The dollar-pegged stablecoin TrueUSD (TUSD) is trading at a discount relative to its compatriot tether (USDT) on Binance.US, the U.S. subsidiary of Binance.

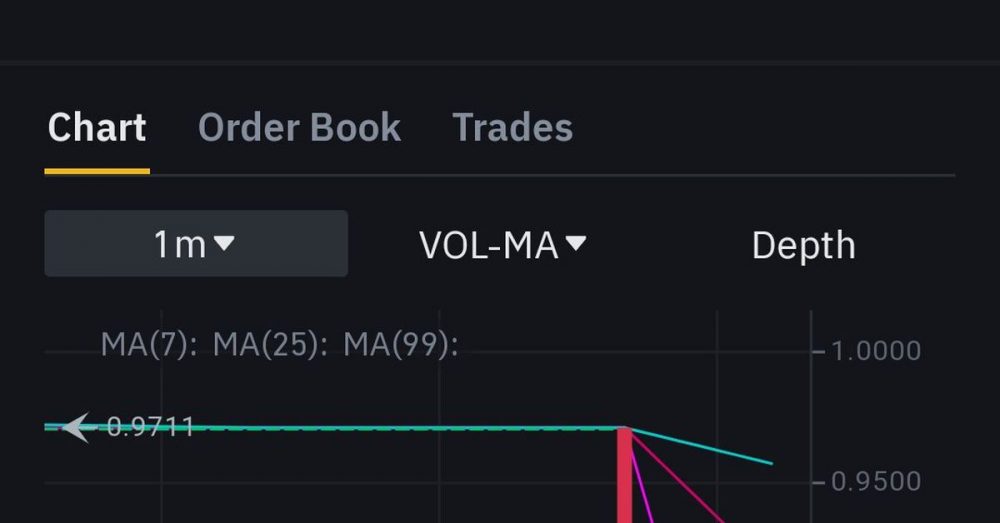

At press time, the TUSD/USDT pair traded at 89 cents on Binance.US, having hit a low of 80 cents on Wednesday, data from charting platform TradingView show. On Binance, the pair traded at around $0.9980.

Volatility in stablecoins, which have evolved as funding currencies over the past three years, often feeds into the broader market. So far, TUSD’s volatility has not impacted the broader market, with bitcoin (BTC) continuing to trade in familiar ranges above $30,000.

TUSD, with a market cap of $3 billion, poses less of a systemic risk to the broader market than tether, whose market cap is $83 billion.

According to pseudonymous market observer Parrot Capital, TUSD is getting hammered amid low volumes.

TUSD’s downside volatility on Binance.US comes hours after the token’s reserve report showed the project held $26,000 in assets backing the stablecoin at a U.S. depository institution that was ordered to halt withdrawals.

The attestation for the reserve report was provided by The Network Firm, a rebranded outlet of former FTX auditor Armanino. That has raised alarm bells on Crypto Twitter about the lack of system of checks and balances in the crypto industry.

“Wait, the auditor who has been attesting to the $TUSD audits (in Prime Trust) was the old FTX auditor who set up under a new name after the FTX scandal?!?!? These guys literally audited the biggest grift in history and just renamed themselves?!?,” Cinneamhain Ventures’s Managing Partner Adam Cochran tweeted.

According to Cochran, TrueUSD’s Chainlink price oracle comprises 17 different notes, but all pull the data from the same source, The Network Firm.

Traders took bearish bets on TUSD early this month amid rumors that the stablecoin project uses embattled crypto service provider Prime Trust to mint and redeem tokens. Later TrueUSD clarified that it has no exposure to Prime Trust.