The asset tokenization and real-world asset (RWA) space caught the eye of retail and institutional capital investors in 2023 for its favorable blend of professionally-managed products and digital asset mechanics. Having advised 40-plus clients on tokenization strategies and issuances to date, we see the following key themes emerging in these markets in Q3 2023.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Blockchain Savings and Bottom-Line Improvements

For investors entering this space, the greatest efficiencies will come through end-to-end digital systems – meaning an on-chain lifecycle. That means savings in dollars or manual labor time relative to traditional processes. For example:

Money Markets and Treasuries as the Low-Hanging Fruit

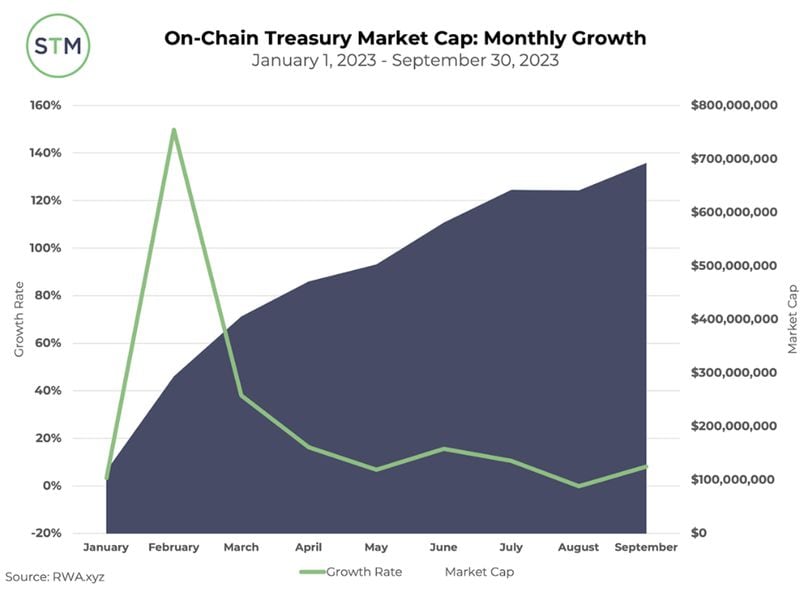

Asset managers and issuers are familiarizing themselves with tokenization workflows by trialing money market and treasury products. These tokenized assets generate a yield that can be passed on to clients, fully on-chain.

While alternative product strategies, like Hamilton Lane’s digitally-native private equity share classes, are in the works, money markets yield ~5% annually in low risk segments. This asset class accumulated almost $700 million in on-chain capital by the end of Q3 2023, up almost 520% YTD.

Tokenized Product Distribution through Institutional Client Bases

One of the weak points in the tokenization industry to date is actual product distribution and capital syndication. Institutions are beginning to move beyond just tokenizing assets for operational uses and savings (repo, collateral management) and are now placing tokenized products with their own client bases as buyers.

Citi is one name leading the charge here, offering digital corporate bonds through Singapore’s BondbloX to its Southeast Asia private banking and wealth management clients. UBS built upon its previous $400+ million digital bond issue to high-net-worth clients with an Ethereum-based money market fund, also in Singapore.

As blue-chips like JP Morgan and Goldman Sachs continue to develop their digital suites, expect their private banking, wealth & asset management, and alternatives teams to act as distribution channels unlocking serious capital that retail broker-dealers struggle to access.

You can read more of the State of Security Tokens 2023 in the Q3 publication.