Bitcoin (BTC) price lost momentum pushing it to $32,300 on May 31, but this week’s option expiration could help the bulls recapture the key price level, according to crypto analyst Marcel Pechman. We have prepared Marcel Pechman’s analysis of Bitcoin for our readers.

What does the S&P 500 and Bitcoin correlation show?

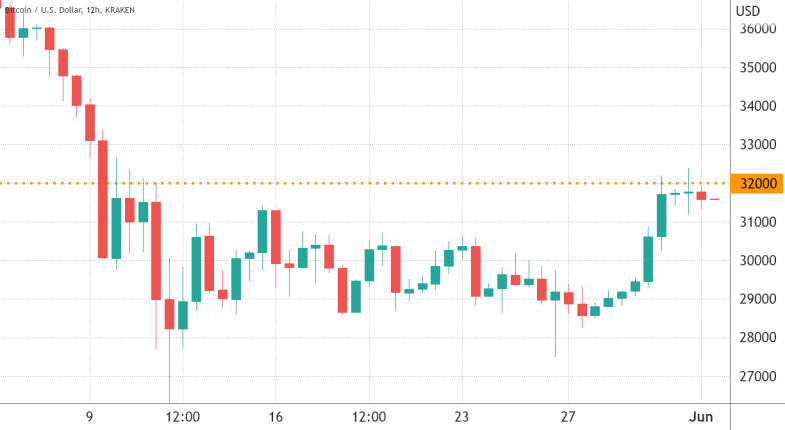

As you can follow from Cryptokoin.com news, twenty-three painful days have passed since Bitcoin (BTC) last closed above $32,000, and on May 29 and 30 The 10% rally that took place is currently evaporating as the BTC price pulls back towards $30,000. A return to $30,000 confirms the strong correlation with traditional assets, and the S&P 500 also fell 0.6% over the same period.

Bitcoin/USD 12 hour price on Kraken Source: TradingView

Bitcoin/USD 12 hour price on Kraken Source: TradingView Weak corporate profits, rising inflation and the upcoming US, according to Citi strategist Jamie Fahy The Central Bank may put pressure on the stock market due to interest rate increases. Yahoo! As reported by Finance, Citi’s research note for clients states:

Essentially, earnings per share expectations for 2022/2023 are virtually unchanged despite concerns about recession.

In short, the investment bank expects macroeconomic conditions to worsen to reduce corporate profits, causing investors to underprice the stock market. According to Jeremy Grantham, co-founder and chief investment strategist at GMO, “We have to be in some kind of recession pretty quickly, and profit margins from a true peak have a long way to go.”

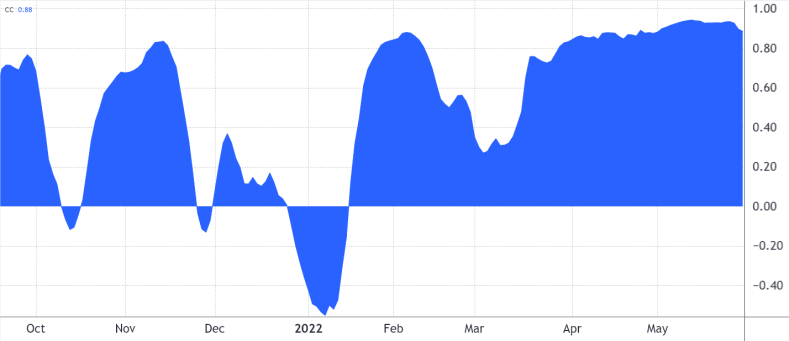

As the correlation with the S&P 500 remains incredibly high, Bitcoin investors fear that the potential stock market drop will inevitably lead to a retest of the $28,000 level.

S&P 500 and Bitcoin/USD 30-day correlation / Source: TradingView

S&P 500 and Bitcoin/USD 30-day correlation / Source: TradingView The correlation metric shows a perfectly symmetrical negative 1 (minus one) meaning selected markets are moving in opposite directions. ranging from positive 1 (plus one) reflecting movement. The inequality or lack of relationship between two entities is represented by 0. Currently, the S&P 500 and Bitcoin 30-day correlation stands at 0.88, which has been the norm for the past few months.

“Bear bets for bitcoin mostly below $31,000”

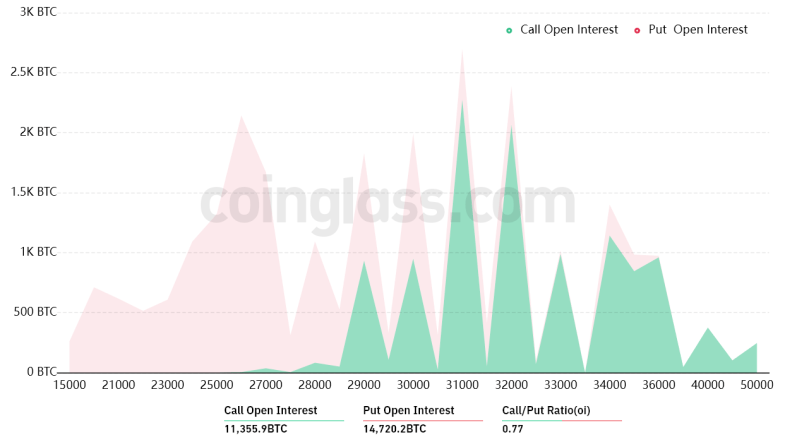

Bitcoin’s rebound above $31,000 on May 30 came as a surprise because the sell (sell) options for June 3 only 20% were placed above such a price level. Bitcoin bulls may have been tricked by the recent $32,000 resistance test, with their stakes up to $50,000 for the $825 million option expiration.

Bitcoin options garnered total open interest for June 3 / Source: CoinGlass

Bitcoin options garnered total open interest for June 3 / Source: CoinGlass A broader view using 0.77 call and put rate shows more bear bets because put ( open interest of $465 million against $360 million of call options. However, as Bitcoin is currently above $31,000, most bearish bets will likely become worthless.

If the price of Bitcoin stays above $31,000 on June 3, it will only be worth $90 million from put (sell) options. This difference is due to not exercising the right to sell Bitcoin at $31,000 if it trades above this level at maturity.

“Bulls can make $160M profits”

Below are the four most likely scenarios based on current price action. The number of options contracts available for buy (bullish) and put (bear) instruments on June 3 varies depending on the expiry price. The imbalance in favor of both parties constitutes theoretical profit:

- Between $29,000 and $30,000: 1,100 searches and 5,100 placements. The net result supports the bears by $115 million.

- Between $30,000 and $32,000: 4,400 searches and 4,000 placements. The net result is balanced between call (buy) and put (sell) instruments.

- Between $32,000 and $33,000: 6,600 searches and 1,600 placements. The net result supports the bulls at $160 million.

- Between $33,000 and $34,000: 7,600 searches and 800 placements. The bulls have increased their earnings to $225 million.

This rough estimate takes into account call options used in bull bets and put options used only in neutral to bearish trades. Even so, this oversimplification ignores more complex investment strategies.

“Bears have less margin to suppress the Bitcoin price”

Bitcoin bears have 3 bids to make a profit of $115 million It should drop the price below $30,000 in June. On the other hand, the best-case scenario for the bulls requires breaking above $33,000 to extend their gains to $225 million.

However, according to data from Coinglass, Bitcoin bears had $289 million in leveraged shorts, which were liquidated on May 29. As a result, they have less margins to drive the price down in the short term.

However, the most likely scenario is a draw that causes the Bitcoin price to hover around $31,000 before the June 3 options expiration.