According to crypto analyst Rakesh Upadhyay, Bitcoin’s technical setup is leaning towards an additional downside. This, in turn, is causing some traders to exit altcoins like SHIB, which are struggling at general resistance levels. While the near term may seem uncertain, long-term investors may be looking for bottom fishing opportunities. Can Bitcoin and major altcoins stay above immediate support levels? Rakesh Upadhyay examines the charts of the top 10 cryptocurrencies to find out.

An overview of the cryptocurrency market

The S&P 500 is still giving up on gains on a daily basis as the Bitcoin (BTC) price tries to change its course. United States stock markets have been down since August 26. With this cryptocoin.comAs you follow, Bitcoin managed to maintain the $20,000 mark.

However, investor interest seems to be moving away from Bitcoin. This has led to a reduction in assets under management (AUM) for Bitcoin investment products, which fell 7.16% to $17.4 billion in August, according to a new report by CryptoCompare. By contrast, AUM for Ethereum products rose 2.36% to $6.81 billion over the same period. This shows that investors took positions in Ethereum products before Merge.

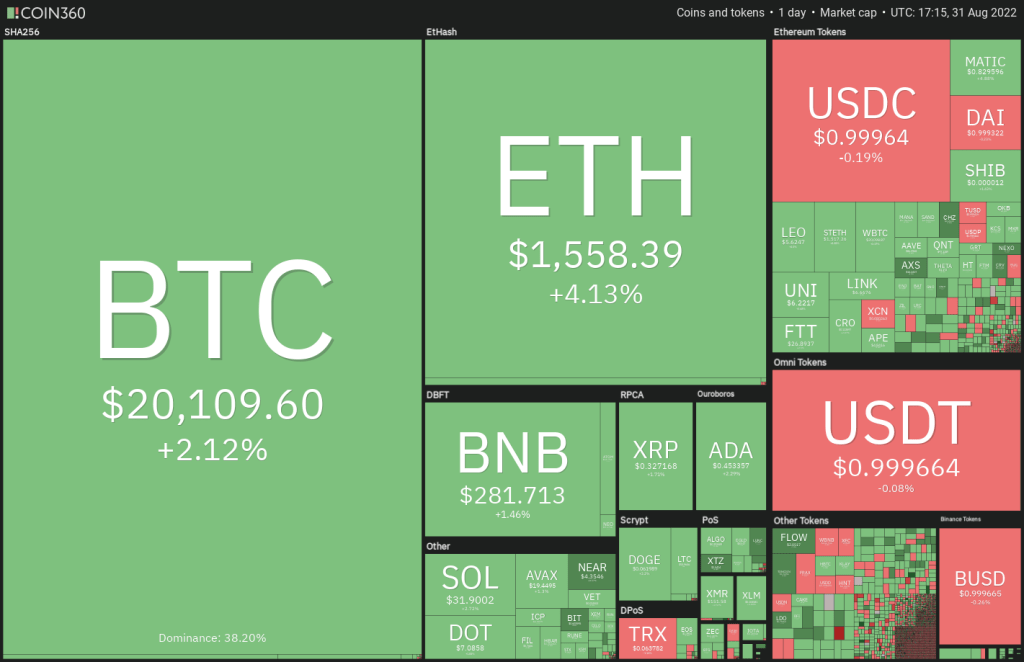

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360While prices are falling across the ecosystem, bear markets offer attractive opportunities, at least to long-term investors. Seven Six, the venture capital firm of Reddit co-founder Alexis Ohanian, is aiming to raise $177.6 million for a crypto investment fund to capitalize on this opportunity. Similarly, former executives of Galaxy Digital and Genesis are seeking to raise $500 million in funding. Now it’s time for analysis…

BTC, ETH, BNB, XRP and ADA analysis

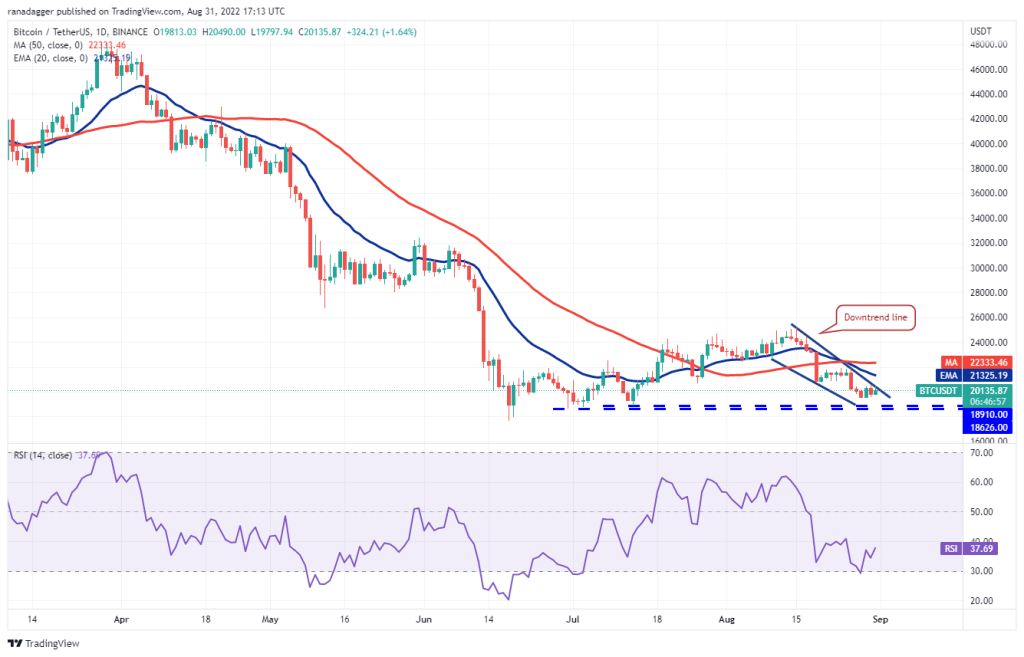

Bitcoin (BTC)

Bitcoin fell from the downtrend line on August 30. A minor positive, however, is that the bulls are buying the dip near $19,500. The bulls are attempting to push the price above the downtrend line again on August 31.

If they are successful, it is possible for BTC to rise to the 20-day exponential moving average (EMA) ($21,325), which is an important level to watch out for. If the price drops from this level, the bears will try to pull BTC into the strong support zone between $18,910 and $18,626. A break and close below this zone is likely to open the doors for a retest of the critical support at $17,622.

Conversely, if the bulls push the price above the 20-day EMA, BTC is likely to rise to the 50-day simple moving average (SMA) ($22,333). If the bulls break this hurdle, it is possible for BTC to gain momentum and rally towards the overhead resistance at $25,211. The bulls have to break through this hurdle to indicate that the bottom may be in place.

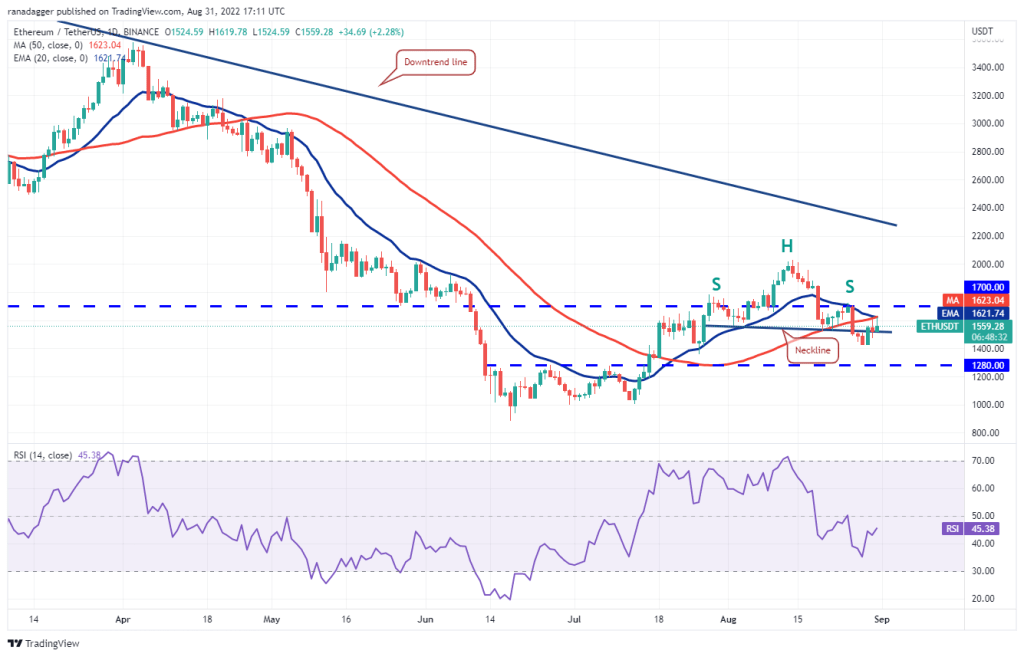

Ethereum (ETH)

ETH rallied at $1,422 on August 29 and broke above the neckline of the head and shoulders pattern. This suggests that the crash on August 26 could be a bear trap.

The bulls are trying to push the price above the moving averages. If successful, ETH is likely to rise to the overhead resistance at $1,700. This is an important level to focus on. Because a break and close above this will allow a possible rally to $2,000. This bullish view will be invalidated if the price breaks below the overhead resistance and dips below $1,422. Such a move suggests that the recovery may be over. It is possible for ETH to drop to $1,280 and then $1,050 later.

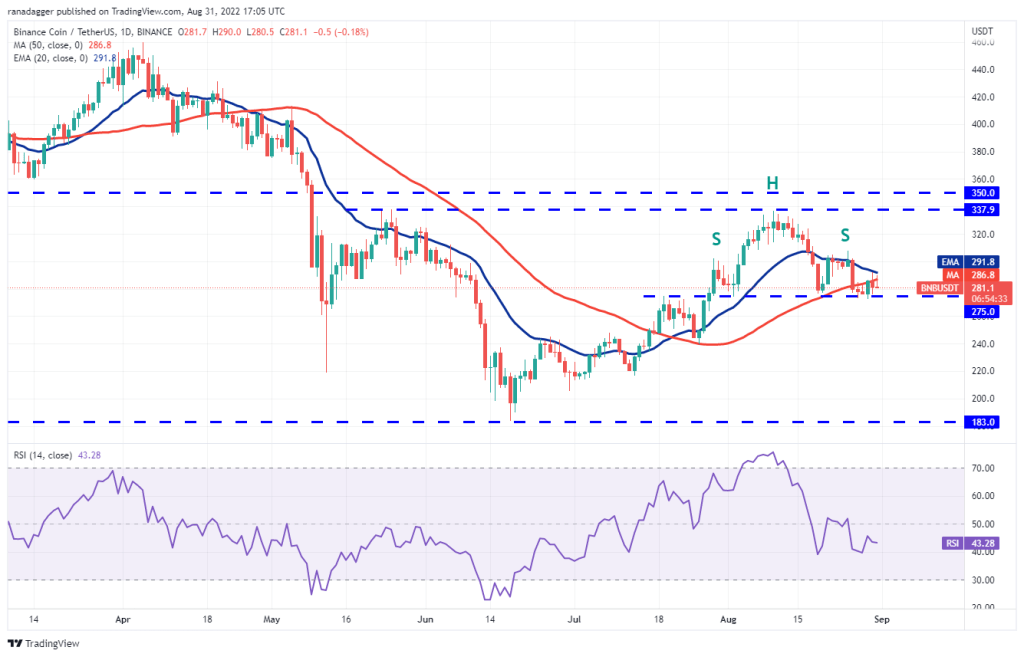

Binance Coin (BNB)

BNB bounced off the strong support at $275 on August 29. This shows that the bulls are aggressively defending this level.

The bulls tried to push the price above the 20-day EMA ($292) on August 30 and 31. But the bears held their ground. If the price breaks and closes below the $275 support, BNB will complete the downtrend. This is likely to start a decline towards the $240 and then $212 pattern target. Conversely, if the price rises from $275 and rises above the 20-day EMA, a rise to $308 is possible for BNB. A break and close above this resistance is likely to open the way for a rally to $338.

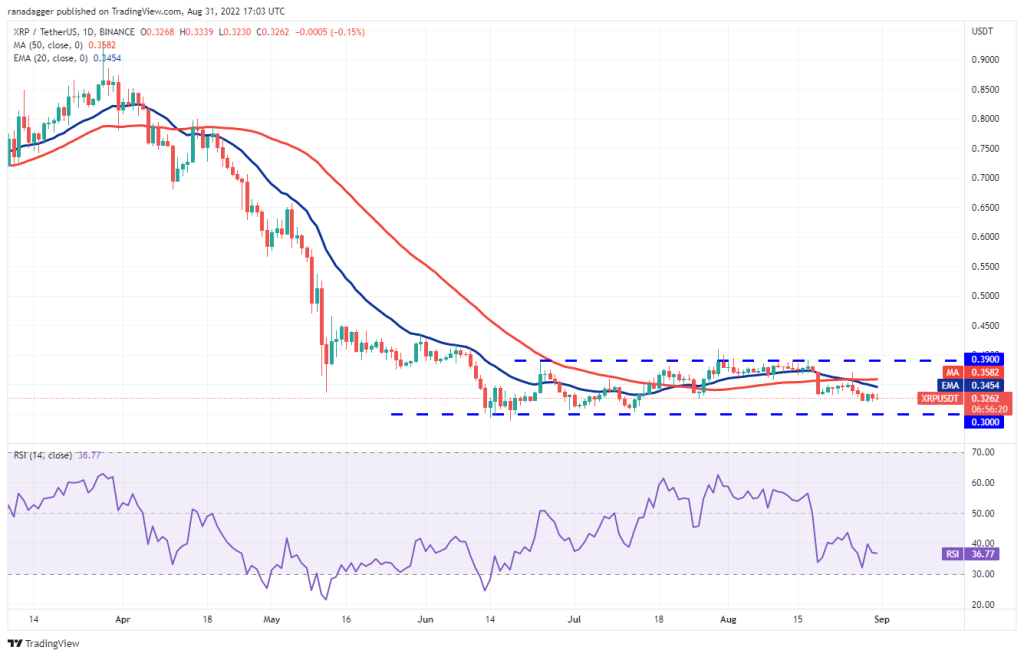

Ripple (XRP)

Buyers have been holding the $0.32 level for the past three days. However, it failed to provide a strong recovery. This indicates a lack of demand for Ripple at higher levels.

The downward sloping 20-day EMA ($0.34) and the relative strength index (RSI) in the negative zone suggest that the bears have a slight advantage. If the price breaks from the current level or the 20-day EMA and dips below $0.32, XRP is likely to slide to vital support at $0.30. The bulls are expected to defend this level with all their might. A break below this support signals the resumption of the downtrend. Conversely, if the bulls push the price above the moving averages, a rise to $0.39 is possible.

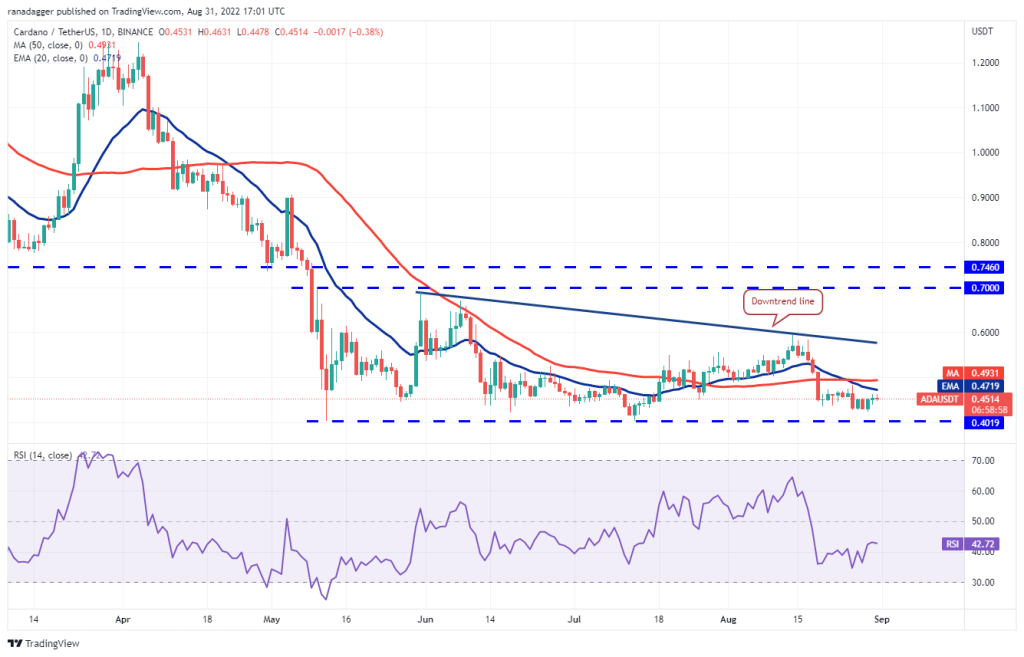

Cardano (ADA)

ADA jumped from $0.42 on August 29. Later, it reached the 20-day EMA ($0.47), where the bears are forming stiff resistance.

If the price drops from the current level, it will signal that the bears will continue to sell on minor rallies. The bears will then try to push the price down to the critical support at $0.40. This is an important level to consider. Because a break and close below this will mark the start of the next leg of the downtrend. On the other hand, if buyers push the price above the moving averages, strong demand will emerge at the lower levels. It is possible for ADA to rise to the downtrend line later on.

SOL, DOGE, DOT, MATIC and SHIB analysis

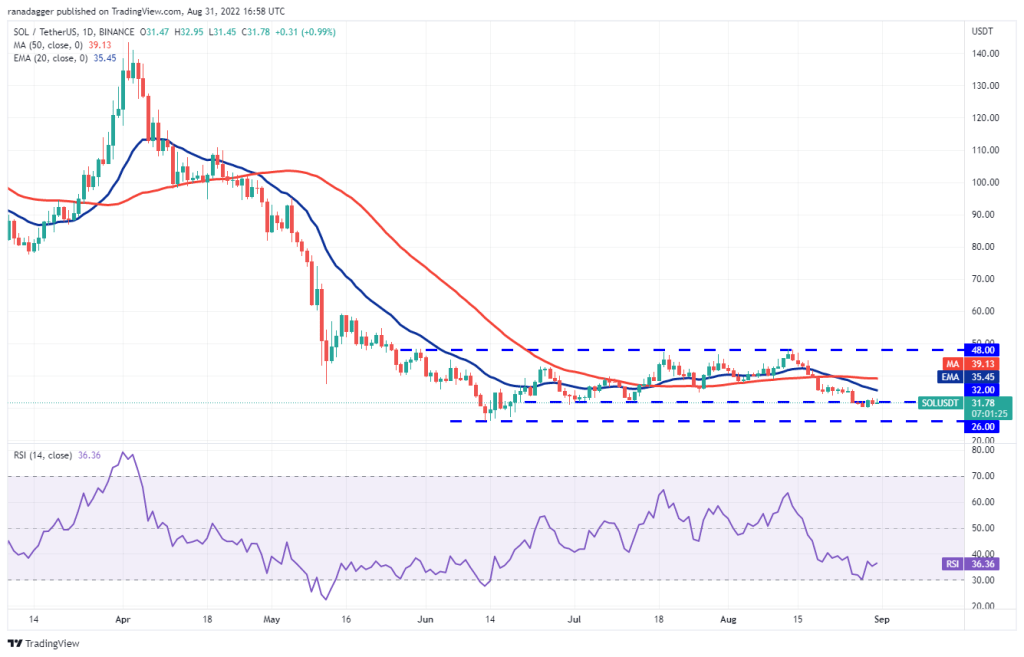

Left (LEFT)

SOL rebounded from $30 and broke above $32 on August 29. However, the bears pushed the price back below the level on August 30. This shows that the bears are selling on every small rise.

The bulls are trying to push the price towards the 20-day EMA ($35), which is again an important level to watch out for in the short term. If the bulls push the price above this level, a rise of the SOL to the 50-day SMA ($39) is possible. The falling 20-day EMA and the RSI in the negative zone indicate advantage for the sellers. If the price breaks from the current level or the 20-day EMA and dips below $30, a drop of the SOL to the key support at $26 is possible.

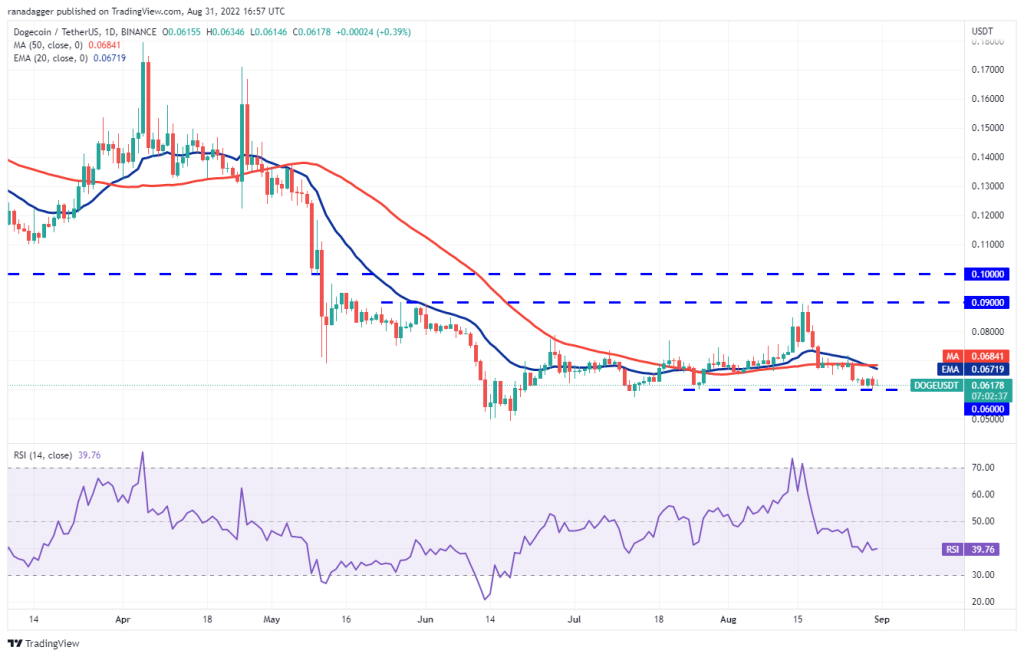

Dogecoin (DOGE)

The bulls have successfully defended the support at $0.06 over the past few days. However, it failed to provide a strong recovery. This indicates a lack of demand for Dogecoin at higher levels.

A tight consolidation near a strong support increases the likelihood of a breakdown. If this happens, DOGE is likely to start its downward move from the June 18 low of $0.05. This is an important level for the bulls to defend. Because a break below this and a close is likely to resume the downtrend. Conversely, if the price rises from the current level and rises above the moving averages, it indicates that the last leg of the correction phase will be over. It is possible for DOGE to attempt a rally to $0.09 later.

Polkadot (DOT)

The DOT has been trading below the moving averages since Aug. However, the bears failed to lower the price to the strong support at $6. This indicates that sales are drying up at lower levels.

The bulls will again try to push the price above the moving averages. If they are successful, it will suggest that the DOT rally to $9.17 and then to the overhead resistance at $10. The bears are likely to build a strong defense at this level. Another possibility is for the price to drop from the moving averages and slide below $6.79. If this happens, the bears will attempt to lower the DOT to the critical support of $6. A break and close below this level likely indicates a resumption of the downtrend.

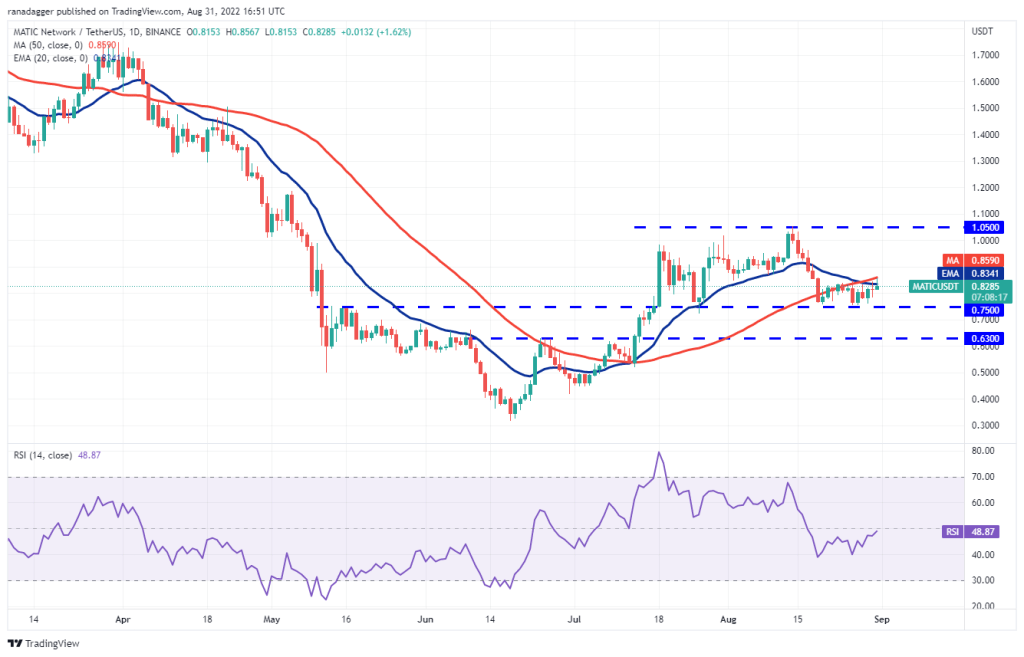

Polygon (MATIC)

MATIC recovered from the $0.75 support on August 29 and reached the 20-day EMA ($0.83) on August 30. However, the Doji candlestick shows indecision between buyers and sellers.

If the bulls sustain the price above the moving averages, a MATIC rise to the north towards the overhead resistance at $1.05 is possible. This level is likely to face stiff resistance from the bears again. Contrary to this assumption, if the price drops from the moving averages, it will show that the bears are fiercely defending the level. MATIC is likely to decline again towards the $0.75 strong support later on. If this support is broken, MATIC could drop to $0.63.

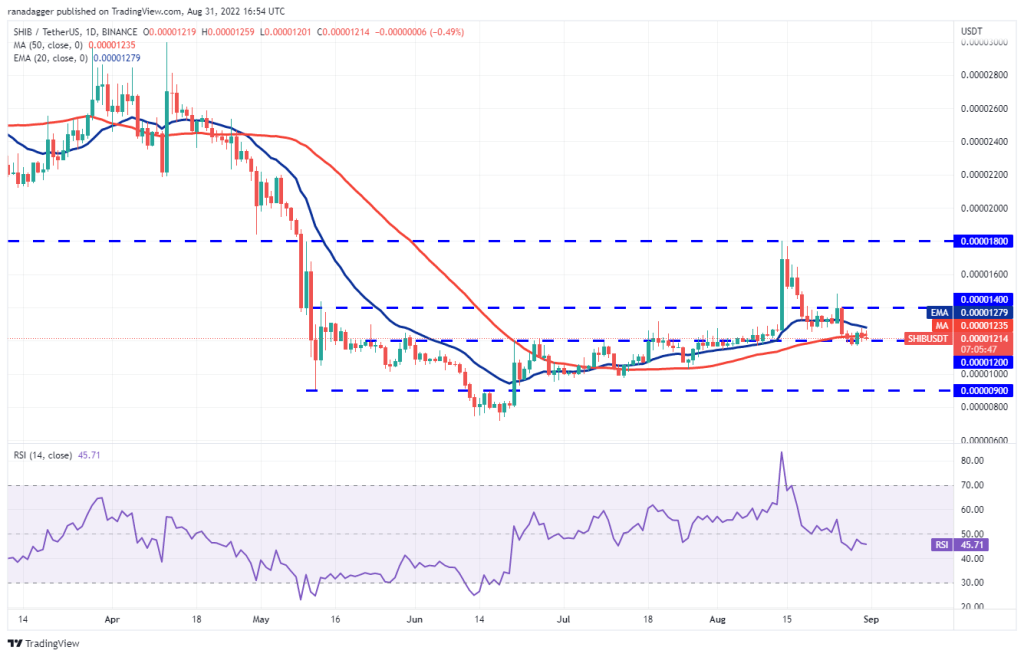

Shiba Inu (SHIB)

SHIB broke above the important level of $0.000012 on August 29. This shows that the bulls are buying on the lows. Buyers tried to push the price above the 20-day EMA ($0.0000013) on August 30. But the SHIB bears did not give up.

SHIB price is stuck between the 20-day EMA and $0.000012. This narrow gap trade is unlikely to continue for long. If the bears sink and hold the price below $0.000012, the Shiba Inu (SHIB) is likely to drop to $0.000010. Alternatively, if the price rises above the 20-day EMA, it is possible for SHIB to rise to the overhead resistance at $0.000014. SHIB bulls have to break through this hurdle to open the doors for a possible rally to $0.000018.