Leading crypto Bitcoin is struggling to find support in the $20,000 region, which has negatively impacted investor sentiment and put pressure on the prices of most altcoins, including SHIB. Will Bitcoin and altcoins continue their downtrend? Crypto analyst Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out. Bitcoin (BTC) price and detailed market data from hereyou can see.

An overview of the cryptocurrency market

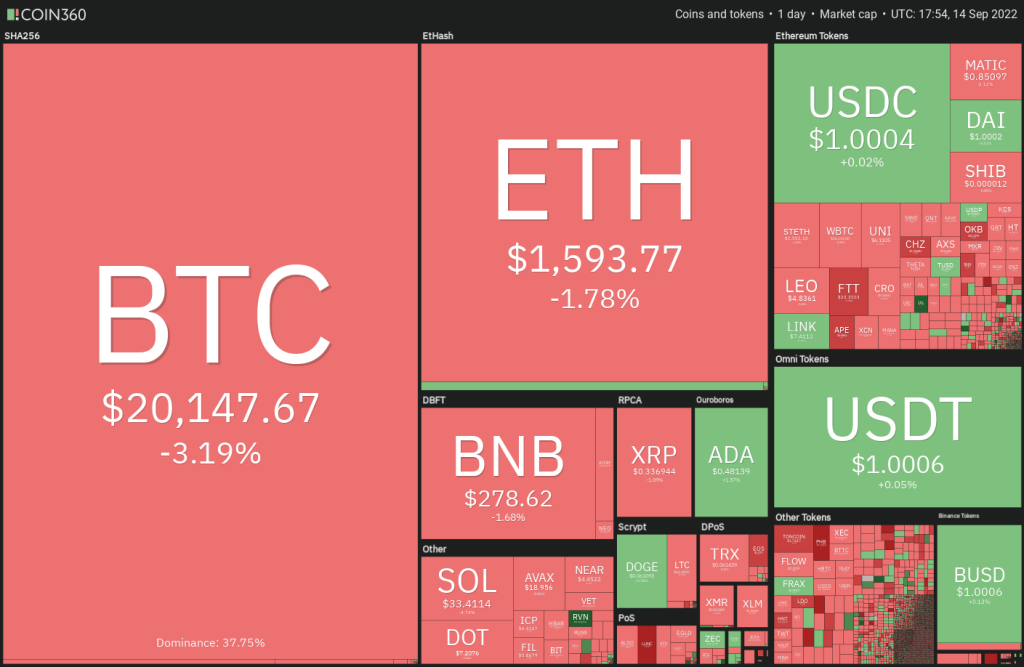

U.S. stock markets and crypto markets soared until the September 13th August CPI data were released. However cryptocoin.comThe rally broke up when the data showed that inflation was rising rather than falling.

Negative data dashed hopes of a Fed pivot in the near term. It also triggered a sharp decline in risky assets. The market value of U.S. stocks fell by about $1.6 trillion on Sept. 13. Thus, the value of crypto money markets fell below $ 1 trillion.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Statistician and independent market analyst Willy Woo says that Bitcoin (BTC) may need to drop further before reaching the maximum pain experienced in previous lows. Woo expects Bitcoin price to drop below $10,000. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

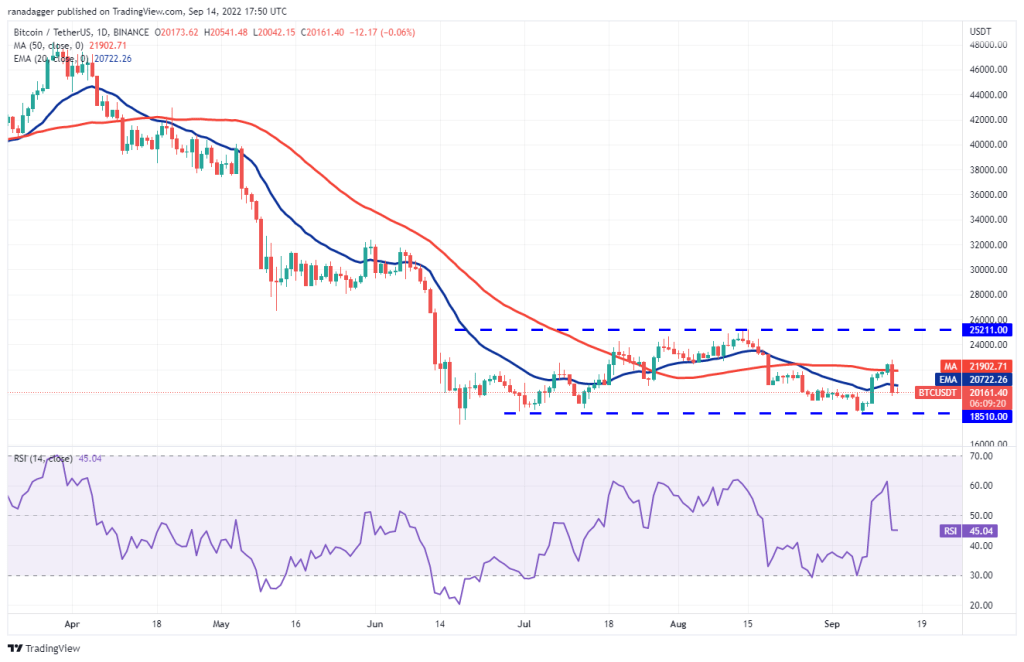

Bitcoin (BTC)

Bitcoin broke above the 50-day simple moving average (SMA) ($21,902) on Sept. 12. But this has proven to be a bull trap. Buyers tried to extend the recovery on Sept. 13. However, the rally reversed direction at $22,799.

The aggressive selling of the bears pushed the price below the 20-day exponential moving average (EMA) ($20,722). A minor positive is that the bulls are trying to stop the decline at $20,000.

If buyers pull the price above the 20-day EMA, it indicates that lower levels continue to attract buyers. BTC will then attempt to rise to the 50-day SMA. It will then retest $22,799. A break and close above this resistance is likely to open the doors for a possible rally to $25,211. Contrary to this assumption, if the price drops below $19,860, a drop to the $18,510 region of $17,622 is possible for BTC. The bulls are expected to strongly defend this area.

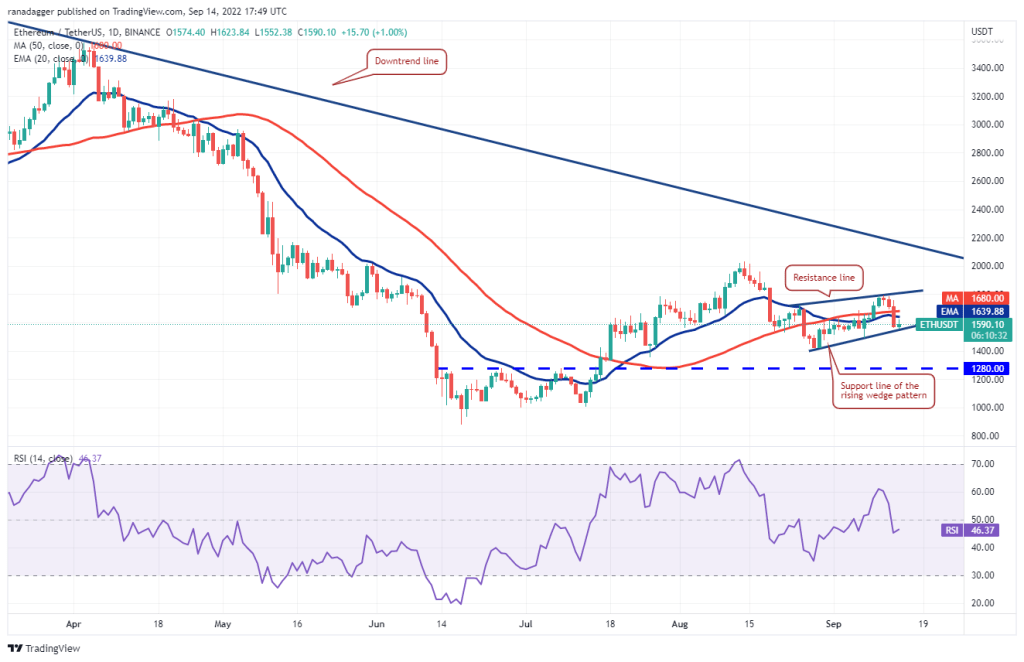

Ethereum (ETH)

ETH bounced back on September 13 and fell below the moving averages. This turned the short-term advantage in favor of the bears. A minor positive is that the bulls are trying to defend the support line of the ascending wedge pattern.

If the price rebounds from the current level and rises above the moving averages, ETH is likely to rise towards the resistance line of the wedge. The bulls will have to push and sustain the price above the wedge to clear the way for a possible rally to $2,030. Alternatively, if the price fails to break above the moving averages, the probability of falling below the bearish wedge pattern increases. If this happens, it is possible for the selling pressure to increase and ETH to drop to $1,422 and then to $1,280. Buyers are likely to build a strong defense at this level.

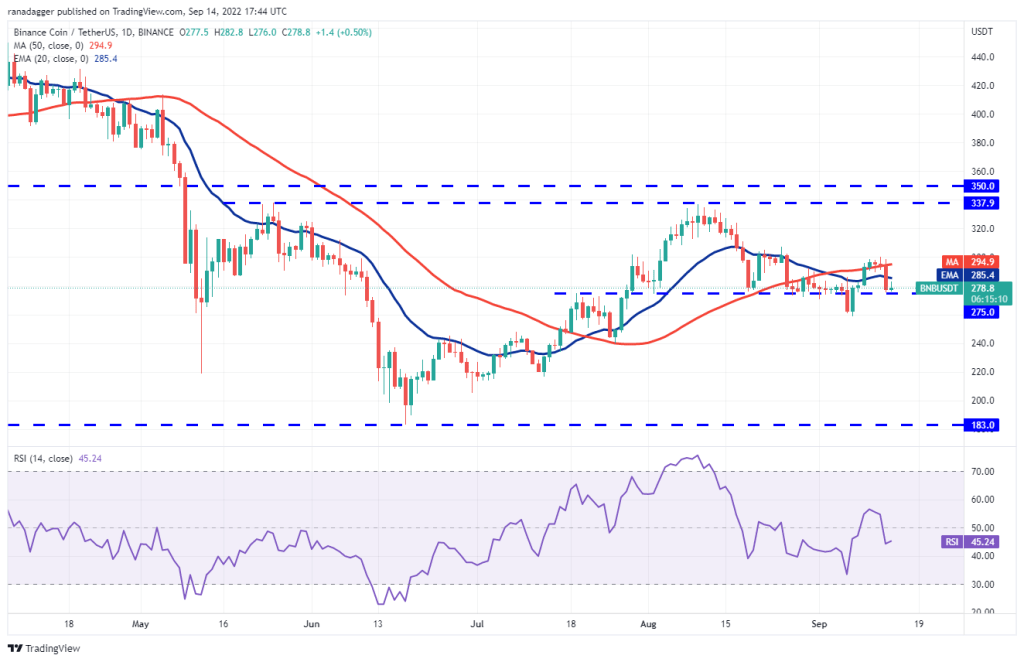

Binance Coin (BNB)

BNB dropped from $300 on September 12 and fell below the moving averages on September 13. This turned the short-term advantage in favor of the bears. But the bulls haven’t given up yet.

Buyers are trying to defend the close support at $275 and push the price above the 20-day EMA ($285). If successful, BNB is likely to challenge the $300 to $307.50 resistance zone. If the buyers clear this area, the rally is likely to pick up momentum. Conversely, if the bulls fail to push the price above the 20-day EMA, it will indicate that the bears are selling on minor rallies. This is likely to increase the likelihood of a break below $275. If this happens, it is possible for BNB to drop to $258 and then to $240.

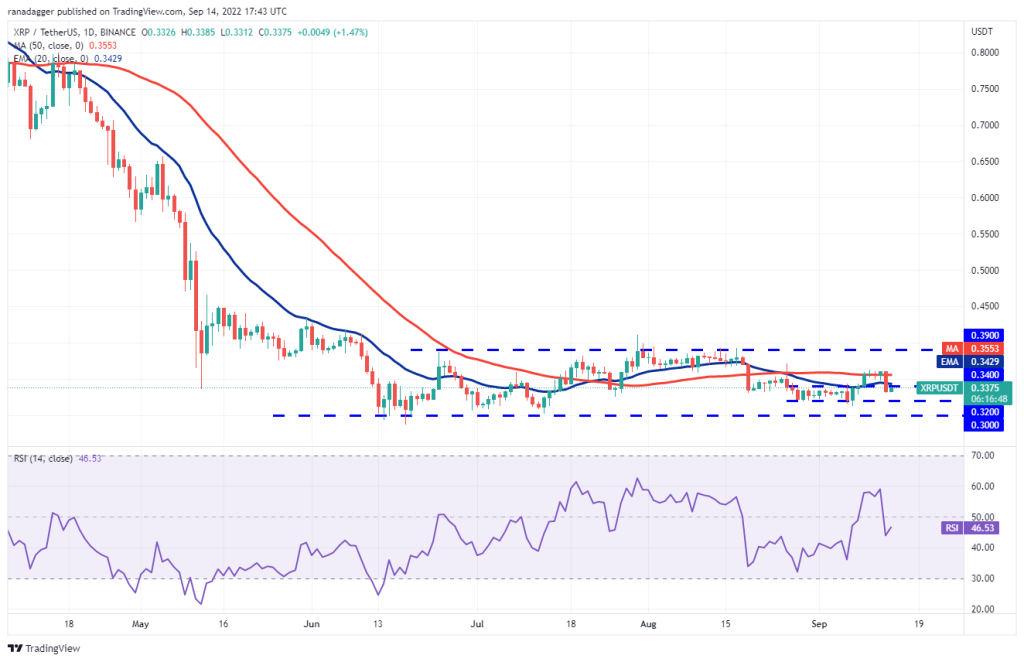

Ripple (XRP)

It traded near the 50-day SMA ($0.35) for three days. Later, Ripple (XRP) bounced back on September 13 and fell below the moving averages. This dragged the price below the $0.34 breakout level.

Buyers are trying to push the price above the 20-day EMA ($0.34) on Sept. 14. If they are successful, it will show that XRP has formed a higher bottom at $0.33. XRP is likely to retest the overhead resistance at $0.36 later. A break and close above this level is likely to push XRP towards $0.39. Contrary to this assumption, if the price drops from the 20-day EMA, it will indicate that the bears are selling on minor rallies. This, too, is likely to push the price towards the strong support at $0.32.

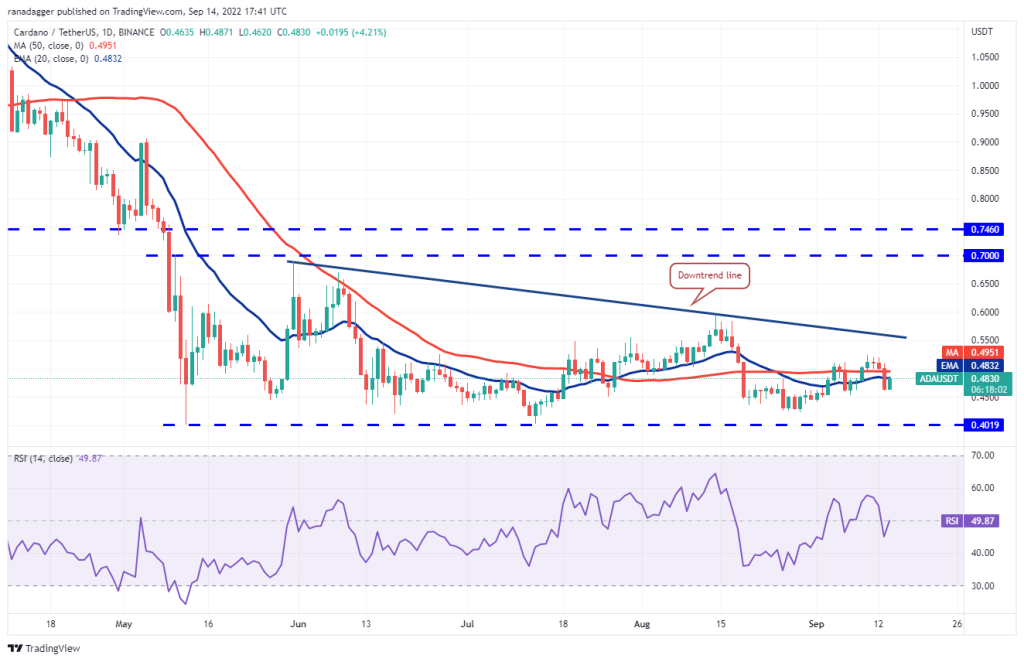

Cardano (ADA)

ADA rallied above the 50-day SMA ($0.49) on Sept. However, the bulls failed to continue the recovery and pushed the price to the downtrend line. This indicates the bulls’ hesitancy to buy at higher levels.

Failure to extend the recovery may have led short-term investors to profit. This brought the price below the moving averages on Sept. 13. A minor positive is ADA’s rebound from $0.46 and bulls attempting to pull the price back above the moving averages. This shows that lower levels continue to attract strong buying from the bulls. If the price breaks above the 50-day SMA, it is possible for ADA to reach the downtrend line. This view will be invalidated in the near term if the price turns down from the moving averages and dips below $0.45. ADA is likely to drop to $0.42 later.

SOL, DOGE, DOT, MATIC and SHIB analysis

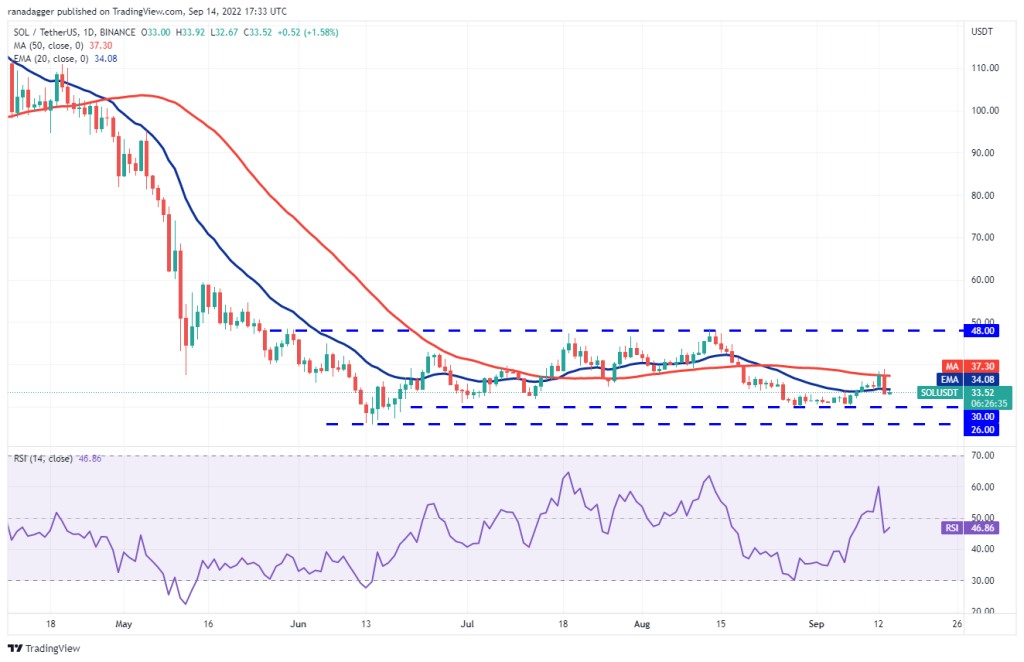

Left (LEFT)

Buyers pushed Solana above the 50-day SMA ($37.30) on Sept. 13 and 14. However, the bulls failed to sustain higher levels. This shows that the bears are fiercely defending the 50-day SMA.

The strong sell-off on September 13 pushed the price below the 20-day EMA ($34). The bears will now attempt to lower the SOL to support near $30. Repeated testing of a support level tends to weaken it. If the $30 level is broken, it is possible for the SOL to start descending to the vital support at $26. Contrary to this assumption, if the price rises from the current level and rises above the 20-day EMA, the SOL is likely to rise to the 50-day SMA. The bulls will need to break through this general hurdle to signal the start of the rise to $48.

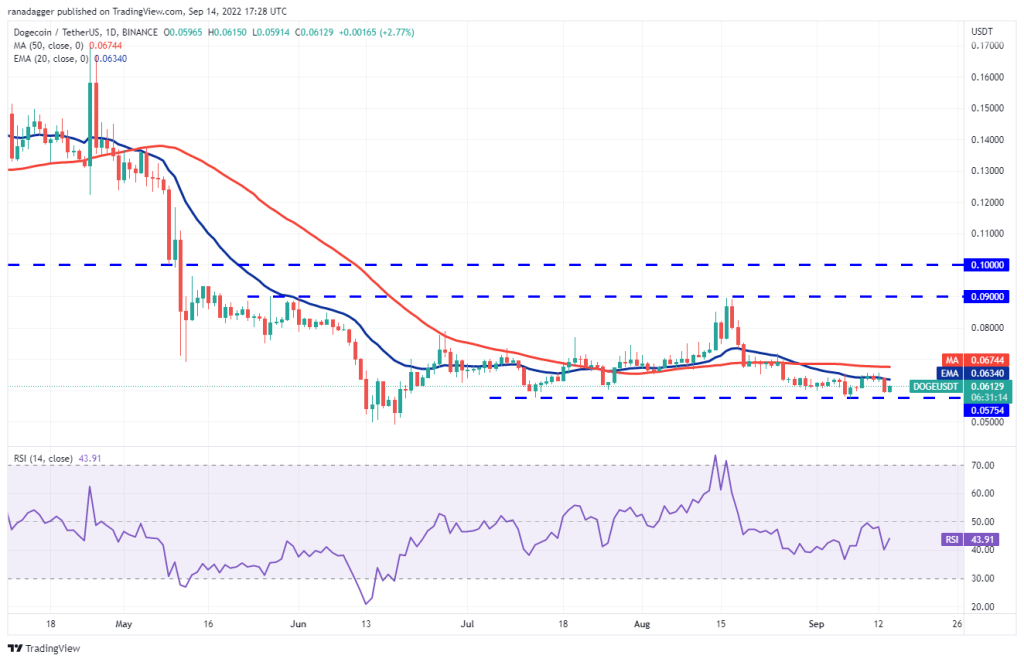

Dogecoin (DOGE)

DOGE bounced off the support zone around $0.06 on Sept. 7. However, the recovery failed at the 20-day EMA ($0.06). This shows that the bears are aggressively defending the moving averages.

The price fell from the 20-day EMA on Sept. 13 and reached support at $0.06. The bulls are expected to aggressively defend the level as a breakout. A close below this is likely to push the DOGE down to the June low of $0.05. If this support is broken, it signals the resumption of the downtrend. This negative view will be invalidated if the price bounces back from the current level and rises above the moving averages. In this case, DOGE is likely to attempt a rally to $0.09.

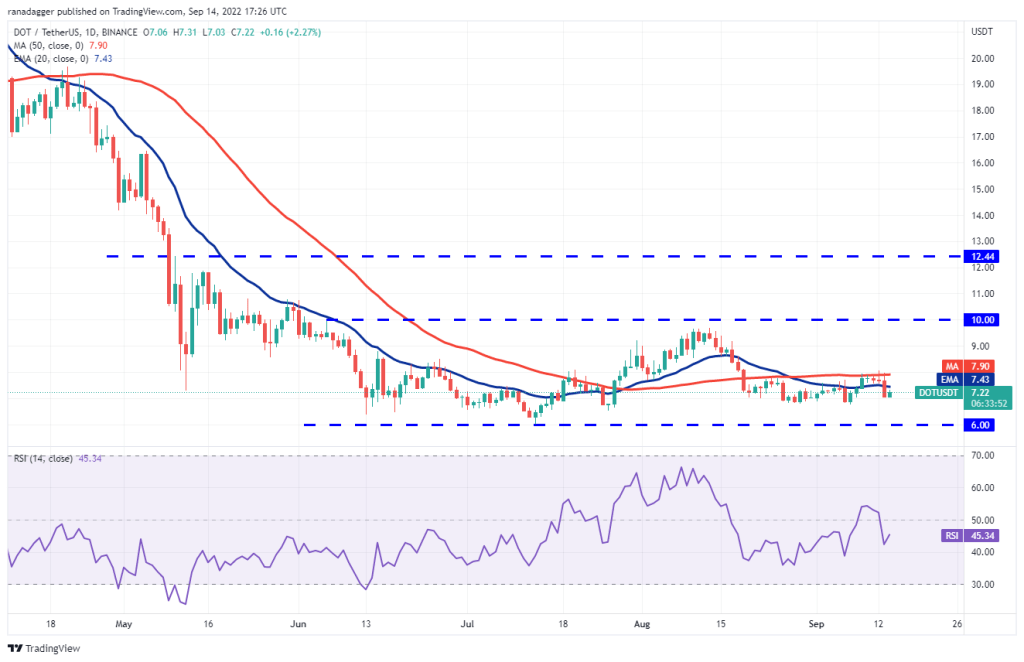

Polkadot (DOT)

The DOT tried to rise above and sustain the 50-day SMA ($7.90) from Sep 9-13. But the bears held their ground. This shows that sentiment remains negative and bears are selling on rallies towards resistance levels.

Failure to break above the 50-day SMA likely attracted strong selling from the bears and profit bookings from the short-term bulls. This pushed the price below the 20-day EMA ($7.43) on Sept. 13. The bears will now attempt to push the DOT below the immediate support at $6.75 and push the crucial level at $6. Alternatively, if the price bounces back from the current level and rises above the 20-day EMA, it will indicate that the bulls continue to buy on the dips. The bulls will then attempt to break through the hurdle at the 50-day SMA. Next, it will start a rally towards $10.

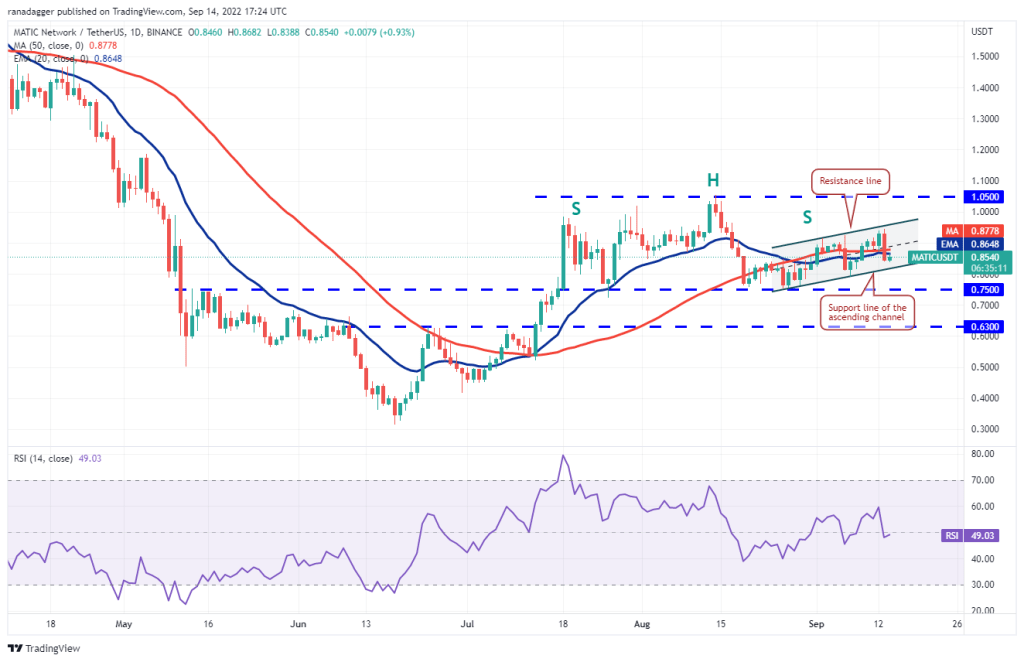

Polygon (MATIC)

MATIC has been in a wide range between $0.75 and $1.05 for the past few weeks. Both moving averages have flattened and the relative strength index is near the midpoint. This shows that there is a balance between buyers and sellers.

MATIC has been trying to rise within an ascending channel for the past few days. If the price breaks below the channel, it will signal a small advantage for the bears. MATIC is likely to drop to strong support at $0.75 later. Contrary to this assumption, if the price rises above the current level and the moving averages, the MATIC will likely reach the resistance line of the channel. A break and close above the channel is likely to open the doors for a possible rally to $1.05.

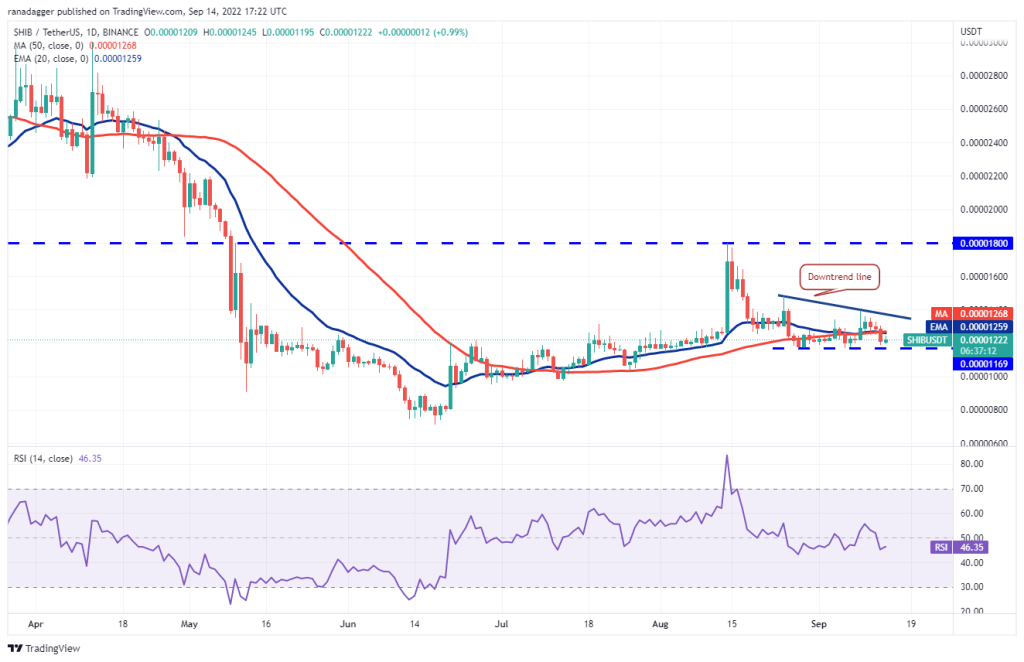

Shiba Inu (SHIB)

SHIB managed to stay above the moving averages between September 9 and 12. However, SHIB bulls failed to develop this strength and were unable to break through the overall hurdle on the downtrend line. This indicates a lack of demand at higher levels.

SHIB price fell below the moving averages on September 13. The bears will now try to push SHIB below the strong support at $0.0012. If they are successful, SHIB will complete a descending triangle pattern. This downtrend has a target of $0.000009. Contrary to this assumption, if the SHIB price rises above the current level and the moving averages, the SHIB is likely to reach the downtrend line. A break and close above this level will invalidate the bearish setup. It will also clear the way for a rally towards $0.000018.