The loss of Binance’s CEO and the leading digital assets exchange’s $4 billion settlement of U.S. criminal charges on Tuesday failed to destabilize the wider crypto market in a big way. It has, however, impacted Binance’s order book liquidity, complicating trading conditions for large traders.

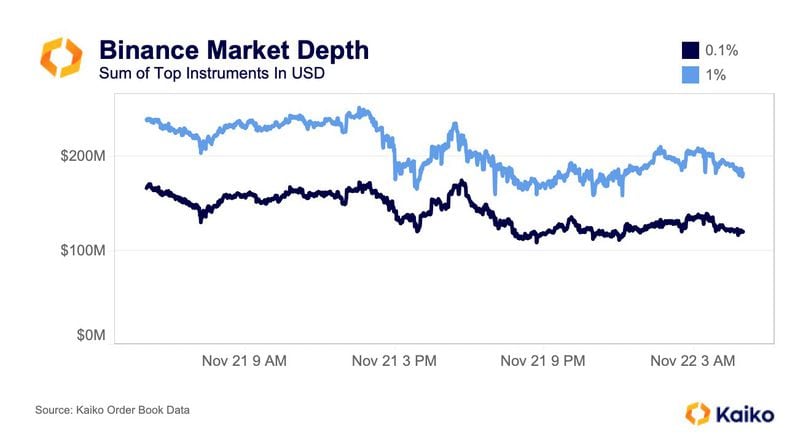

Liquidity for top cryptocurrencies on the exchange, measured by 0.1% and 1% market depth indicators, has declined by 25% or more to less than $150 million and around $180 million, respectively, in the past 24 hours, data tracked by Kaiko show. Market depth is a collection of buy and sell orders within a certain percent of the mid-price, or the average of the bid and the ask prices.

In other words, moving the market by 0.1% and 1% in either direction is now 25% easier than it was 24 hours ago. It also means trading large orders on Binance at stable prices has become tougher, exposing so-called whales to slippage, that is movement between the price quoted when a trader places the order and what they actually pay when the order is filled.

As of now, it’s still being determined whether the liquidity has moved to other exchanges.

The 0.1% and 1% market depth indicators have tanked by at least 25% in the past 24 hours. (Kaiko) (Keiko)

On Tuesday, Binance founder Changpeng “CZ” Zhao stepped down as CEO and pleaded guilty as part of the U.S. settlement. Since then, users have withdrawn almost $1 billion in funds from the exchange.

Bitcoin (BTC), the biggest cryptocurrency by market value, dropped nearly 4% to $35,700 late Tuesday only to bounce back to $36,500 at press time.