Crypto traders await the September 21 FOMC. In the midst of this wait, there is an increase in volatility in Bitcoin and altcoin prices. Traders are preparing to reduce their risks and tighten their monetary policy. As a result, the Bitcoin price has fallen by 15% in the past seven days.

“Bitcoin price decline will continue with interest rate hikes”

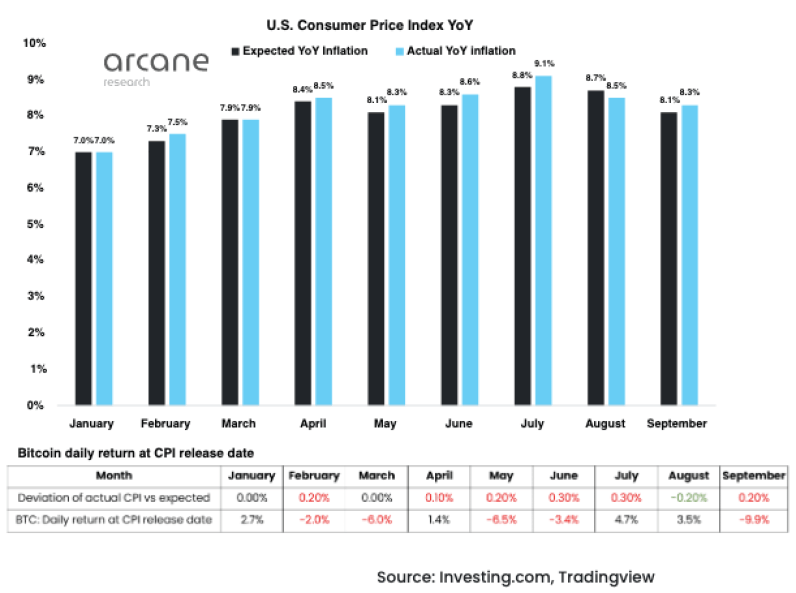

The price of the leading crypto Bitcoin (BTC) fell last week with a drop in stocks. cryptocoin.com As you can follow, August US CPI came in at 8.3% compared to 8.1% expected. Markets perceived the higher than expected CPI as a sign of the continuation of the Fed’s hawkish stance. The market reacted to the CPI news with risk aversion. In this environment, Bitcoin also witnessed a huge drop.

US Consumer Price Index YY

US Consumer Price Index YYThe drop in Bitcoin price last week was the worst compared to previous CPI-related dips in the asset in 2022. The brutal response was the result of a mismatch of expectations and uncertainty among investors ahead of this week’s FOMC. Analysts at Arcane Research note that the crypto market is priced in with a high interest rate hike.

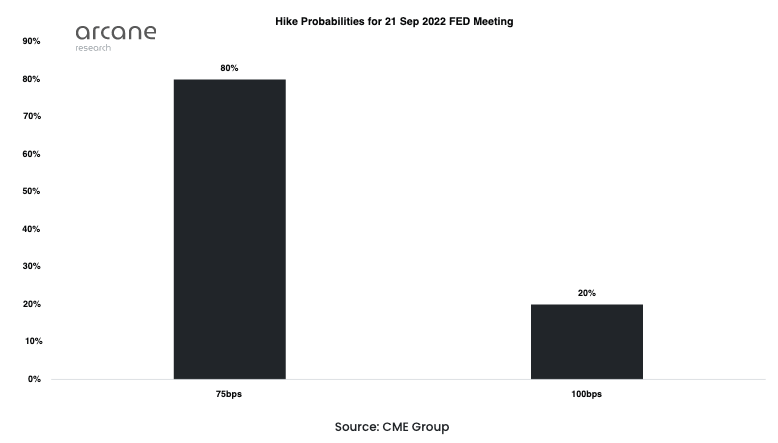

Raising possibilities for the September 21, 2022 FED meeting

Raising possibilities for the September 21, 2022 FED meetingCurrently, the expectation is 75 bps. Markets give it an 80% chance. However, investors do not rule out a possible 100 bps increase. Therefore, this week’s decision will be key to Bitcoin’s price trend. Because all the FOMC events have led to Bitcoin price volatility. Analysts are warning investors to prepare for a new boom in BTC volatility on September 21.

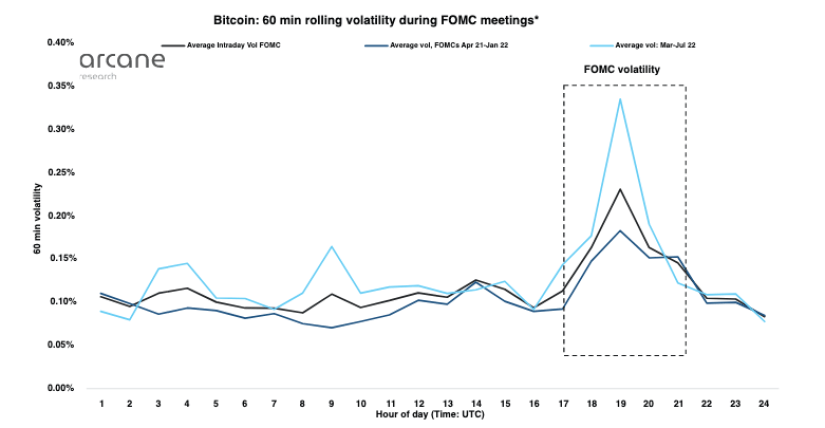

Bitcoin volatility during FOMC meetings

Bitcoin volatility during FOMC meetingsBitcoin price tends to move highly correlated with the Nasdaq and S&P 500 during major macro events like the FOMC meetings.

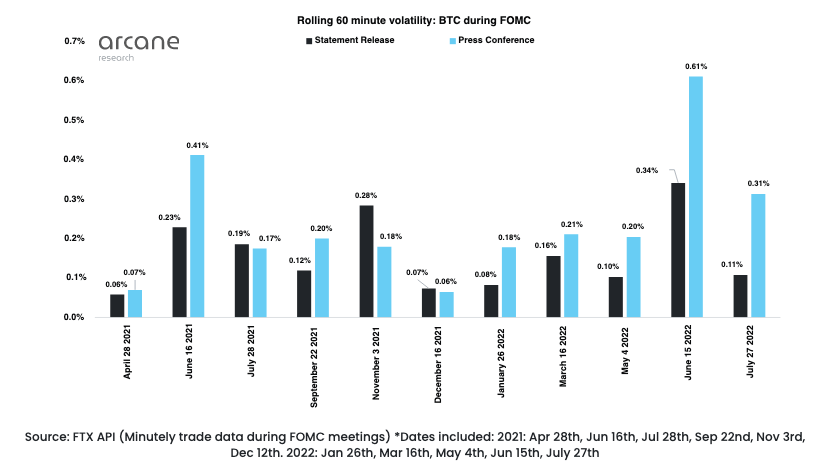

Trading strategy for BTC during the FOMC statement

To help traders trade during the FOMC meeting, the researchers prepared a 60-minute volatility chart. In this context, they examined the effects of the FOMC release and press conference on Bitcoin volatility.

60-minute volatility: BTC during the FOMC

60-minute volatility: BTC during the FOMCActive day traders are most affected by the FOMC-induced volatility in the Bitcoin price. Therefore, the rate hike expectations for September 21 guarantee extremely high volatility. A rate hike of 100 bps is likely to have a short-term negative impact on the BTC price. However, according to experts, a softer increase of 75 bps will most likely reflect positively.

Intraday volatility is insignificant on longer timeframes. But the Federal Reserve’s mid-term outlook and uptrend play an important role in determining the direction of Bitcoin’s trend reversal. BigCheds, a crypto analyst and trader, evaluated the BTC price trend in this context. The analyst noted that BTC should stay above $18,923. According to the analyst, a drop below this price level would mean a reversal of the bearish trend in BTC price.

BTC price chart

BTC price chart