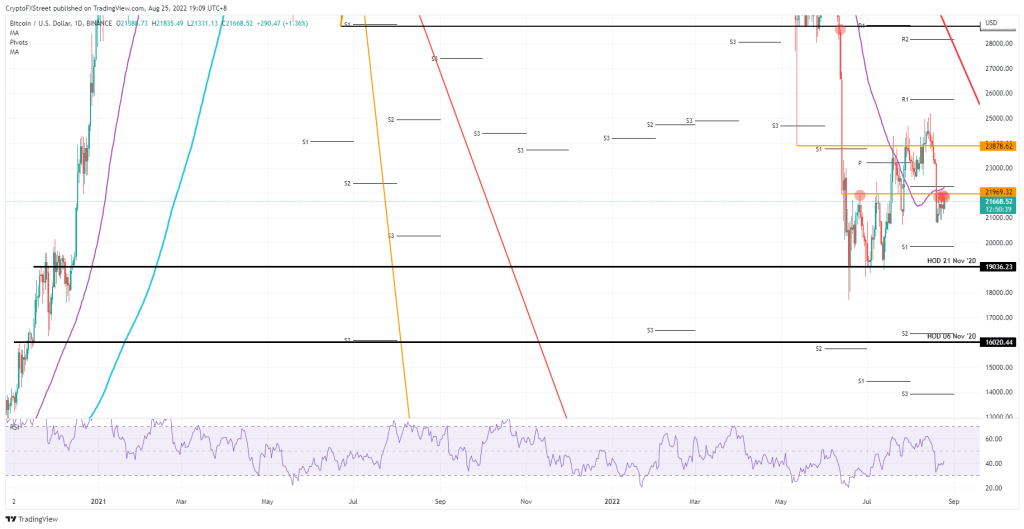

Bitcoin price is seeing a short-term bullish move towards $21,969. BTC price could bounce back at the same pace as a false break above $22,000 could create a bull trap. Traders are currently following a setup that suggests a double-digit correction.

Bitcoin traders see its chart suggest a 12-26% drop

BTC price is poised for a major battlefield for Friday’s trading session. The event at hand is the Jackson Hole Symposium taking place this evening. Cryptocurrency investors and analysts are waiting for the impact of the results from the meeting. Investors preparing for this event are aware of current market conditions. False statements will pave the way for a collapse in Bitcoin for the bears. The first support waiting for the leading cryptocurrency in this direction will be $ 16,000.

Is BTC price ready for another June 13 move?

Bitcoin price has experienced a 15% drop in the past in just one trading session on June 13. A replay of the same size and magnitude is possible, as the markets are a little too enthusiastic at the moment.

Technically, the BTC price set a trap for the bulls to jump behind this event. With a possible rise above $21,969 or even $22,000, Bitcoin bulls will jump on the break. Thus, it will run the risk of being dragged under the entry points. This event is purely headline driven. As a result, any word or phrase can trigger a market reaction in a matter of seconds. A short drop to $19,036 awaits BTC price in the best case. However, with harsher statements and the ensuing sell-off, the bears are on the way to $16,020. We will observe this from the momentary price movements that come with the sudden selling of the bears.

As we mentioned, markets will chase some positive elements from Fed chairman Jerome Powell’s speech. This reinforces the fact that some investors are coming back with a lot of cash set aside for most of 2022. Markets will see buyer-side demand explode as BTC movement rockets up. FXStreet analyst Filip expects BTC to hit $30,000 by the end of next week if the first level is $23,878 to the upside and if the fundamentals are positive.

Bitcoin’s weekly on-chain record

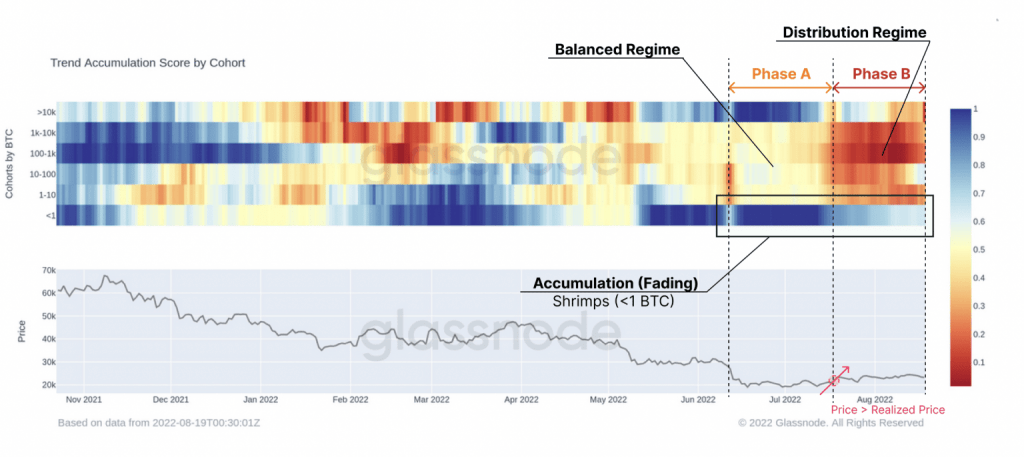

Glassnode reports indicate that the current BTC market is in the distribution phase. The analytics firm found that after BTC plunged below $20,000, investors with less than one BTC and whales with more than 10,000 BTC were accumulating BTC. The Glassnode chart below shows that the recent surge in Bitcoin has “triggered a distribution phase across the board, adding selling pressure to the market.”

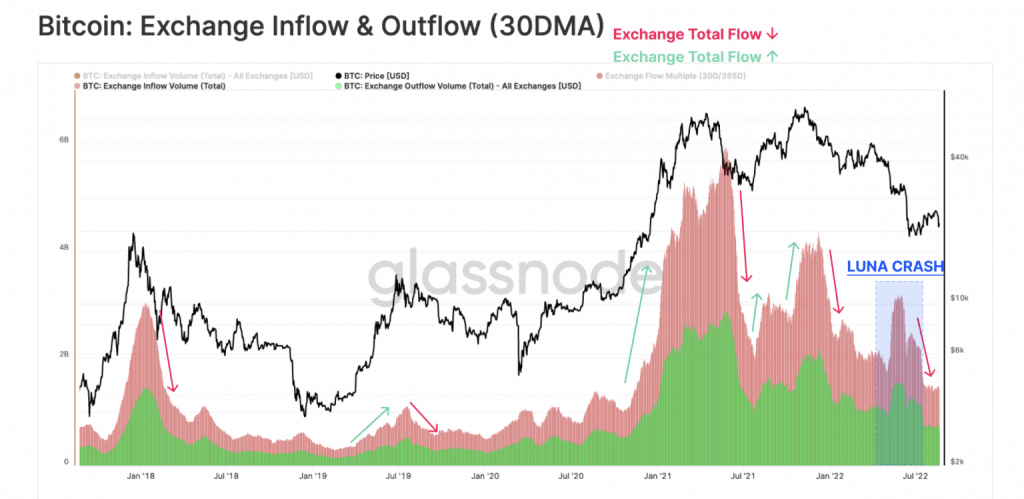

Glassnode also found that “a general lack of speculative interest in BTC remains.” This is a result of the decline in foreign exchange flows to levels in late 2020.

cryptocoin.comAs you follow, Bitcoin spent most of the day consolidating below the $22,000 resistance.