Ethereum is outperforming Bitcoin ahead of September’s Merge. The second-largest cryptocurrency by market capitalization has risen 61 percent against Bitcoin since June. Traders anticipate a broader rise for the largest altcoin. Here are the details…

Leading altcoin Ethereum revives “flippening” hopes

The chart below shows the price of Ethereum against Bitcoin since 2018. ETH has finally crossed the 0.077 BTC level not seen since January 2022. It is now only 12 percent behind its 4-year high (in the BTC pair). The bullish sentiment could rekindle hopes of “Flippening” attributed to Ethereum’s overtaking Bitcoin in terms of market cap. For this to happen, Ethereum would need to increase an additional 100 percent to reach roughly $3,750. This price target is still 23% below the all-time high of $4,800 reached in November 2021.

Ethereum hit a peak of 0.15 BTC in 2017. It has struggled to regain 0.1 BTC since February 2018. The news that the upcoming Merge has finally become more than a dream seems to have ignited the market to favor ETH over Bitcoin. The chart below shows the price of Ethereum against both the dollar and Bitcoin. It is clear that Ethereum is currently rising faster against Bitcoin than it is against the dollar. This, in turn, marks a strong position in the broader crypto market, according to experts.

What do other metrics show?

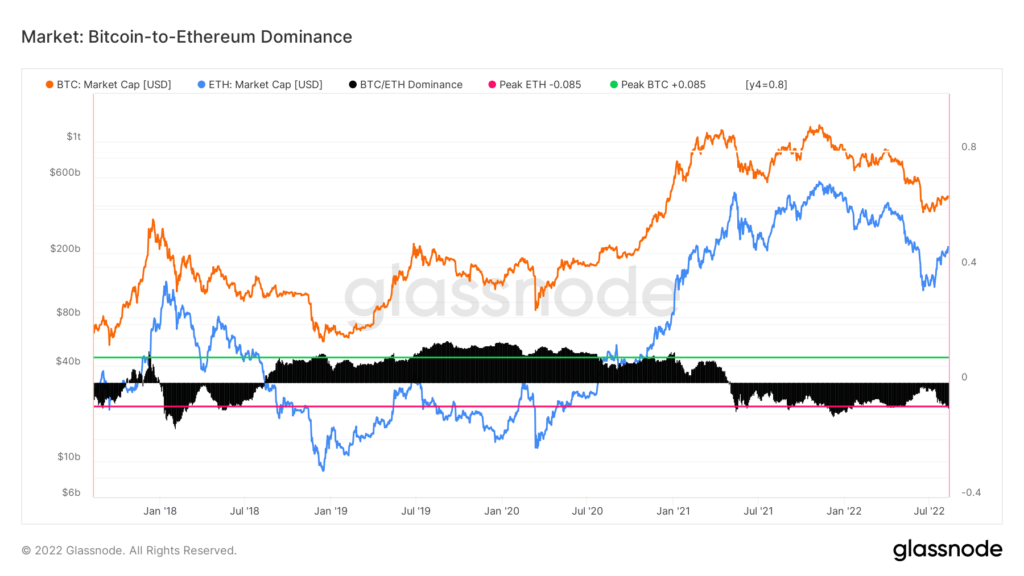

Ethereum’s overall market dominance is also increasing compared to Bitcoin. The chart below from Glassnode shows the strength of Ethereum’s overall market dominance, which is currently at its highest level since December 2021.

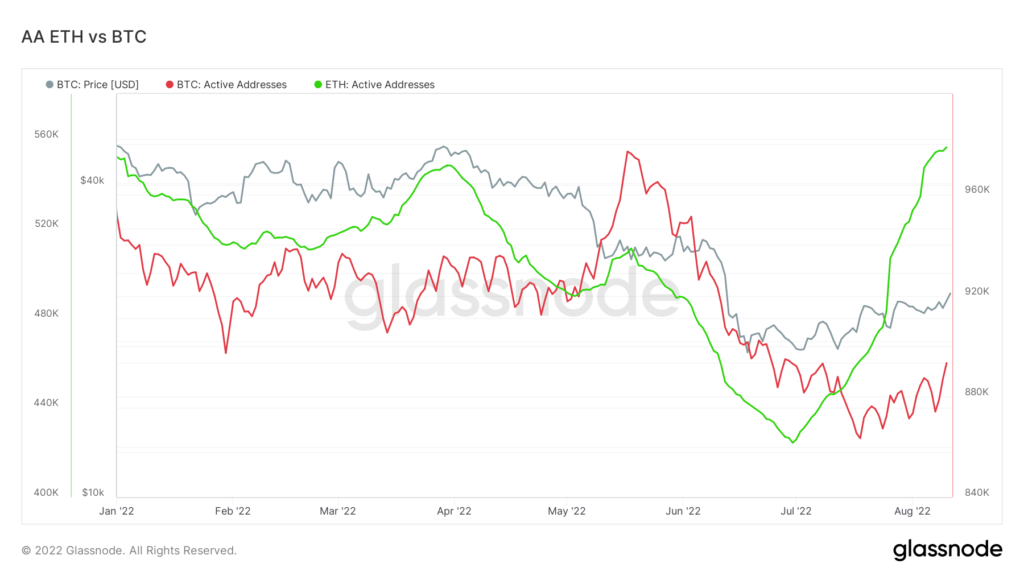

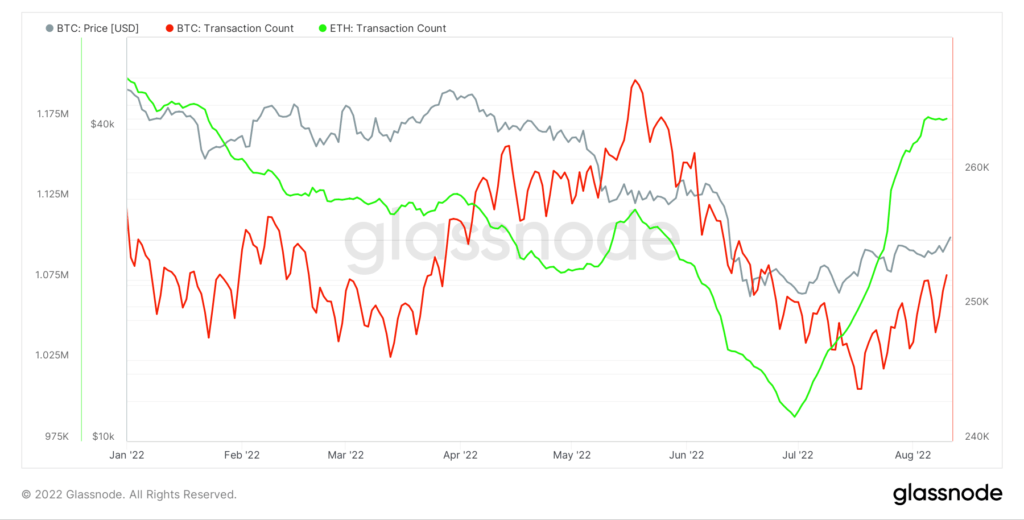

Ethereum also dominates other metrics such as the number of active addresses and the number of transactions. Both metrics started rising around July, with the altcoin now registering almost 100,000 more active addresses than its rival Bitcoin.

Will there be a 499 percent increase in Ethereum price?

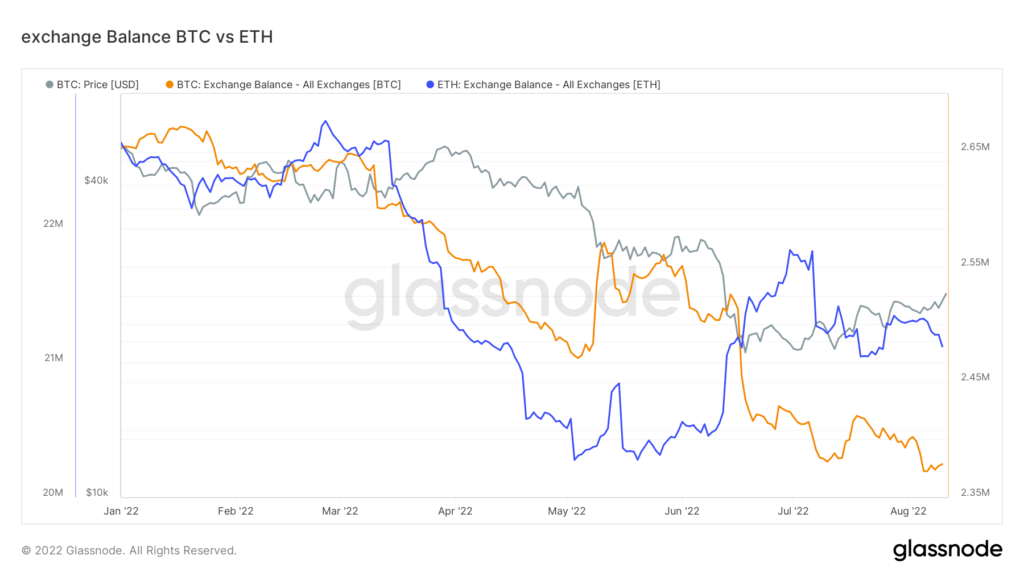

However, a key indicator could suggest that Ethereum’s resurgence may be short-lived. While the amount of Ethereum held on exchanges has increased over the past few months, Bitcoin levels have decreased significantly. This change may indicate that the increase in Ethereum dominance against Bitcoin is due to Merge speculation.

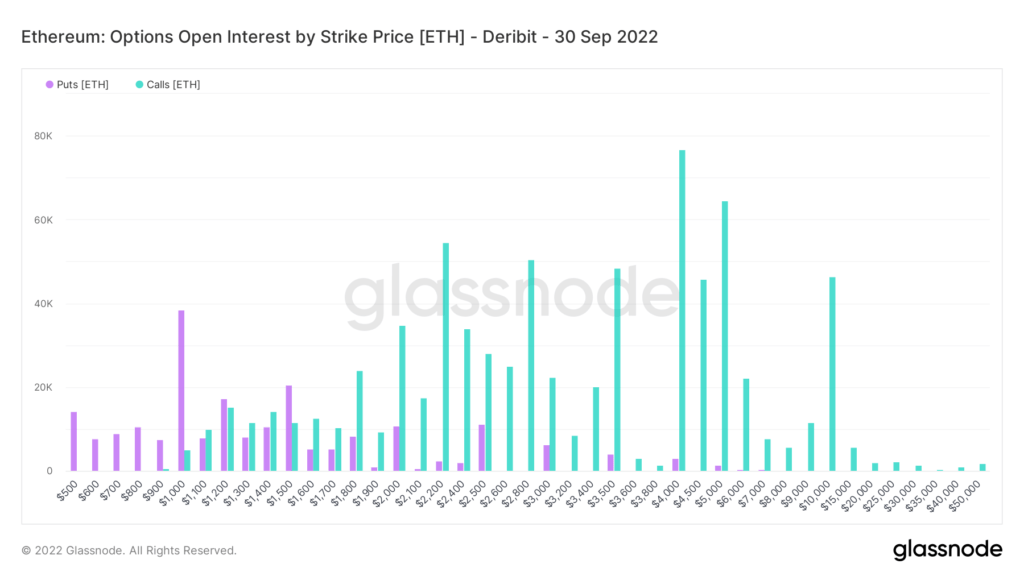

Another chart shows the strike prices of Ethereum options with users taking large open positions. High-volume usage prices for ETH go up to $10,000. This marks a 499 percent increase from the current price. These calls are likely to be used as part of a more complex trading strategy. In this way, the trader can open a short position at a lower strike price to minimize the risk.

The truth is, Ethereum currently outperforms Bitcoin. On chain data such as active addresses indicates that this is happening with users interacting with the network rather than just HODLing. The rising Ethereum level on exchanges softens this feeling a bit. However, the increase in the volume of coins held on exchanges is by no means a perfect indicator of a downtrend.