The monthly green candle series that Bitcoin (BTC) has been continuing since the beginning of the year ended in May. Price estimates for June fluctuate between $30,000 and $25,000. Meanwhile, trending coins like ETH and PEPE are preparing to test their critical technical level.

Bitcoin, Ethereum and PEPE forecasts for June

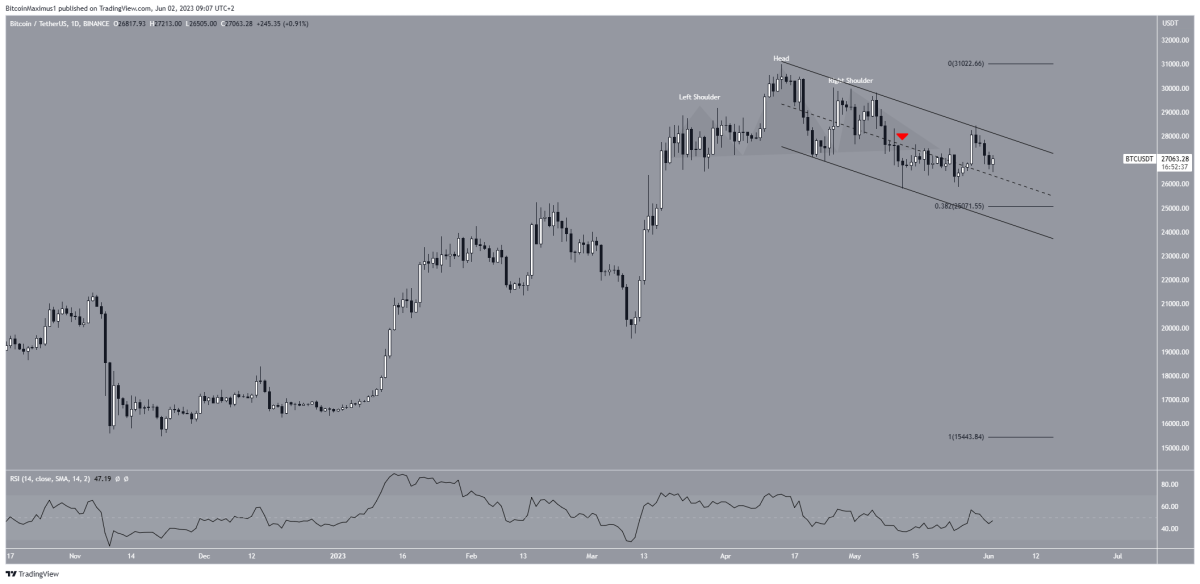

Bitcoin price broke out of the head and shoulders pattern on May 11 (red icon). Head and shoulders are considered bearish. After that, the bears were expected to make more moves. However, the move has been unusual since the breakout. Instead of falling sharply, BTC price rose twice. It even rose above the middle line of the patterns once again on May 30. However, it crashed again a short time later.

Therefore, technical analyst Valdrin Tahiri says the next most likely pattern is a descending parallel channel. On the other hand, the decline could take the price to $25,000, which is the support line of the channel. This is also the 0.382 Fib retracement support level as it measures the entire previous upward move. Therefore, it is a very likely level for a bottom.

RSI movement also supports this possibility. Using the Relative Strength Index (RSI) as a momentum indicator, traders can determine whether a market is overbought or oversold. This is also effective when choosing between hoarding or selling a coin.

If the RSI reading is above 50 and the trend is up, the bulls will take advantage. However, an RSI below 50 indicates the opposite. The indicator is currently below 50 and falling, which is a sign of a downtrend.

Ethereum (ETH) pushes new year highs against Bitcoin

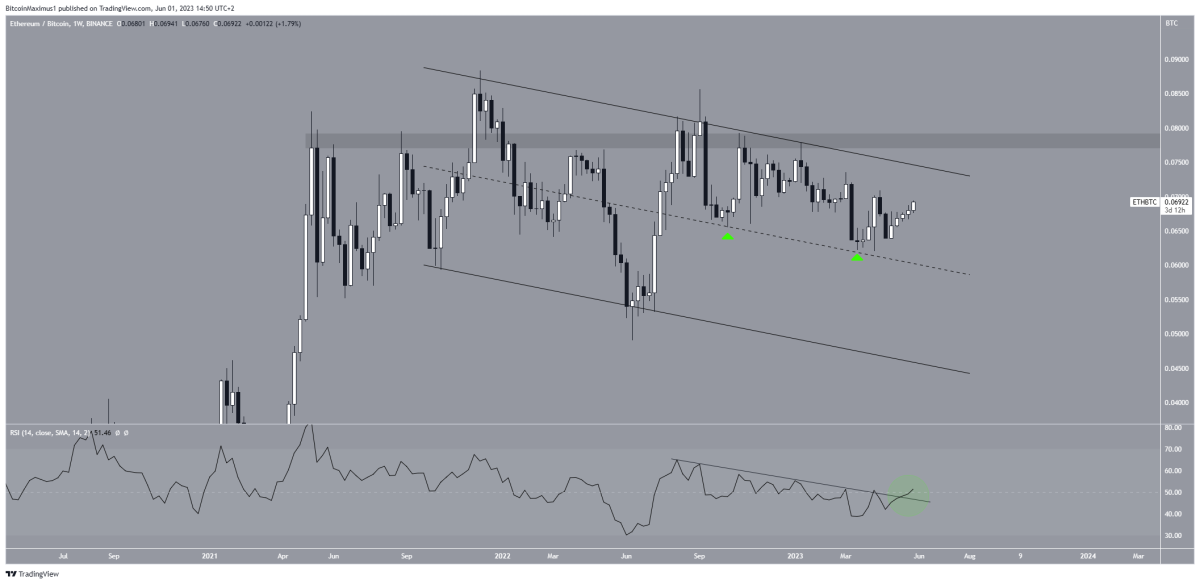

Ethereum price outperformed Bitcoin throughout the month of May. According to estimates, it will probably do the same in June. ETH/BTC price has been falling inside a descending parallel channel since early 2022. In April 2023, it jumped in the middle line of the channel. This is the second time he has jumped on the line. An exit from here is the most likely scenario as the price is currently trading at the top of the channel.

Additionally, the weekly RSI supports continued growth. The RSI broke out of a descending resistance line (black line) and then rose above 50 (green circle). If the price breaks out of the resistance line of the channel, it is likely to surpass the ₿0.078 resistance area and move to ₿0.01.

Despite this bullish ETH price prediction, closing below the middle line of the channel will mean that the trend is still bearish. In this case, ETH price may drop to ₿0.045, the support line of the channel.

Pepe (PEPE) shows signs of improvement

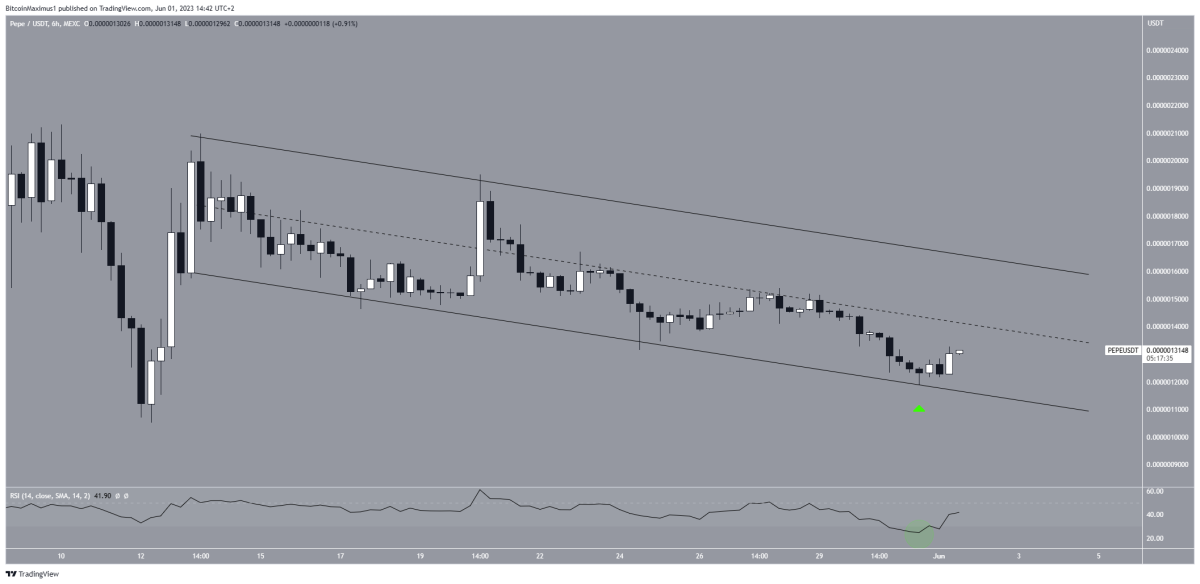

PEPE was the main altcoin story in May. It has become one of the top altcoin earners of all time. However, the price reached the ATH level on May 5 and has fallen sharply since then. Despite this decline, June seems to provide some recovery. There are several reasons for this. The decline since May 13 is kept inside a descending parallel channel.

The channel is considered a corrective pattern. So a break with it is the most likely scenario. On May 31, the price bounced off the support line of the channel (green icon). The bounce is coupled with the lowest ever RSI reading (green circle). The RSI has been rising ever since. Therefore, the most likely PEPE price prediction is for it to rise to the next resistance at $0.0000022.

Despite this bullish prediction, a dip below the support line of the channel means the trend is bearish. In this case, PEPE could sustain its long-term decline to $0.0000009. Meanwhile, cryptocoin.comIn a hot Pepe news we quoted as, it turned out that an investor was the victim of a 540,000 dollar phishing attack.