Tokenized gold assets surpassed $1 billion in combined market capitalization on Tuesday, according to data by crypto price tracker CoinGecko, as gold’s price neared its all-time high.

Tokenized gold is a type of stablecoin that pegs its price to gold, while the tokens on the blockchain represent ownership of physical gold managed by the issuer. It offers investors a way to get exposure to the precious metal without the management fees of an exchange-traded fund (ETF) or the burden of storing gold bullions.

The two largest gold stablecoins – by far – are pax gold (PAXG), issued by the New York-based fintech firm Paxos Trust Company, and tether gold (XAUT), issued by Tether, the same company behind the $80 billion dollar-pegged stablecoin USDT. At the time of publication time, the market cap of PAXG and XAUT was standing at $518 million and $499 million, respectively, per CoinGecko data.

The price of gold, a traditional safe haven asset, has risen since March amid investor concerns about flailing banks and a possible government bailout, which would lead to expanding fiat money supply and currency devaluation. The metal was trading at $2,021 per ounce on Tuesday, just some 3% off its all-time high recorded in August 2020.

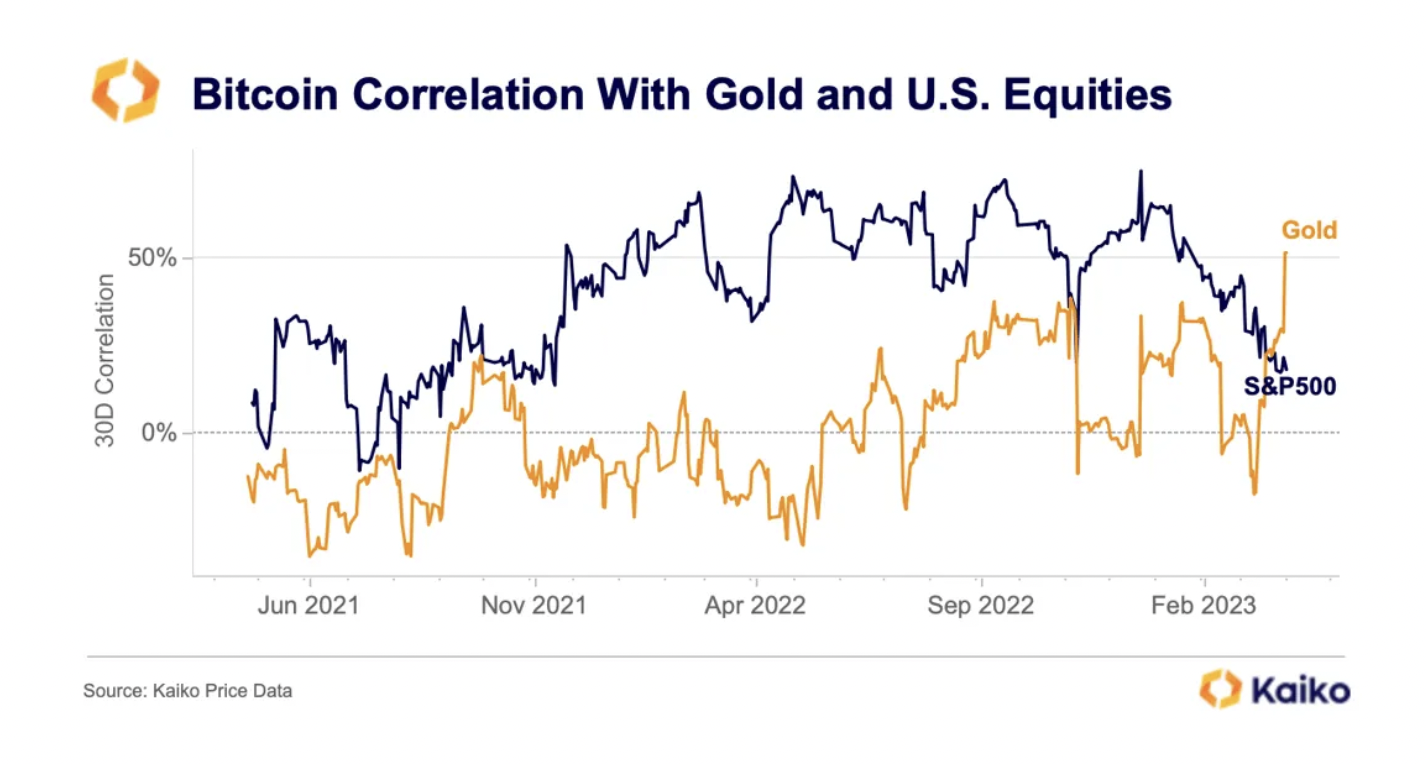

Bitcoin (BTC), which is often called digital gold due its program-coded supply cap, has rallied to as high as $29,000 from $20,000 in tandem with gold’s surge. BTC’s correlation with gold hit a multi-year high last week, surpassing equities, digital asset market research firm Kaiko reported Monday.

Recommended for you:

- Ethereum’s Mainnet Tenth ‘Shadow Fork’ Goes Live Ahead of September Merge

- Web3 Firm Unstoppable Domains and Crypto Browser Opera Expand Digital Identity Offerings

- 0x’s Token Surges 20% on Pact to Build Relay Network With Robinhood Wallet, Polygon

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

BTC correlation with gold, equities (Kaiko)