As equity markets continue their bullish trend, crypto investors await this week’s Federal Reserve announcements before choosing which direction altcoin prices like BTC and XRP will take. Could strength in US equity markets and weakness in the US dollar index (DXY) attract purchases in the ailing cryptocurrency industry? Crypto analyst Rakesh Upadhyay examines the charts to find out.

An overview of the cryptocurrency market

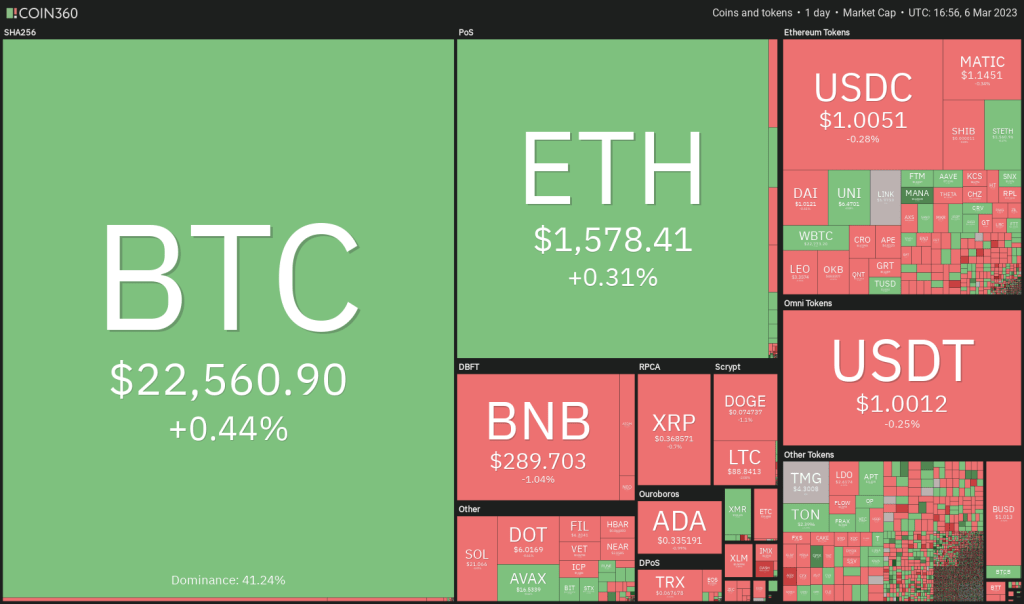

US stock markets are trying to continue their recovery at the beginning of the new week. One of the reasons that can boost investor confidence is that the benchmark 10-year bond yield has dropped to 3,924%. However, the bullish sentiment in the equity markets has not been reflected in the crypto markets, which continue to underperform. Bitcoin’s BTC narrow range trading since March 4 shows uncertainty about the next directional move.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Generally, periods of low volatility are followed by an increase in volatility. cryptocoin.com As you follow, Fed Chairman Jerome Powell’s congress speeches on March 7 and March 8 will be followed for the outlook on inflation and interest rate hikes. Then, the release of the February jobs report on March 10 could increase volatility.

BTC, ETH, BNB and XRP analysis

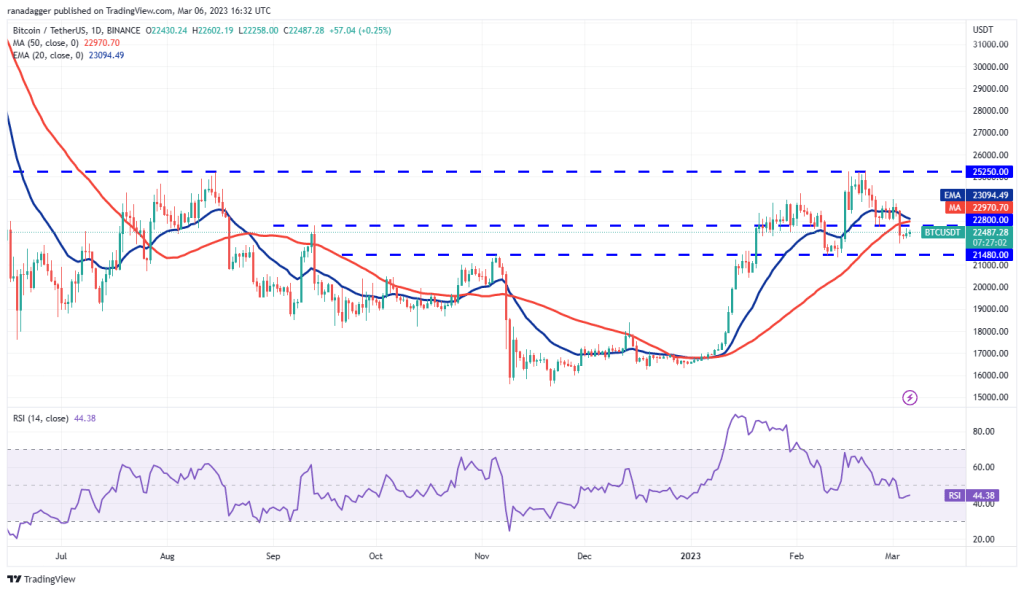

Bitcoin (BTC): Signals an advantage to the bears

Bitcoin struggles to break above $22,800, which suggests the bears are trying to turn the level into resistance. The moving averages are about to complete a bearish crossover and the relative strength index (RSI) is in the negative territory. This signals an advantage to the bears.

If the price turns down from the current level, BTC could decline to the critical $21,480 support. This level can be the scene of a fierce battle between bulls and bears. If the bears peak, BTC could extend its decline to the psychologically important $20,000 level. On the other hand, if the price rebounds from $21,480, the bulls will make another attempt to break the overhead barrier at $22,800. If they manage to do so, BTC could start to rally towards $25,250.

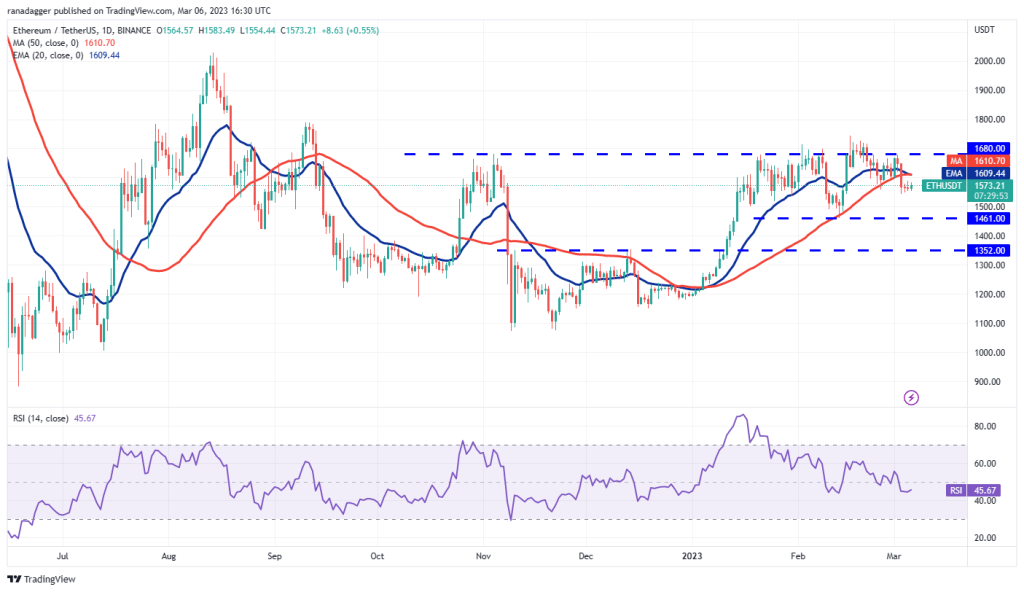

Ethereum (ETH): Indecision between buyers and sellers

ETH is trading in a tight range after the sharp decline on March 3. This points to indecision between buyers and sellers.

If the bears sink the price below $1,544, the advantage could turn in their favor and ETH could decline towards the strong support at $1,461. This level is likely to act as strong support again. If the price bounces back from this level, ETH could be stuck between $1,461 and $1,743 for a while. On the upside, the bulls will need to push and sustain the price above the moving averages to signal a reversal. ETH could then attempt to climb above the $1,680 – $1,743 resistance zone. If that happens, ETH could start its journey towards $2,000.

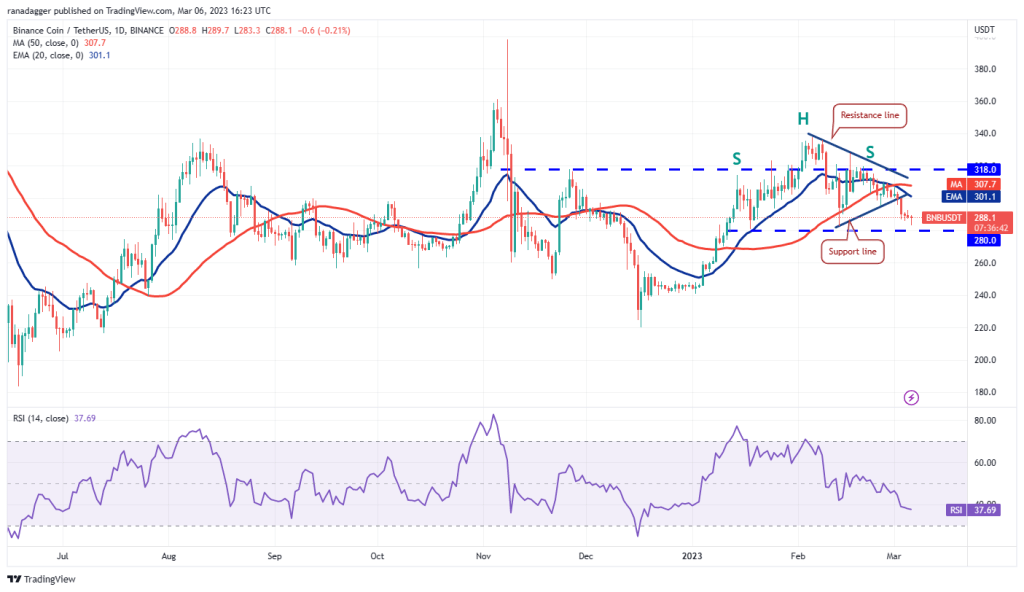

Binance Coin (BNB): Path of least resistance is down

BNB’s shallow pullback from the current level indicates that the bulls are not buying aggressively. The downward sloping 20-day EMA ($301) and the RSI in the negative zone indicate that the path of least resistance is to the downside.

If the bears pull the price below $280, BNB will complete the downtrend. This could start a downward move towards the first target at $245 and then $222. If the bulls want to avoid a decline, they will have to fiercely defend the $280 support and quickly push the price above the 20-day EMA. This could increase the possibility of a rise above the overhead resistance at $318.

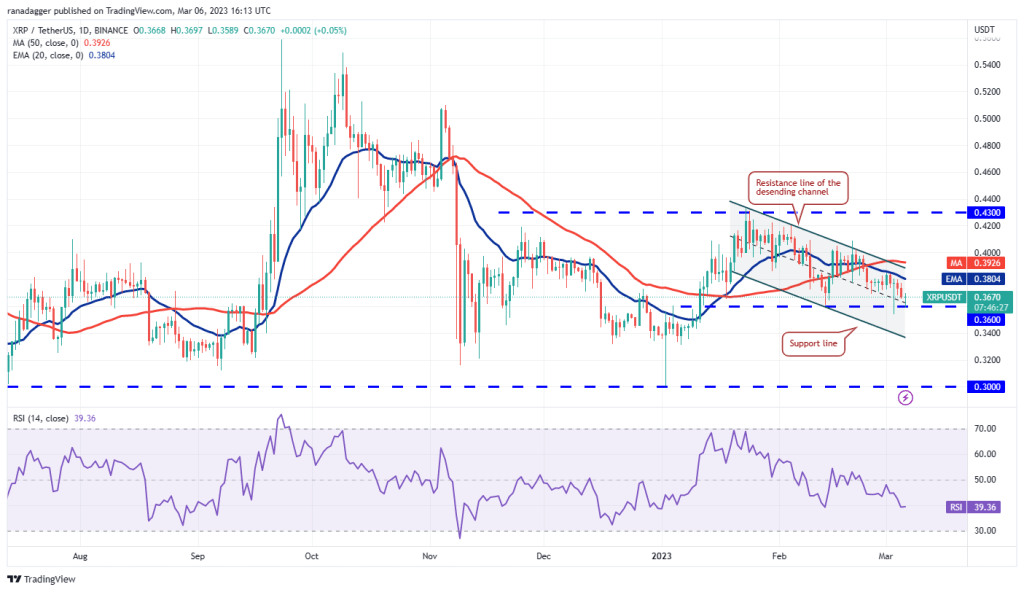

Ripple (XRP): Traders sell on rallies

XRP recovered from the $0.36 support on March 3 and faced strong selling near the 20-day EMA ($0.38). This shows that sentiment is negative and traders are selling on rallies.

If the price breaks below $0.36, XRP could reach the support line of the descending channel pattern. Buyers can buy this drop to keep the XRP price inside the channel. However, breaking the $0.36 hurdle for XRP may be difficult. The first sign of strength will be a break and close above the resistance line of the channel. This could attract more buying and XRP could attempt to rise to $0.43, where it will likely face stiff resistance from the bears.

ADA, MATIC, DOGE and SOL analysis

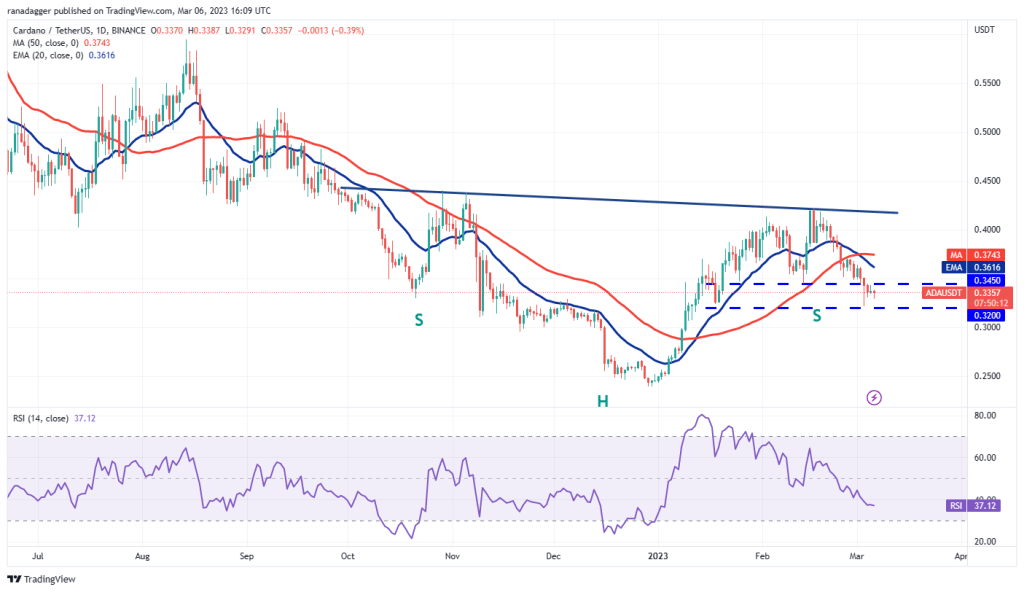

Cardano (ADA): Rally sold out

ADA bounced off the $0.32 support on March 3 but the bulls failed to push the price above the overhead resistance of $0.34. This indicates that the rallies are sold out.

The bears will again try to push the price below the $0.32 support. If they succeed, the ADA could witness aggressive selling. There is no major support until ADA hits $0.26. This negative view could be invalidated in the near term if the price recovers from $0.32 and rises above the moving averages. This can increase the likelihood that the right shoulder of the inverted H&S pattern will form.

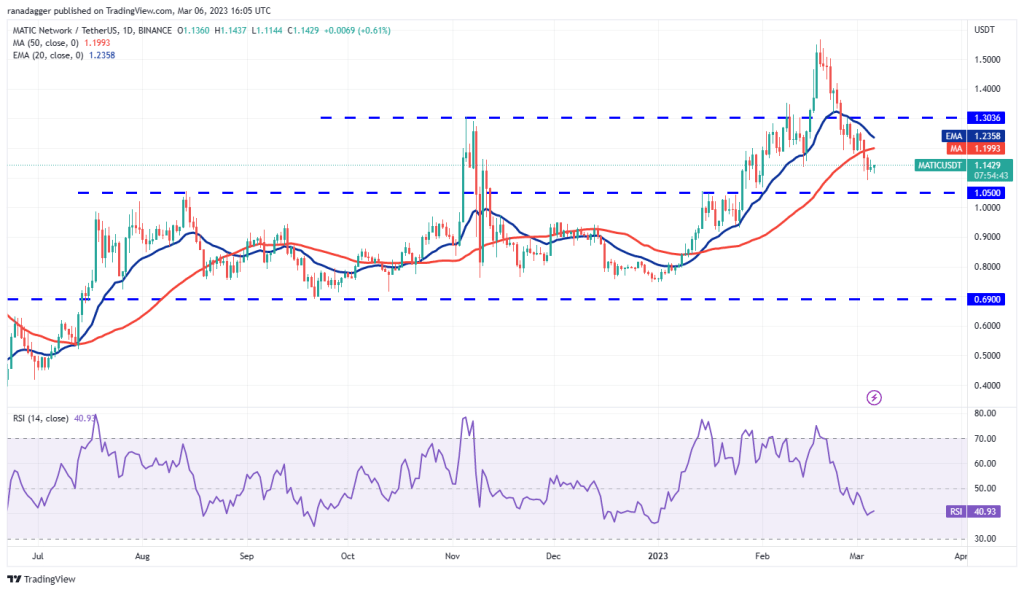

Polygon (MATIC): Undecided between bulls and bears

MATIC created an intraday candlestick pattern on March 5, signaling indecision between the bulls and bears.

The falling 20-day EMA ($1.23) and the RSI below 41 are giving the bears an advantage. MATIC could decline to solid support at $1.05. Buyers are expected to defend this level aggressively. Because, a break and close below this could bring the MATIC down to $0.90 and then $0.69. Alternatively, if the price rises from the current level or bounces back strongly from $1.05, it will indicate that demand is at lower levels. This could initiate a relief rally to the 20-day EMA, where the bears can once again form a strong defense.

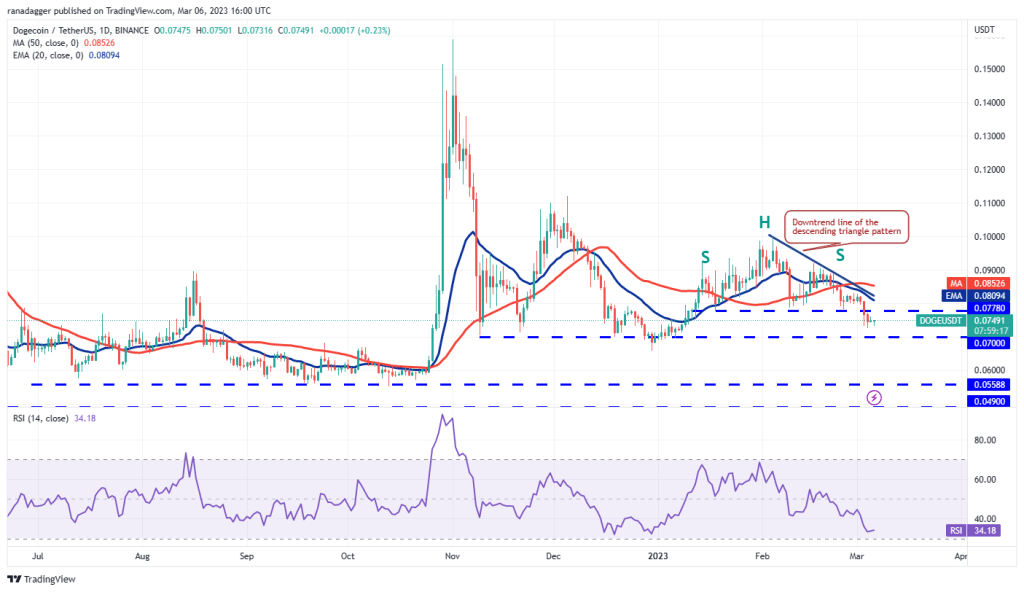

Dogecoin (DOGE): Sees selling in rallies

DOGE attempted a recovery on March 5, but the long wick on the day’s candlestick indicates selling on rallies.

The falling 20-day EMA ($0.08) and the RSI near the oversold zone suggest bears dominate. Sellers will try to further strengthen their positions by pushing the price below the critical support near $0.07. If this level breaks down, DOGE could hit the $0.06 pattern target. On the way up, the first resistance to look out for is $0.08. If this level scales, DOGE could start a recovery towards $0.10.

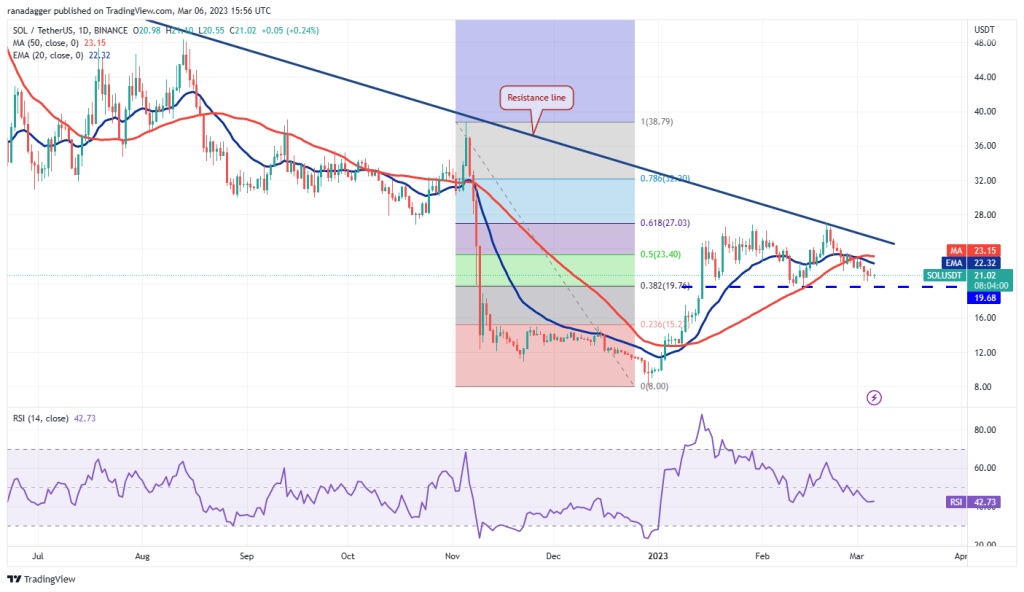

Solana (LEFT): Bulls failed to recover

The bulls attempted to start a recovery on the SOL on March 5, but the long wick on the day’s candlestick is showing selling near the 20-day EMA ($22.32).

The bears will try to push the price below the strong support near $19.68. If successful, the sell-off could intensify and the SOL could decline towards the strong support near $15. Conversely, if the price rebounds from $19.68, it indicates accumulation on the downside. The bulls will then try to push the price above the moving averages. If this happens, it may rise to the SOL resistance line. The region between the resistance line and $27.12 remains the key area to watch out for. Because a break above this could launch the SOL to $39.