As the cryptocurrency market enters the week of February 13, all eyes are on altcoin projects that are preparing to make the most important moves. That’s why analysts take a look at the best altcoins to watch next week based on their current popularity, the narrative they drive, and their potential to outperform the market.

First altcoin project SingularityNET (AGIX)

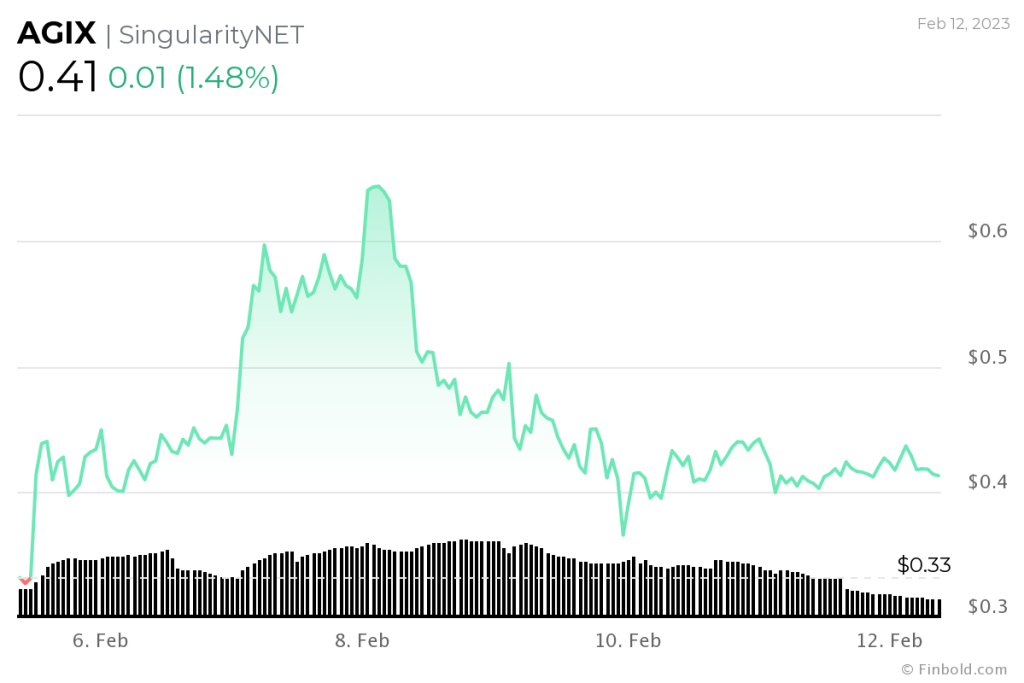

SingularityNET (AGIX), a decentralized artificial intelligence (AI) focused crypto ecosystem, has seen an aggressive pullback recently. The altcoin has been on the rise since the beginning of the year, with the hype of AI-related products such as text-based ChatGPT enjoying significant success in its early stages. The token’s growth is highlighted by AGIX on February 6th, which is up nearly 900% in 2023 alone.

In particular, SingularityNET allows users to easily ‘create, share and monetize’ AI services. Also, the globally accessible artificial intelligence market is making waves by forging significant partnerships. In particular, the platform recently announced a collaboration with Cardano (ADA).

The close integration of blockchain and #AI is a key part of creating a #decentralized, democratic, beneficial #AGI, and the collaboration between #SingularityNET and #Cardano is currently at the forefront of this integration.#BuildingOnCardano #BuildingOnSNET pic.twitter.com/rdl1fA4VjT

— SingularityNET (@SingularityNET) February 9, 2023

Over the next week, as established firms like Microsoft and Alphabet fight for AI market share, the focus on AGIX will be whether the token can sustain AI-centric gains. At press time, AGIX was trading at $0.41 with daily gains of around 1.5%. On the weekly chart, AGIX is up almost 30%.

AGIX seven-day price chart

AGIX seven-day price chartLeading altcoin Ethereum (ETH) is also on the list

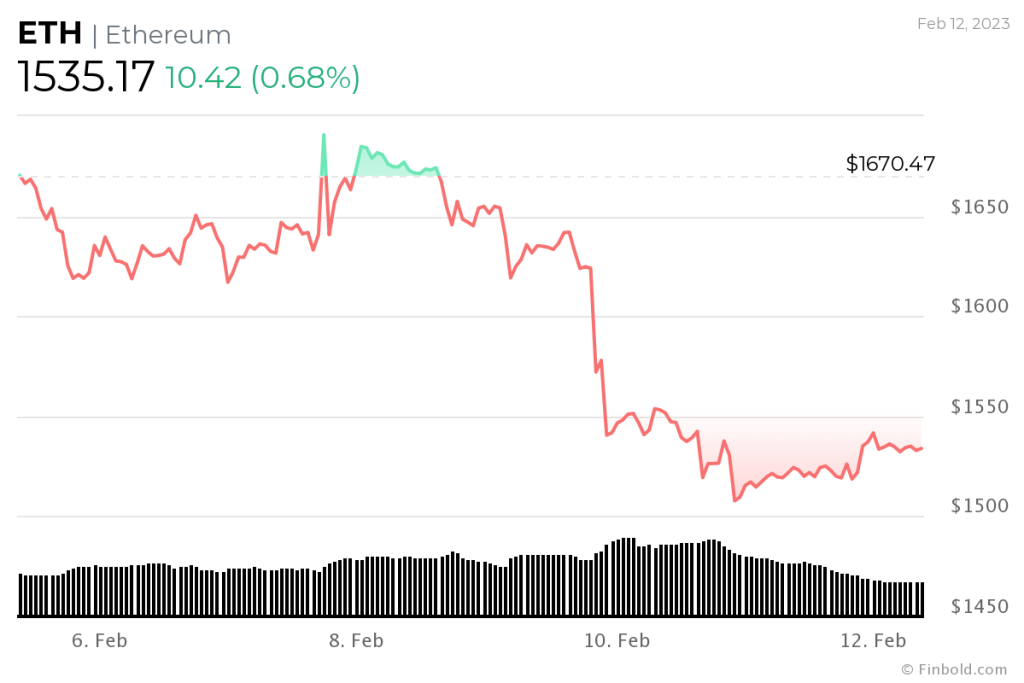

cryptocoin.com As you follow, the leading altcoin entered 2023 with a series of sequential network upgrades aimed at completing the Merge update that shifts it to the Blockchain Proof-of-Stake (PoS) protocol. Specifically, investors are gearing up to start withdrawing their staked ETH from March after the Shanghai update goes live. Meanwhile, traders simulate the withdrawal process through the Zhejiang test-net. Currently, the developers at Blockchain have announced February 28 as the Sepolia test-net date as part of the path to launch the Shanghai upgrade. Specifically, the next update after Sepolia will be Goerli, the last testnet to receive the Shanghai upgrade.

While the upgrades are likely to positively impact Ethereum’s price, the asset remains vigilant after renewed regulatory pressure on staking by US regulators. In this regard, the Securities Exchange Commission (SEC) has reached an agreement with crypto exchange Kraken, which includes stopping the trading platform’s staking services. Therefore, the fallout from the SEC’s move will likely play a role in determining ETH’s price trajectory.

Interestingly, Cardano founder Charles Hoskinson has described Ethereum staking as problematic, a factor he stated could hurt the entire industry due to fears of centralization. Overall, the SEC’s crackdown on staking has been met with criticism from the crypto space. Ethereum is currently changing hands at $1,535, down about 10% weekly.

ETH seven-day price chart

ETH seven-day price chartArtificial intelligence coin The Graph (GRT)

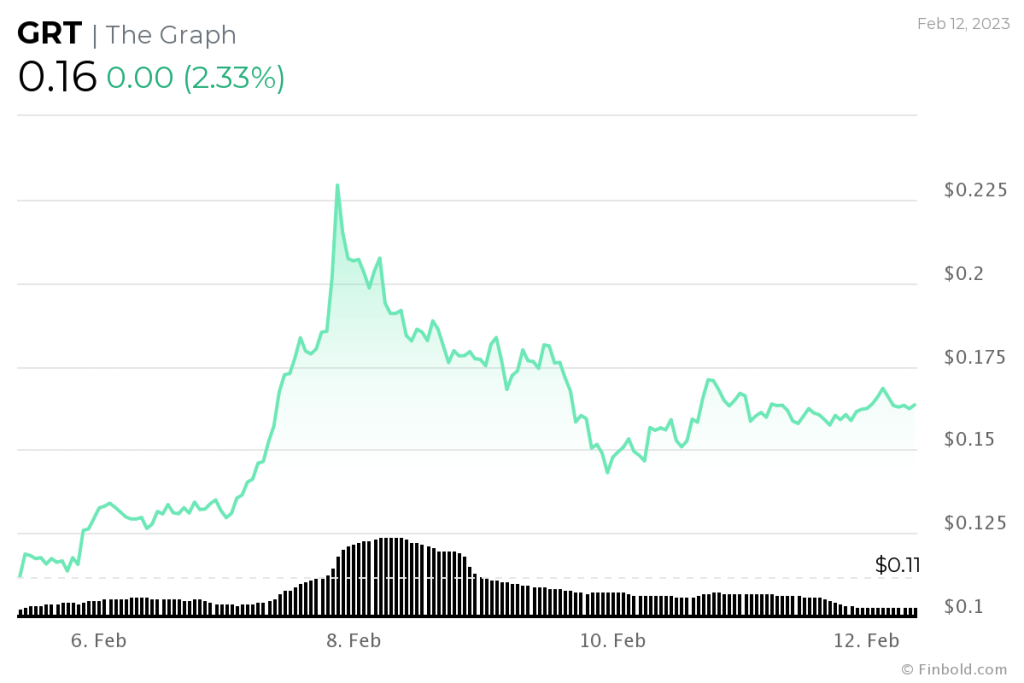

The GRT token rallied mainly due to the consistent growth in vital on-chain metrics. It’s worth noting that The Graph (GRT) is an indexing protocol for querying networks like Ethereum, and a recent report shows that several metrics describe steady quarterly growth.

The report stated that as of December 2022, The Graph mainnet had 618 active subgraphs, with a 25% increase in QoQ and a 151% year-over-year increase thanks to improved on-chain data accessibility by developers. At the same time, the platform’s revenue from query fees on The Graph saw a 66% quarter-on-quarter increase in the fourth quarter of 2022, up 6,228% year-on-year. The report also predicts continued growth in query charges as more subgraphs move to the mainnet in the coming quarters.

Indeed, the token was among the top earners in 2023, with almost 190%. While the asset is still trying to settle in the crypto space, the price momentum is intriguing, especially on the selling and buying pressure trends. In particular, the price of the asset will be under threat of correction, especially if investors start to profit. At press time, GRT was trading at $0.16, gaining over 2% in the last 24 hours.

GRT seven-day price chart

GRT seven-day price chartEthereum rival Cardano (ADA)

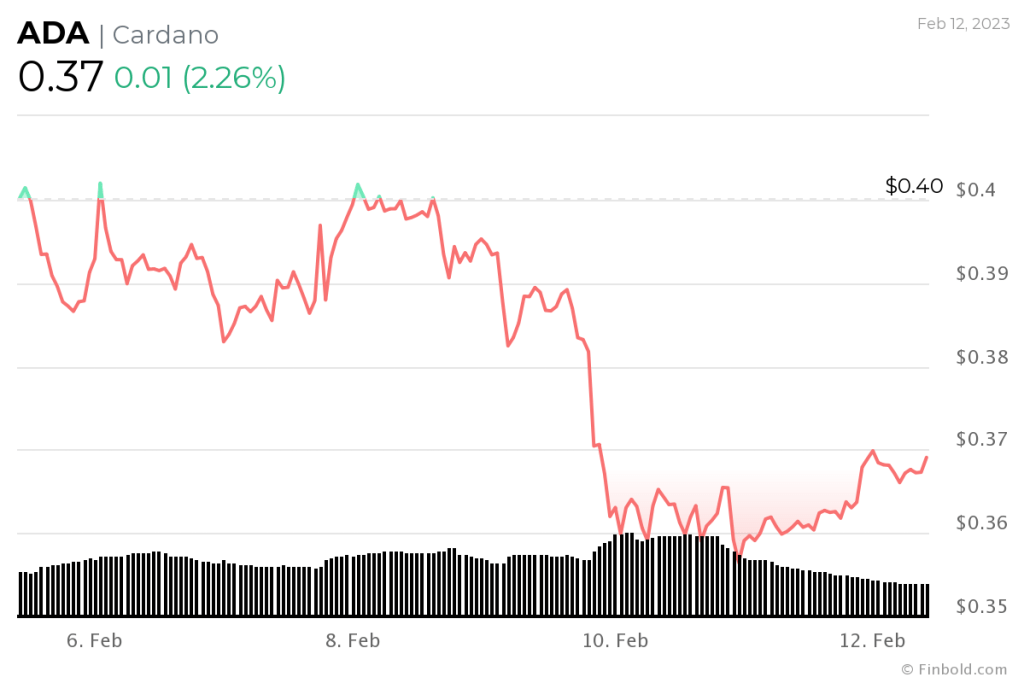

The Cardano (ADA) ecosystem is dominated by continuous development activities that have accelerated in recent months. The activities were launched to help the network’s native token ADA recover in the future. Part of the growth has seen it reach 5,000 smart contracts as of February 2, since Cardano introduced the functionality in September 2021. Elsewhere, Cardano ranked second among the leading smart contract crypto projects, raising its market cap to $10.4 billion. The network also tops the GitHub development event with 701 events.

It’s worth noting that the focus is on how Cardano’s price will play out, particularly regulatory concerns regarding staking. Along these lines, founder Hoskinson proposed the contingent staking model as a way to channel regulatory concerns. According to the proposal, staking participants will adhere to strong know-your-customer practices. Therefore, the continued fallout from the staking controversy will likely affect the price of ADA next week. At press time, ADA was trading at $0.37, gaining over 2% daily.

ADA seven-day price chart

ADA seven-day price chartLast ranked altcoin TRON (TRX)

Thanks to sustainable network developments and proposed partnerships, TRON (TRX) is among the altcoin projects to watch. For example, TRON is making its way into the world of AI with its founder Justin Sun recently announcing the launch of a new decentralized payment framework for AI systems. According to Sun, the framework will work for AI research firm OpenAI and its flagship project, ChatGPT, which is revolutionizing the text-based AI industry.

It also received support from organizations such as TRON, crypto exchange Binance. According to the trading platform, TRON has reset the withdrawal limits on its network to their previous levels, in line with community feedback. Along this line, Sun announced that it is working with Binance to reduce withdrawal fees.

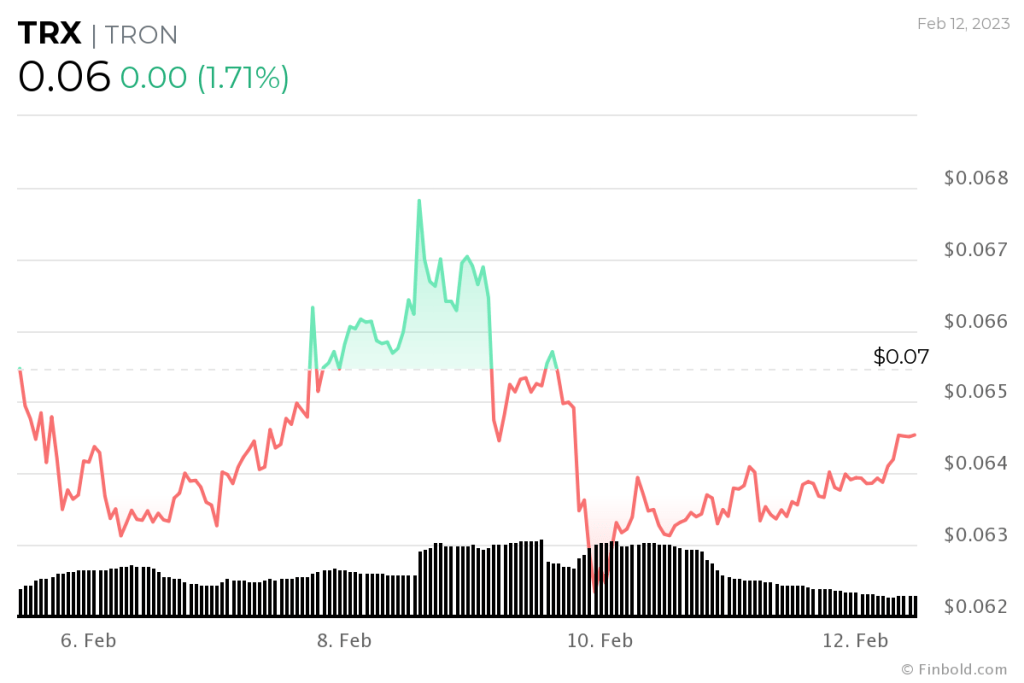

While the price of TRX is worth watching mainly because of its network development activities and partnerships, the platform may face a few hurdles in the coming days. Notably, a recent report from crypto analytics platform Santiment stated that TRX’s volume has dropped significantly, which could affect the future of the protocol. The metric shows that fewer people are actively trading TRX, which could affect the liquidity of the token. At press time, TRON was trading at $0.06, gaining almost 2% on the daily chart.

TRX seven-day price chart