TRON founder Justin Sun shared at what level he will buy Ethereum (ETH). The altcoin market has been in a downtrend since November. This weekend, sellers got stronger, dragging BTC and ETH to their lowest levels in years. Justin Sun says that these levels are not the bottom.

Tron founder says he will buy Ethereum at these levels

Ethereum (ETH), the largest altcoin by market cap, is threatened by Lido (stETH) liquidity crisis. As Kriptokoin.com we have got the details covered in this article. Marking a LUNA and UST-like collapse, stETH is a staked DeFi variant of Ethereum. The deterioration of price instability between the two has been causing panic in the market in recent days. Meanwhile, Bitcoin and Ethereum lost support at $28,000 and $1,500, respectively.

Am considering taking ethereum private at $420. Funding secured.

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) June 11, 2022

Now investors will see what levels the decline will find support at. calling. A guess on this came from Tron founder Justin Sun. The founder, who is closely followed by the crypto community, is considering buying ETH at $ 420. In the tweet above, he also reported that he had secured the funding for it.

At the time of writing, Ethereum is down 6.89% while the altcoin market is in free fall. ADA and DOGE were the biggest losses among the top 10. If Justin Sun is right on the level you point out, that would mean an extra 70% loss for Ethereum. The leading altcoin was last traded at these levels before the 2021 bull.

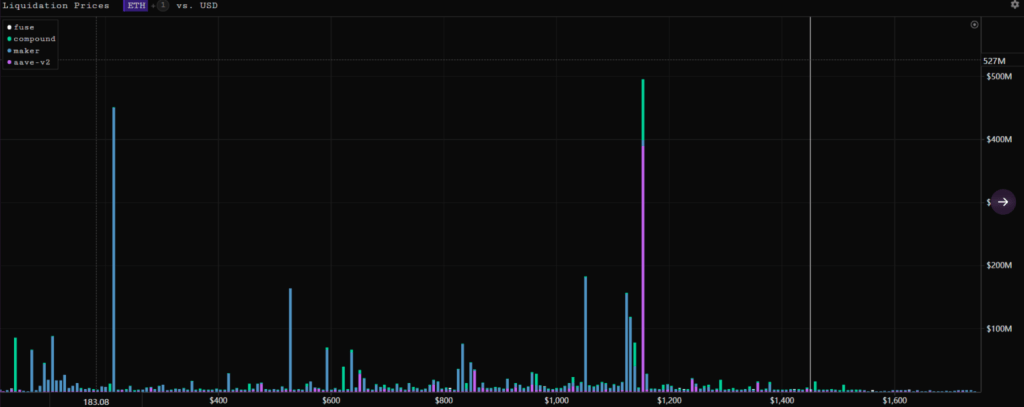

ETH facing $500M liquidation

Tron founder’s predictions aside, Ethereum is currently Despite the expectations around merge, it is depreciating. Instead, we can say that Ethereum is seeing a belated plan. Ethereum core developer Tim Beiko recently stated that the transition to PoS will occur between August and November. This announcement comes after more bad news for Ethereum enthusiasts hoping for the completion of the Ethereum 2.0 Merge in August.

📈 #Ethereum $ETH Number of Addresses in Loss (7d MA) just reached an ATH of 36,321,323.268

View metric:https://t.co/eTr2V1rqmQ pic.twitter.com/2ZWBos3jk6

— glassnode alerts (@glassnodealerts) June 12, 2022

Also, Glassnode’s on-chain alerts for June 12 As explained in his account, the losses of long-term investors increased significantly. This is the effect of increasing Ethereum selling pressure as the price continues to drop.

According to Parsec fiannce data, once ETH drops to around $1,150, it will face liquidation of around $500 million. wBTC will have more than $300 million in on-chain collateral close to $21,600 or face liquidations.

Additionally, Curve Finance pools lost their stETH/ETH stability. Thus, ETH became unbalanced by 24.11% and stETH by 75.89%. The fixation of stETH is slightly broken. This uneven pool indicates that in this case one of the assets, stETH, has become more liquid, meaning that it will be difficult to sell as stETH does not have enough ETH liquidity to combine sell orders at current prices.