Legacy markets continue to negatively impact the Bitcoin (BTC) price. However, according to crypto analyst Rakesh Upadhyay, there is also a positive sign. This is also because the bulls have not allowed BTC to retest June lows. The analyst says that a positive trigger could start a strong recovery in certain altcoins like Bitcoin and MATIC. It examines the top 10 cryptocurrencies to identify key resistance levels to watch out for.

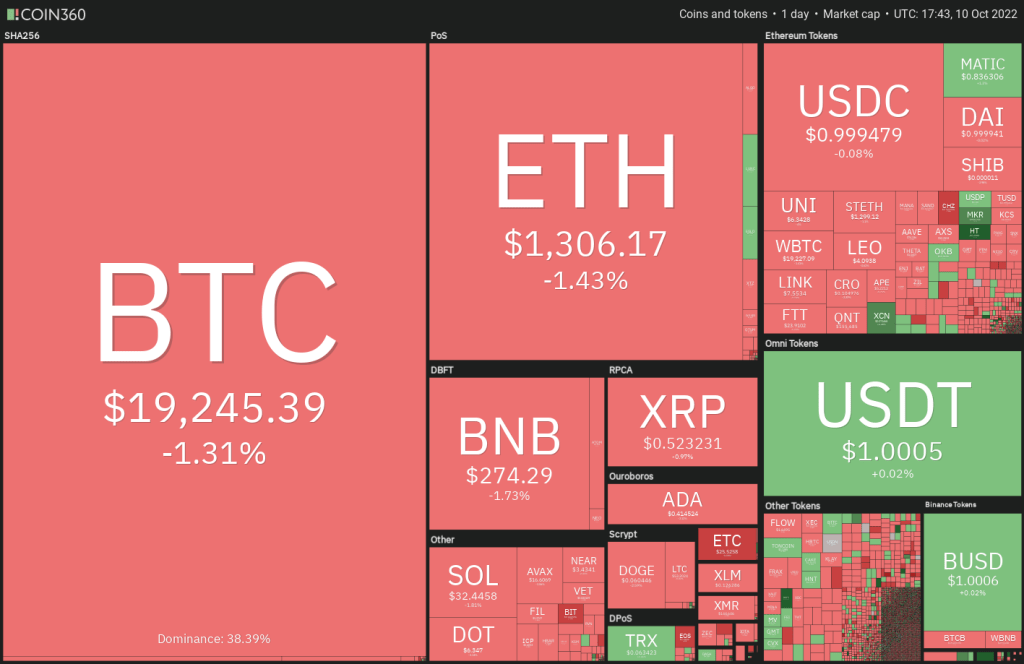

An overview of the cryptocurrency market

US stock markets started the week on a weak note as investors are not convinced the Federal Reserve will pull back on its aggressive monetary policy. The Nasdaq Composite index fell to its lowest level since September 2020. cryptocoin.comAs you follow, all eyes are on the US Consumer Price Index data for September, which will be released on October 13, as it may influence the Fed’s decision on the size of the rate hike at its next meeting in November.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Depending on how the market perceives the data, it is possible for legacy markets and crypto markets to witness an increase in volatility. A minor positive for the bulls is that Bitcoin (BTC) is not testing June lows. It also outperforms the Nasdaq and S&P 500 in the short term.

BTC, ETH, BNB, XRP and ADA analysis

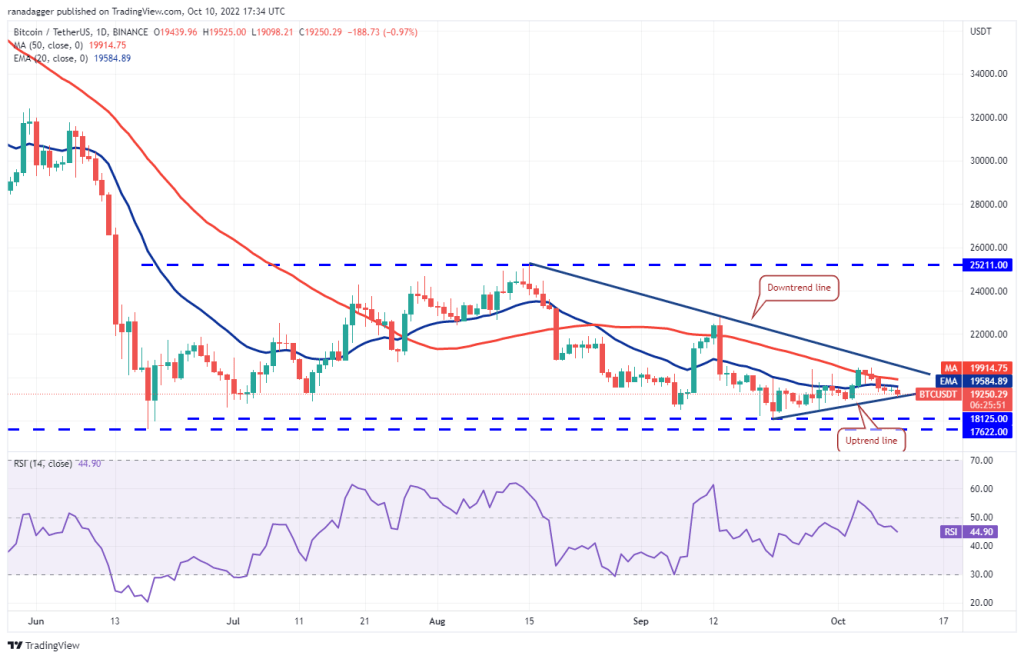

Bitcoin (BTC)

Bitcoin fell below the 20-day exponential moving average (EMA) ($19,584) on Oct. He then successfully defended the level from October 8-10. Sellers are trying to further strengthen their position by pulling the price below the bullish line.

If they do, it is possible for BTC to drop into the $18,125 to $17,622 support zone. Buyers will probably defend this area with all their might. Because if they don’t, it’s possible for BTC to start the next leg of the downtrend. BTC is likely to drop to $15,000 later. On the contrary, if the price bounces back from the uptrend line, the bulls will try to push BTC above the moving averages and challenge the downtrend line. A break and close above this level will be the first indication that the bears will lose their grip. It is possible for BTC to attempt a rally to $22,800 later.

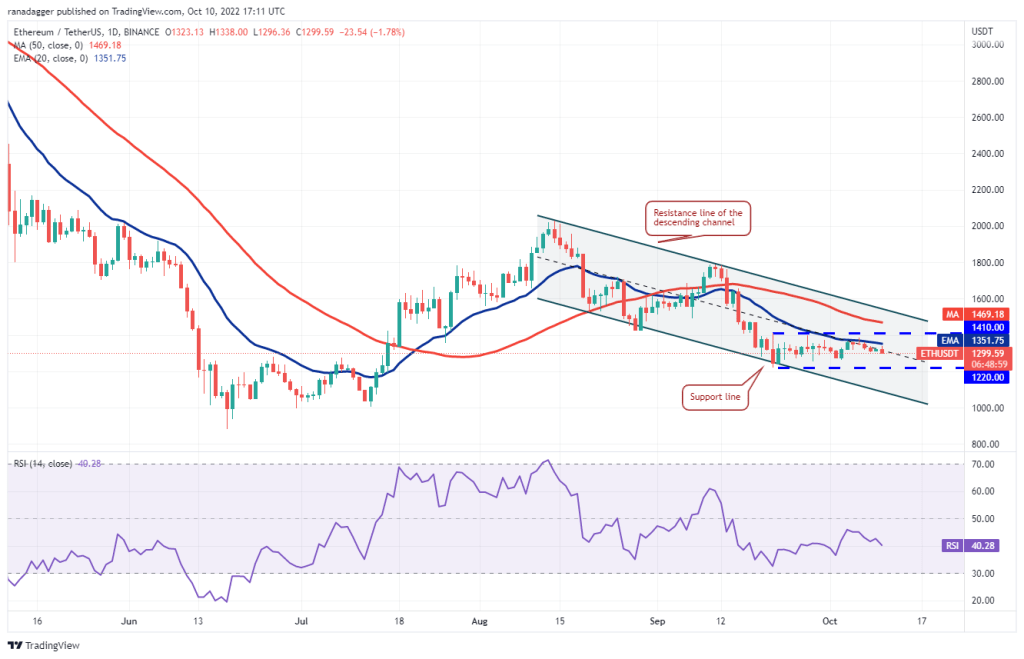

Ethereum (ETH)

ETH is struggling to break above the 20-day EMA ($1,351). This indicates that the bears are selling on the rallies and will try to push the price down to the strong support at $1,220.

The gradually decreasing 20-day EMA and relative strength index (RSI) in the negative zone point to an advantage for the bears. Intensification of selling is possible if the price drops below $1,220. Thus, ETH is likely to drop to the support line of the descending channel pattern. Conversely, if the price rises from the current level and rises above the 20-day EMA, BTC is likely to rally to $1,410. The bulls will have to push and sustain the price above the channel to signal a potential trend change.

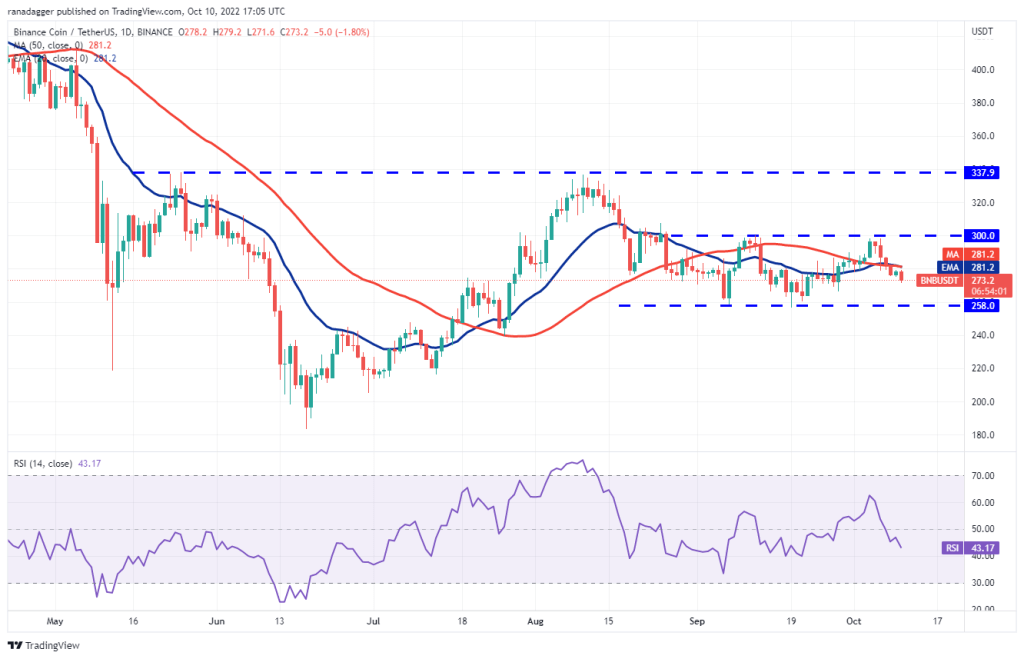

Binance Coin (BNB)

BNB has been trading between $258 and $300 for the past few days. A break below the moving averages on October 8 paves the way for a possible drop to the strong $258 support.

If the price bounces back from $258, it will suggest that the range-bound move will continue for a while. The longer it is spent in range, the stronger the detachment from it will be. The next trend move will start with a break above $300 or a drop below $258. The direction of the breakout is difficult to predict with certainty. Therefore, it is better to wait for the breakout to occur before placing directional bets. If the price dips below $258, a drop to $216 is possible for BNB. On the other hand, a break above $300 is likely to push BNB towards $342.

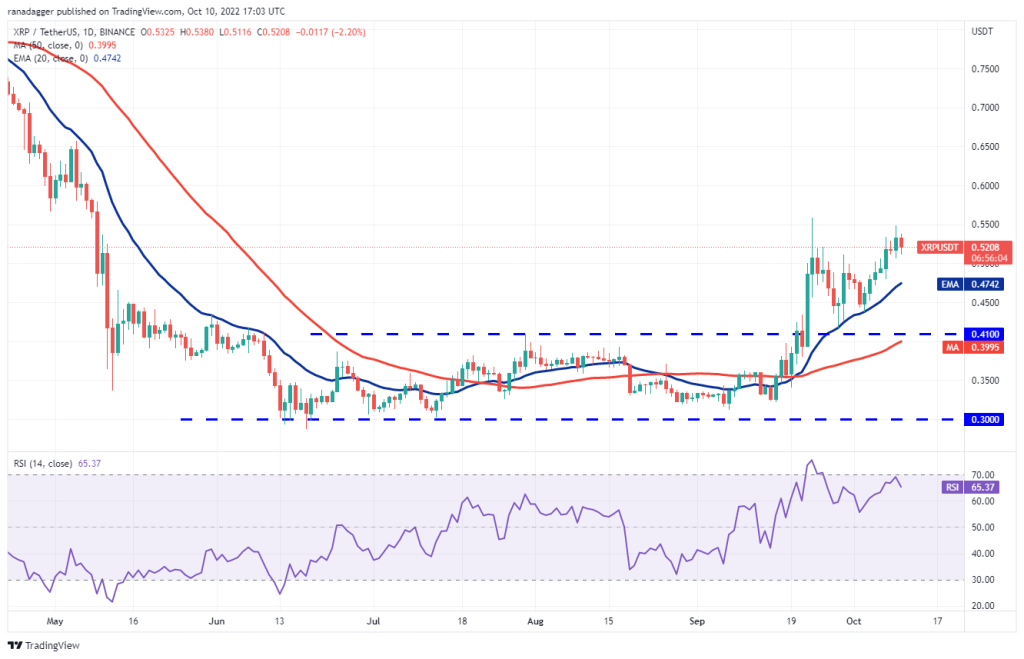

Ripple (XRP)

The bulls tried to push XRP above the overhead resistance of $0.56. But the bears did not move. Sellers will try to push the price to the 20-day EMA ($0.47).

If buyers want to hold the upper hand, they will have to buy the dips in the 20-day EMA. If the price recovers strongly from this support, the probability of a break above $0.56 increases. It is possible for XRP to continue its uptrend later and rally to $0.66. This positive view is invalidated if the price falls and breaks below the 20-day EMA. XRP is likely to drop to the breakout level of $0.41 later. A bounce from this support will indicate that XRP will be stuck between $0.41 and $0.56 for a while.

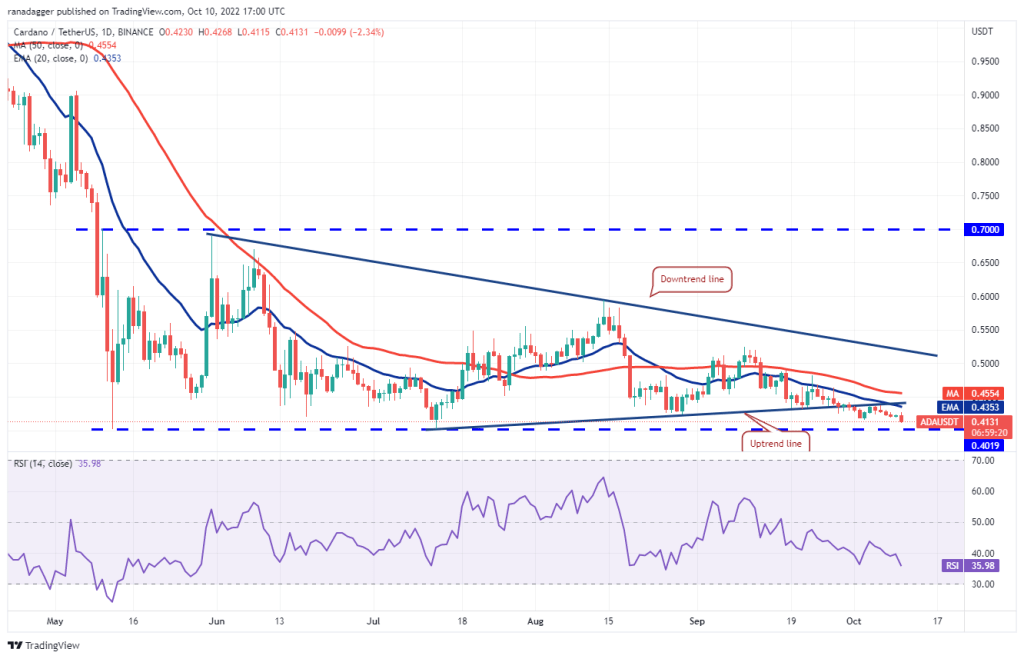

Cardano (ADA)

ADA is slowly sliding towards vital support at $0.40. This level has been held twice before. Hence, it is possible for the bulls to make a strong defense against this support again.

Any recovery will likely face selling at the 20-day EMA ($0.43) and again at the 50-day simple moving average (SMA) ($0.45). The bulls will have to break this resistance to signal the start of a possible sustainable recovery. ADA is likely to rise to the downtrend line later on. Instead, if the price breaks below the support at $0.40, it will signal a resumption of the downtrend. It is possible for ADA to drop to the strong support at $0.33 later, where buying is likely to emerge.

SOL, DOGE, DOT, MATIC and SHIB analysis

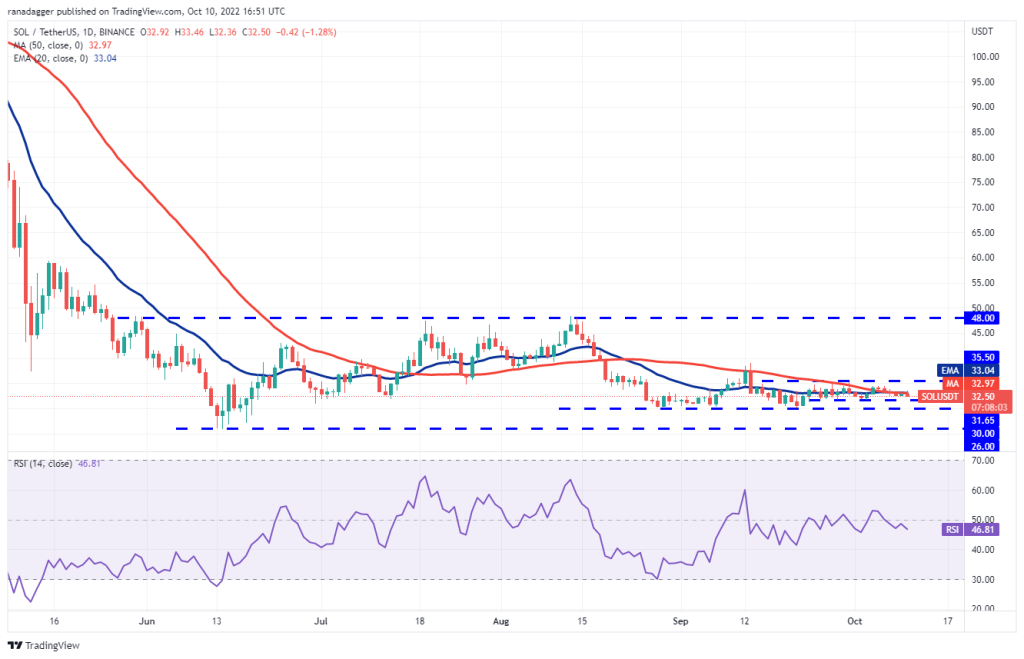

Left (LEFT)

SOL has been fluctuating between $31.65 and $35.50 for the past few days. The horizontal moving averages and the RSI just below the midpoint indicate a balance between supply and demand.

The first sign of strength will be a break and close above the overhead resistance at $35.50. If this level is breached, a rally to $39 is possible for SOL. The previous recovery had stalled at this level. Therefore, bears will try to aggressively defend this level again. On the downside, the region between $31.65 and $30 is likely to attract strong buying from the bulls. If the bears want to stay in control, they will have to drop the price below $30. It is possible that this could extend the decline from $26 to the next support.

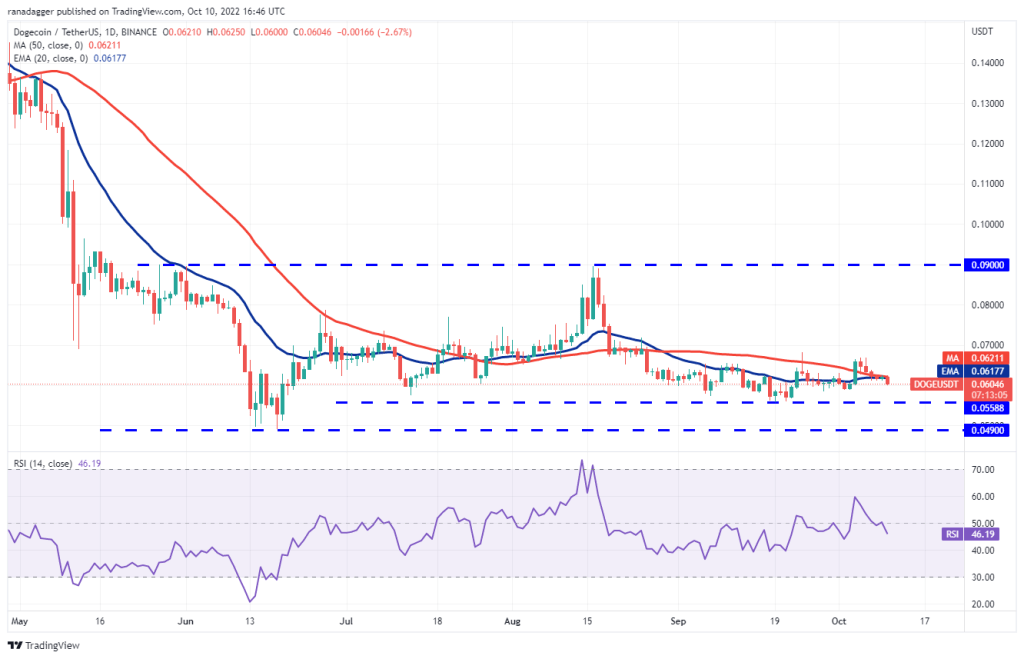

Dogecoin (DOGE)

DOGE broke below the 20-day EMA ($0.06) on Oct. 8 and closed. Also, the bulls failed to push the price back above the 50-day SMA ($0.06) on Oct.

Sales resumed on October 10. The bears will now attempt to push the price down to the support around $0.06. Buyers successfully defended this support on September 19 and again on September 21. Therefore, the bulls are likely to buy the drop to this level lively. If the price bounces back from the current level or support, the bulls will try to push DOGE to the overhead resistance at $0.07. The next major trend move is possible with a break above $0.07 or below $0.05.

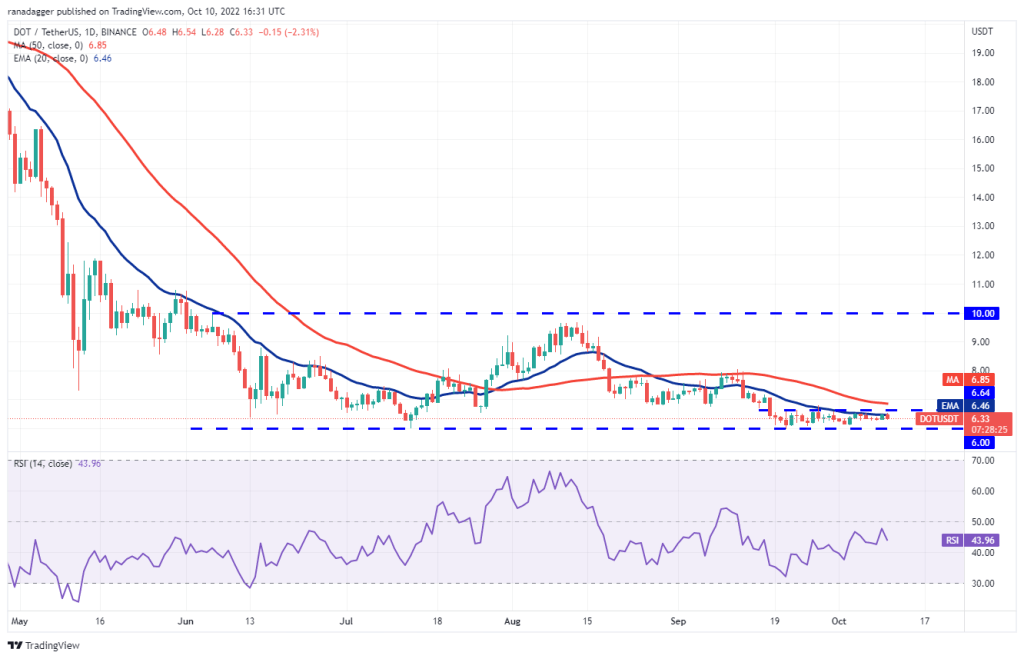

Polkadot (DOT)

DOT has been consolidating between $6 and $6.64 for the past few days. The bears are trying to further strengthen their advantage by not allowing the price to climb above the 20-day EMA ($6.46).

If the price continues to drop below $6.25, it is possible for DOT to retest the important support at $6. If this level is broken, DOT will likely start the next leg of the downtrend. DOT is likely to slide to $5.36 later. If the bulls want to reject this bearish view, they will have to quickly push the price above the resistance zone between $6.64 and the 50-day SMA ($6.85). If they are successful, it is possible for DOT to gain momentum and rally towards the next resistance at $8.

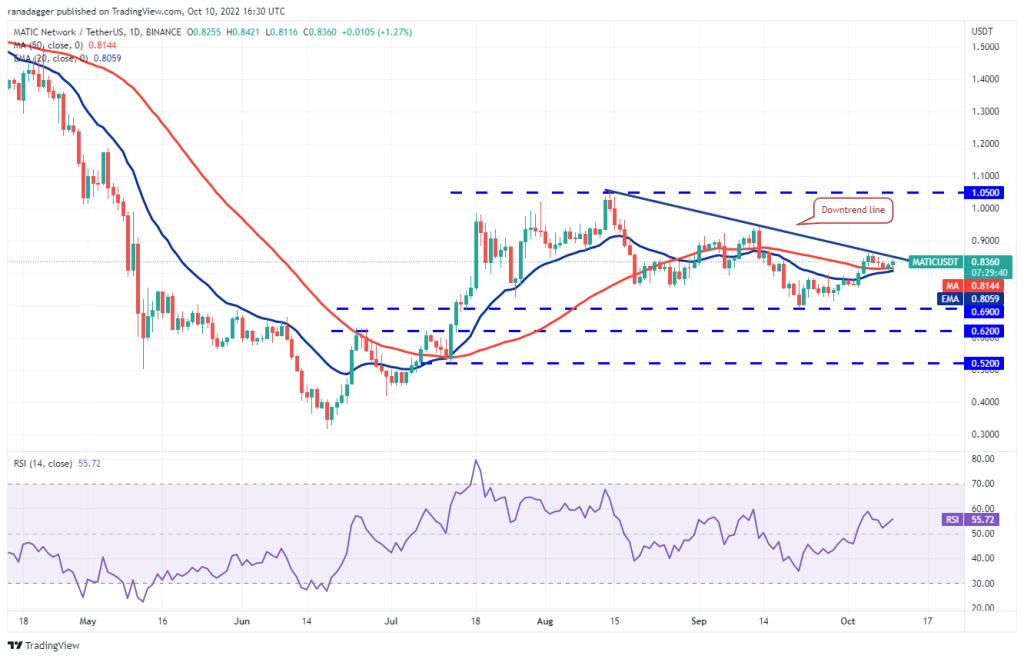

Polygon (MATIC)

MATIC has fallen from the downtrend line. However, the bears failed to push the price below the moving averages. This indicates that the bulls are buying the dips to the moving averages.

Buyers will have to push and sustain the price above the downtrend line to indicate a possible change in the short-term trend. MATIC could then attempt a rally to $0.94 where it could face resell by the bears. Alternatively, if the price drops from the current level and dives below the moving averages, the short-term advantage will turn in favor of the bears. MATIC could then drop to $0.75, where buying is likely to occur.

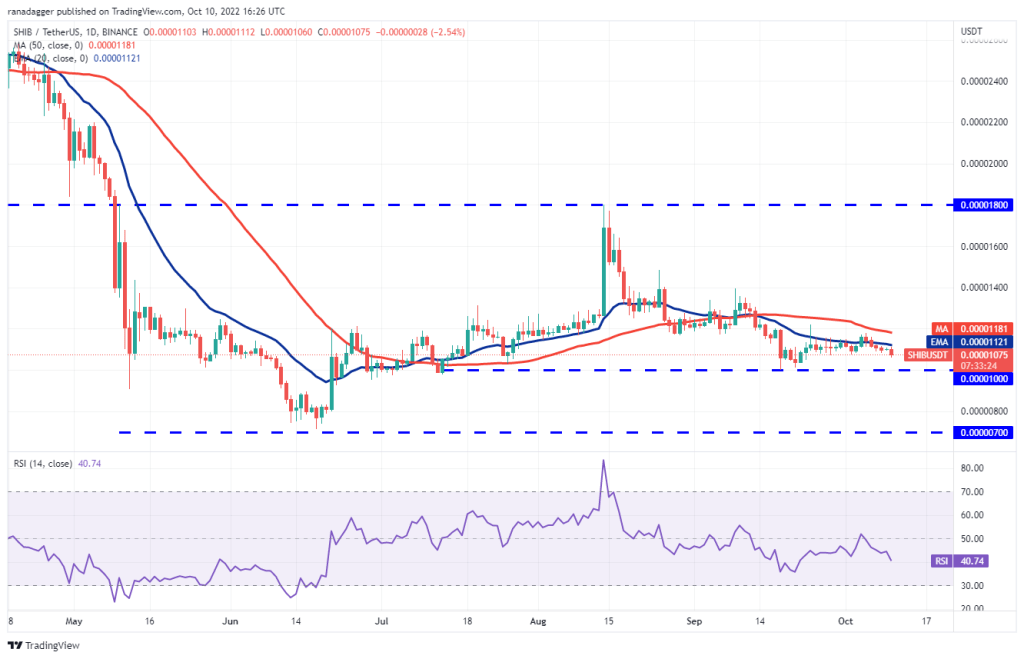

Shiba Inu (SHIB)

SHIB broke below the 20-day EMA ($0.00011) on Oct. 6 and closed. Buyers tried to push the price above the 20-day EMA on October 9 and 10, but the bears held their ground.

SHIB has strong support in the region between $0.000011 and $0.000010. If the price bounces back from this zone, the bulls will try to push the SHIB back above the moving averages. A break and close above the 50-day SMA ($0.0000012) suggests that the recovery could gain momentum. SHIB is likely to rally to $0.000014 later. It is difficult for the bears to push the price below the psychological support at $0.000010. But if they manage to do so, it is possible for SHIB to drop to $0.000007.