The positive analyzes for the three altcoins on Binance, the largest cryptocurrency exchange with daily trading volume, draw attention. Here are the recent analyzes for DOT, ETH and EOS…

Analyst: Polkadot (DOT) could rise 70 percent

Analyst Crypto Tony points to a 70 percent bullish probability for DOT. A direct competitor to Ethereum, Polkadot has implemented a staked DOT pool and advocates local staking rather than centralized third-party systems. This strategy improves user control and accessibility and allows the user to stake even with 1 DOT. With this new development, the price of Polkadot (DOT) has seen a significant increase with the addition of a large number of tokens to the system.

Really are currently knocking on heavens door. Once we break through we have a chance at a 30% then a 70% target range pic.twitter.com/UyrgPcJrqo

— Crypto Tony (@CryptoTony__) February 18, 2023

The latest price analysis for Polkadot (DOT) reveals a positive trend as an upward price action has been recorded in the previous twenty-four hours. The price has increased significantly as a result of the recent uptrend that the market has been following for the past few hours. Polkadot’s native token DOT is on the verge of a major breakout with the potential for a 30 percent increase, according to an analysis recently published by the pseudonymous cryptocurrency expert Crypto Tony.

However, if the first breakout is successful, it also requires seeing a 70 percent price increase. The price of DOT is still roughly 87 percent off its all-time high of $55 on November 04, 2021. Another key factor holding back DOT’s potential price increase has been the shrinking time required for staking, which is currently 28 days.

The bullish prospect for the leading altcoin Ethereum (ETH)

A major rise in the price of altcoin Ethereum (ETH) could be imminent, according to crypto analyst Mohit Sorout, co-founder of Bitazu Capital. In a recent tweet, Sorout highlighted that the volatility of the cryptocurrency has reached extremely low levels, which could lead to a price spike. For Ethereum’s volatility to return to higher levels, Sorout suggests that the price must rise. Ethereum has a market cap of $207 billion.

$ETH volatility experienced extreme lows.

For vol to mean-revert to higher levels, price will have to do the needful, no?Translation: Number go up more. https://t.co/nPYEvojROt

— Mohit Sorout 📈 (@singhsoro) February 19, 2023

However, price performance has been on a roundabout course with fluctuations between the $1,500 and $1,700 price levels over the past seven days. However, Sorout’s bullish forecast may indicate a major price increase is on the horizon. As the backbone of the decentralized finance (DeFi) industry, Ethereum holds the key to a treasure trove of possibilities. A fluctuation in its price could have a ripple effect in the broader cryptocurrency market.

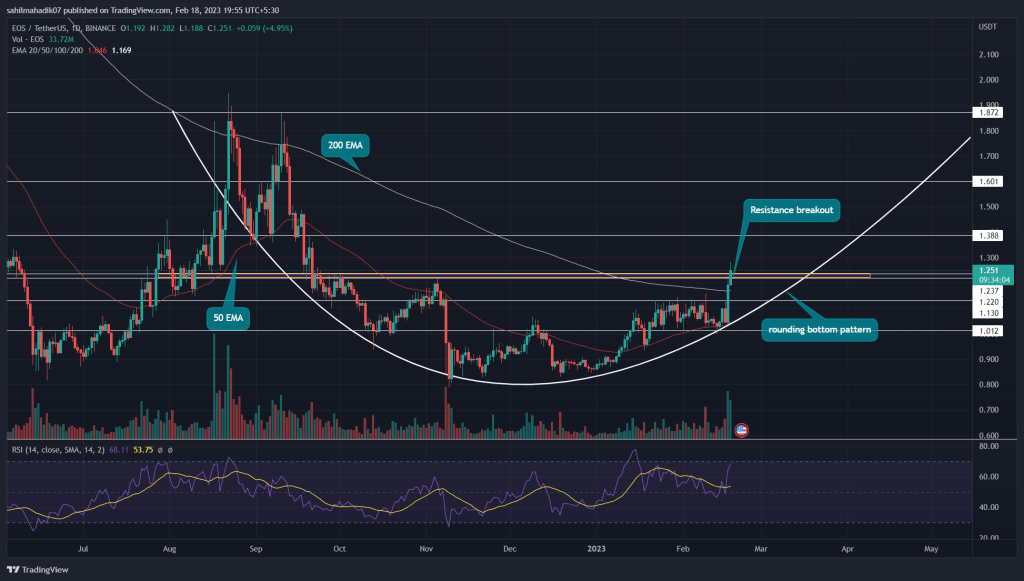

EOS analysis drew attention

According to analyst Brian Bollinger, EOS shows the formation of a rolling bottom pattern on the daily time frame chart. The pattern is characterized by a gradual downward trend followed by a period of stability/accumulation and a steady upward trend resulting in a U-shaped curve. Currently, the coin is heading from the accumulation zone to the recovery phase where more buyers can enter with additional confirmation. So, under the influence of this pattern, EOS price must rise by 47.5 percent to reach the neckline resistance of this pattern.

Amid the recent recovery in the crypto market, EOS has seen nearly vertical growth over the past five days. This bullish rally registered a gain of 24.4 percent and broke a crucial resistance area of $1.24-1.22. The aforementioned resistance is the neckline barrier of the bullish pattern, the accumulation zone, the breakage of which could encourage further recovery in EOS price. Therefore, a breakout will mark the transition of EOS price from a horizontal accumulation zone to an impending recovery.