According to the analyst, the first crypto to see a drop in the market in 2023 is Sweatcoin. cryptocoin.com As we reported, Sweatcoin, launched on the NEAR Blockchain in September 2022, rewards app users with SWEAT for exercising. Sweatcoin’s smart contracts will release 326,223,776.52 SWEAT ($3,500) for the SWEAT airdrop and contributions to the SWEAT treasury on January 13, 2023. A further 227,105,696 SWEATs ($2,430.03) are planned to be unlocked in August 2023. These unlocked tokens represent roughly 2 percent of SWEAT’s daily trading volume.

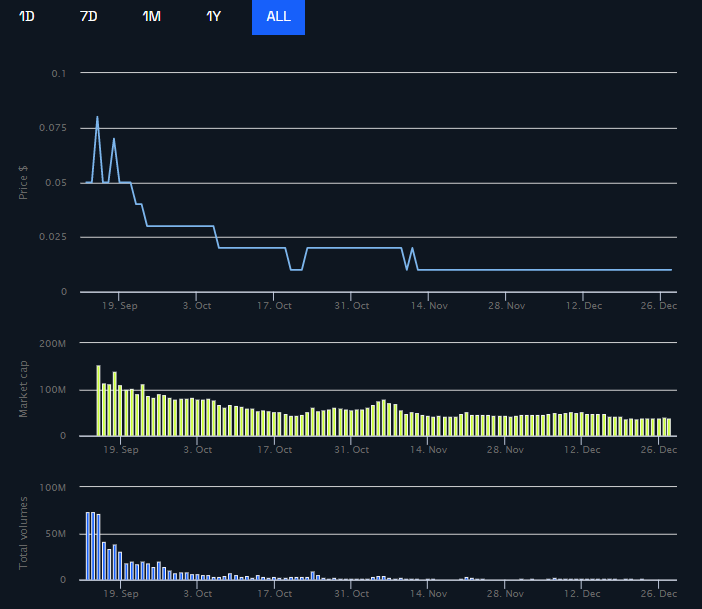

The first airdrop of SWEAT’s nearly 2 billion utility tokens took place on September 15, 2022. This saw the price spike to around $0.915. Then, about a week later, about 583 million SWEATs were unlocked, causing the price to drop by 40 percent. Then two unlocks at a similar rate caused the price to drop by 20 percent and 30 percent. According to the analyst, these figures show that Sweatcoin’s price may drop below $0.01, by dropping as much as 30 percent after unlocking in 2023.

188 million BITs will be freed on BitDAO

The second coin to look out for is Ethereum-based BIT, BitDAO’s governance token. BitDAO is a decentralized, autonomous organization that supports DeFi projects through research and development, token swaps, and grants. According to TokenUnlocks, BitDAO will release approximately 188 million BITs ($53 million) on January 15, 2023. This represents about ten times the trading volume of the token.

BitDAO smart contracts released 2 billion BIT tokens in July 2021. It caused the price of BIT to surge to $1.72 before falling roughly 22 percent on September 8, 2022. After releasing about 267 million BITs on September 15, 2022, the price dropped 11 percent. Afterwards, the token saw a long bearish divergence to its current price, as low as $0.28. Injections of 188 million BITs on January 15, 2023 could make the price drop below $0.25.

If the “winter” continues for Bitcoin and altcoins, the APE will also be in danger

Launched by Yuga Labs in March 2022, ApeCoin (APE) is the third cryptocurrency to be unlocked in 2023. Yuga Labs is the company behind the popular NFT collection Bored Ape Yacht Club. APE holders have governance rights in the ApeCoin DAO to help drive Yuga Labs’ Web3 and metaverse development. Yuga Labs initially distributed 150,000,000 APE to Bored and Mutant Ape Yacht Club NFT owners. It also plans to unlock 7.3 million ($26 million) APE for the ApeCoin DAO treasury on January 17, 2023. Apart from this, 33 million APE ($ 105 million) will enter the market on March 17, 2023.

After the launch of ApeCoin in March, its price reached $13.00. However, after this short rise, it fell to $ 9.62. Then, it reached a peak of $26.70 on April 29, 2022. It then fell sharply to $5.63 on May 12, 2022. The downward trend so far for the rest of the year closely mirrors the decline in interest in speculative NFTs such as BAYC and the metaverse. According to the analyst, the unlocking of the token worth more than $100 million could mean more pain for APE holders unless interest in the NFT market and metaverse resurfaces in 2023.