U.S. Treasury Secretary Scott Bessent on Lowering Borrowing Costs

On Wednesday, U.S. Treasury Secretary Scott Bessent announced that the Trump administration is focused on reducing borrowing costs across the economy by aiming to lower the yield on the 10-year Treasury note.

“He and I are focused on the 10-year Treasury,” Bessent stated in an interview with Fox Business when asked about strategies to lower interest rates. He clarified, “He is not calling for the Fed to lower interest rates,” emphasizing the administration’s approach.

The 10-year yield, often regarded as the risk-free rate, plays a crucial role in influencing various long-term loans within the economy, including mortgages and business loans. A declining yield on the 10-year note tends to stimulate borrowing and investment, fostering increased risk-taking in both the economy and financial markets.

As a result, a softening of the 10-year yield is generally perceived as bullish for risk assets, including cryptocurrencies like bitcoin (BTC). Trump’s strategy to achieve a lower yield revolves around controlling inflation, a move that may positively impact BTC while also addressing the pressing issue of the budget deficit, which could pose a challenge for risk assets.

Bessent remarked, “The energy component for them is one of the surest indicators for long-term inflation expectations,” reiterating the administration’s belief that boosting energy supply will assist in lowering inflation rates. With all other factors held constant, a decrease in inflation would provide the Federal Reserve (Fed) with the opportunity to continue cutting rates, which currently remain in a restrictive range. This scenario could contribute to a bullish momentum for risk assets.

Since September, the Fed has lowered the benchmark borrowing cost by 100 basis points, bringing it into the 4.25%-4.5% range. In addition, Bessent’s approach to exert downward pressure on the 10-year yield also includes addressing the substantial budget deficit through reduced fiscal spending. A reduction in the deficit would lead to decreased bond supply, resulting in higher bond prices and lower yields.

However, it is essential to note that the Biden administration’s extensive fiscal spending has somewhat mitigated the impact of elevated Fed rates, thus easing the financial markets. Consequently, any reduction in spending could potentially destabilize risk assets, including cryptocurrencies.

“Of course, getting the 10-year yield on a downward path implies moves to improve the U.S. fiscal position as well as managing inflation. So far, we’ve seen his partner, Musk, cutting federal programs like USAID and reducing the number of Federal employees. However, these measures barely scratch the surface,” commented Eamonn Sheridan, Chief Asia-Pacific Currency Analyst at ForexLive.

He further added, “Most of U.S. spending is directed toward healthcare, Social Security, and defense. The question remains: will Trump be willing to inflict the necessary pain that his focus seems to imply? There are very few politicians who would take such drastic measures.”

Enjoy the Move Lower While It Lasts

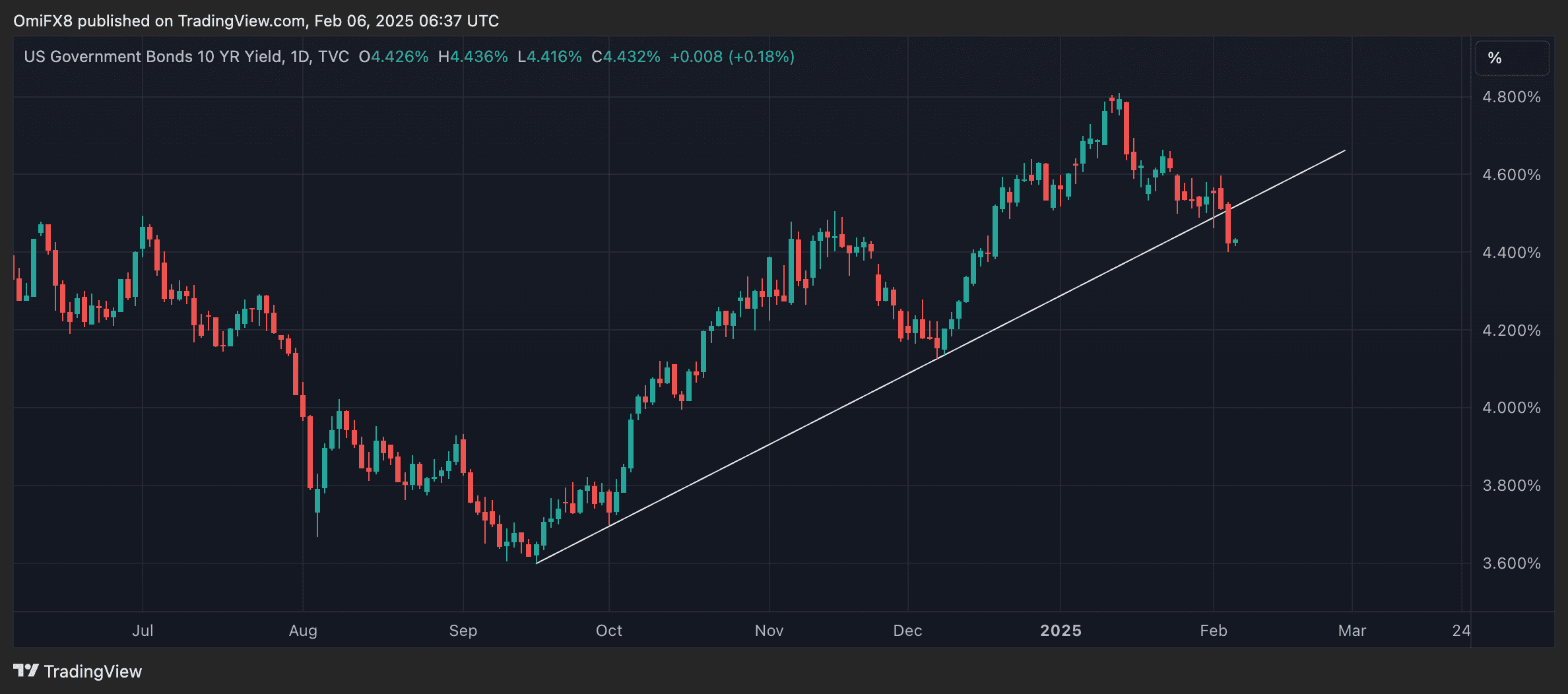

The 10-year yield has seen a decrease of 38 basis points, now sitting at 4.42%, as markets react to lower energy prices and the prospect of non-inflationary growth, according to Bessent.

However, analysts at ING caution against the expectation of a sustained drop in yields. They stated, “We believe there is limited room for further declines in the 10-year yield. An effective floor is in place just under 4%, as indicated by the funds rate strip. While this floor could shift lower, it would require more compelling reasons beyond an approaching 10-year rate. Currently, the 10-year Treasury yield sits around 50 basis points above this level. Therefore, enjoy the move lower while it lasts,” they advised in a note to clients.

ING also noted that it is challenging to identify a significant driver for a lower 10-year yield, aside from the potential success of the newly established Department of Government Efficiency, or DOGE, which aims to cut wasteful fiscal expenditures and reduce federal regulations.

U.S. 10-year yield. (TradingView)