Circle, the company behind USDC, has started accumulating assets again.

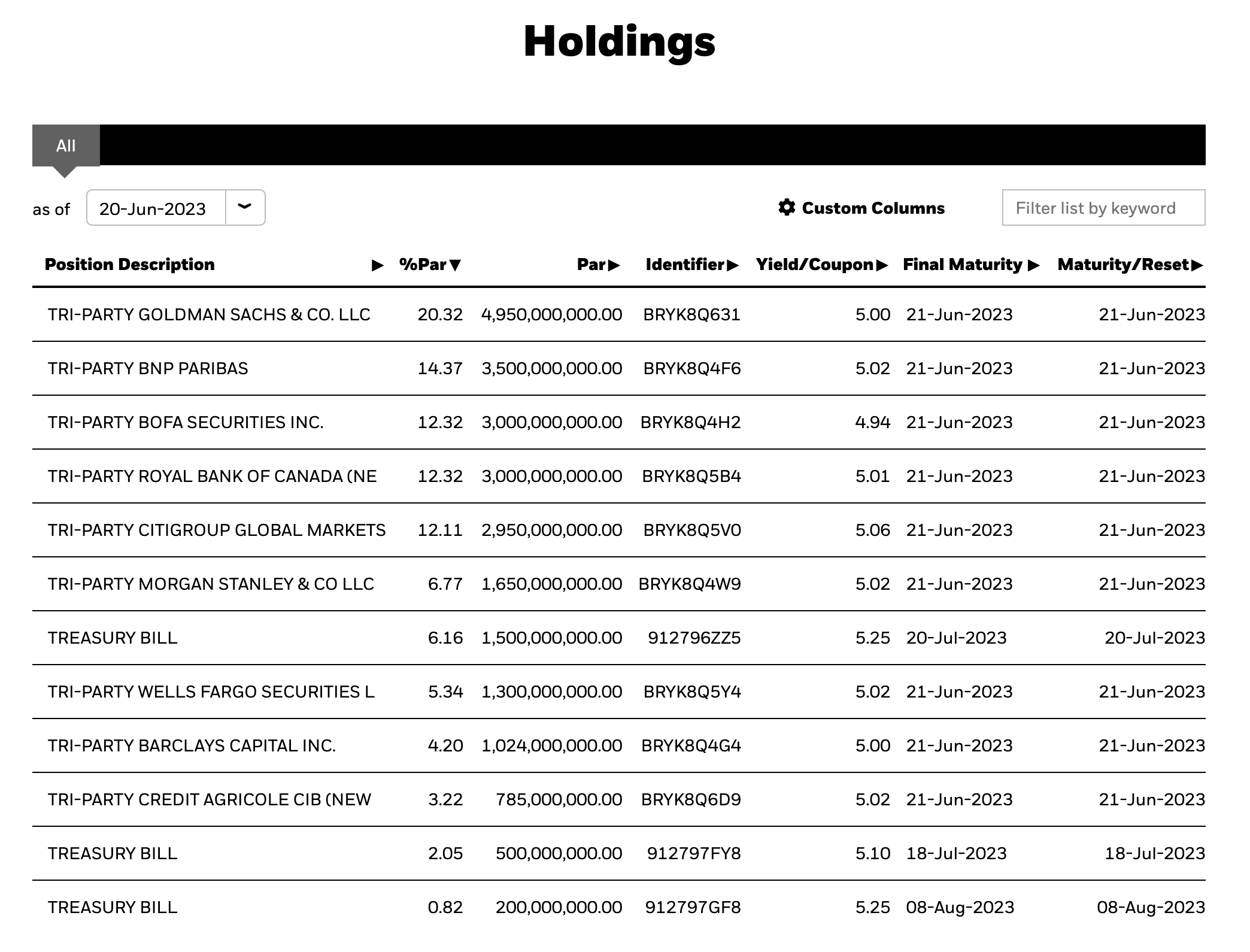

Circle announced that it has resumed buying US bonds. However, the company shared a list.

Circle Redirects to US Treasury Bills

Circle Internet Financial has resumed accumulating assets for USD Coin (USDC) as a reserve fund using US Treasury bonds. Circle’s chief financial officer, Jeremy Fox-Geen, stated that the Circle Reserve Fund is managed by BlackRock and has begun investing directly in US Treasury assets. He also stated that repurchase agreements will be kept as part of the reserves.

This move was made in an effort to stabilize USDC as Circle limited the US government’s borrowing ability last month. Circle CEO Jeremy Allaire had announced that the bonds would not be held at maturity, during which time Circle reportedly replaced its reserve holdings with triple repos.

After Circle announced this move, a list of assets was shared. Wanting to solidify the asset treasury of its stablecoin, the company announced that it has resumed US bond purchases.

The purpose of the company with these purchases lies in the fact that the US government has imposed a debt ceiling limitation. The company is increasing its reserves to maintain a one-to-one ratio of the stablecoin USDC with its share purchases.