Crypto expert Marcel Pechman says that Bitcoin bears are trying to fix the BTC price below $23,000 before options expire this month. According to the analyst, the $1.9 billion BTC option expires on February 24 and the Bulls are in a good position to make a profit despite the Federal Reserve’s intention to cool the US economy.

Bitcoin bears try to fix below $23,000

Bitcoin’s 16% price surge between February 13 and February 16 virtually extinguished the bears’ expectation that the monthly option expiration would expire below $21,500. As a result of the spike, these bearish bets are unlikely to pay off, especially since it expires on February 24. However, the bulls were not counting on the strong $25,200 price rejection on Feb. 21, reducing their chances of making a $480 million profit on this month’s BTC options expiration.

Tighter monetary policy is the primary concern of Bitcoin investors as the US Federal Reserve (FED) raises interest rates and shrinks its $8 trillion balance sheet. cryptocoin.comAs you follow, the minutes of the most recent Federal Open Market Committee (FOMC) meeting showed that members agreed on the latest 25 basis point rate hike and are willing to continue raising rates as long as the Fed deems necessary.

Louis Fed Chairman James Bullard told CNBC on Feb. 22 that a more aggressive rate hike would give them a better chance to contain inflation. In this context, Bullard said, “Let’s be sharp now, get inflation under control in 2023.” If this view is confirmed, the increased interest rate rate would be negative for risky assets, including Bitcoin, as it provides greater profitability for fixed-income investments. Even if the news feed remains negative, bulls could profit up to $480 million at the end of the monthly option expiry on Friday. However, the bears could significantly improve their situation by pulling the BTC price below $23,000.

Bears didn’t expect Bitcoin (BTC) to hold $22,000

Open interest is $1.91 billion for monthly options expiring February 24, but the actual figure will be lower as bears are expected to have prices below $23,000. However, these traders were surprised when Bitcoin surged 13.5% between February 15 and February 16.

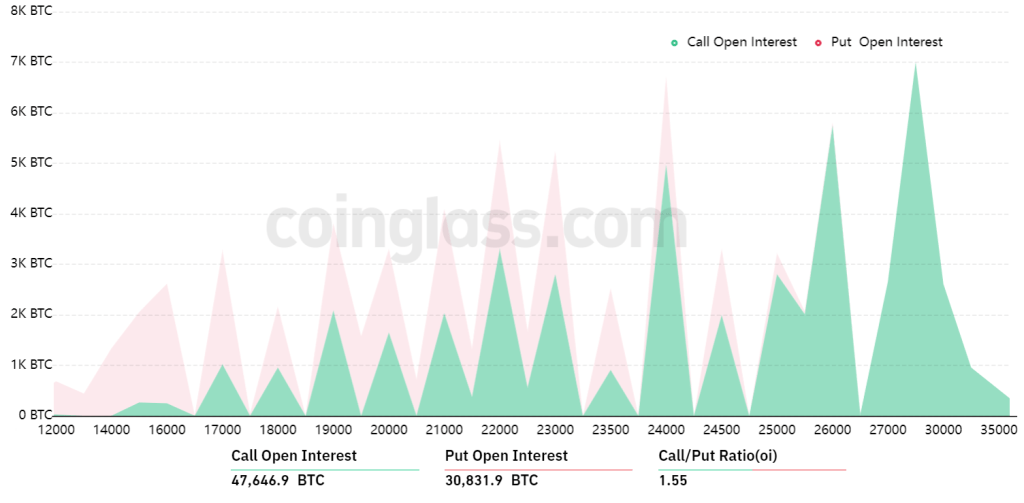

Bitcoin options, total open interest for February 24 / Source: CoinGlass

Bitcoin options, total open interest for February 24 / Source: CoinGlassThe 1.55 Call-Put ratio reflects the imbalance between $1.16 billion in call (buy) open interest and $750 million in put (sell) options. If the price of Bitcoin stays near $24,000 on February 24 at 08:00 UTC, it would only be worth $125 million from the put (sell) options. This difference is due to the fact that the right to sell Bitcoin at $22,000 or $23,000 is useless if BTC trades above that level at expiry.

Bulls target $23,000 for $155 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available for call (bull) and put (bear) instruments on February 17 varies depending on the expiry price. The imbalance in favor of both parties creates the theoretical profit:

- Between $22,500 and $23,000: 12,500 calls and 10,700 puts. The net result supports call (bull) instruments by $40 million.

- Between $23,000 and $24,000: 16,200 calls and 7,600 puts. The net result supports call (bull) instruments by $200 million.

- Between $24,000 and $24,500: 21,100 calls and 5,200 puts. The bulls increase their advantage to $385 million.

- Between $24,500 and $25,000: 23,200 calls and 3,600 puts. The bulls dominate with a profit of $480 million.

This rough estimate considers call options used in bull bets and especially put options on neutral to bearish trades. However, this oversimplification ignores more complex investment strategies.

Fed’s tightening policy is bears’ best chance

Bitcoin bulls must push the price above $24,500 on February 24 to secure a potential profit of $480 million. On the other hand, the best-case scenario for bears requires BTC to drop below $23,000 with a 3.5% price drop to minimize losses.

Given the negative pressure from the Fed’s desire to weaken the economy and contain inflation, the bears are likely to improve their situation and settle for a loss of $40 million on Feb. This move may not be successful, but it is the only way for the bears to survive the loss of millions as BTC monthly options expire. Looking at the broader time frame, investors still believe that the Fed will reverse current monetary policy in the second half of 2023. Probably paving the way for a sustainable rally ahead of the April 2024 Bitcoin block reward halving.