Crypto Money Analyst Defitracer, in a tweet series on April 3, 2025 on the X platform, claimed that new customs duties of US President Donald Trump could lead to great recession in the global economy. Based on leaked market data, the analyst argued that the price of Bitcoin (BTC) would fall below $ 21,750 and Ethereum (ETH) would lose 75 %.

However, the analyst argues that Trump is called the “World Tax War, and that he aims to revive the crypto markets in the long run, although in the short term caused panic in the markets. Here are the details of Defitracer’s analysis…

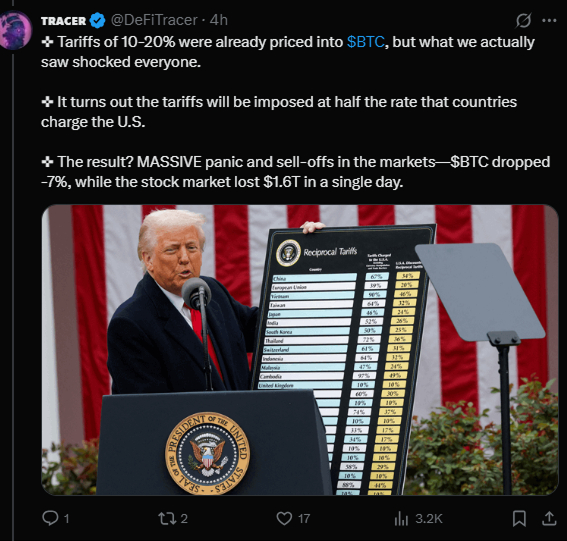

Trump’s customs duties policy and the first reaction in markets

In a speech on April 2, 2025, Trump announced that comprehensive customs duties for the products imported to the US will be applied. These taxes were determined by half the rates applied by other countries to the US; For example, 10 %for England, 34 %for China and 49 %for Cambodia were announced.

According to Fitch Ratings, US President of US Economic Studies, Olor Sonola, this step increased the US’s total import tax from 2.5 %to 22 %, which has been seen since 1910. Following the announcement of the taxes, there was a great panic in the markets; Bitcoin lost 7 %, while the overall crypto market decreased by a 92.45 decrease of $ 1.6 trillion.

Trump’s Plan: Create crisis, Solution

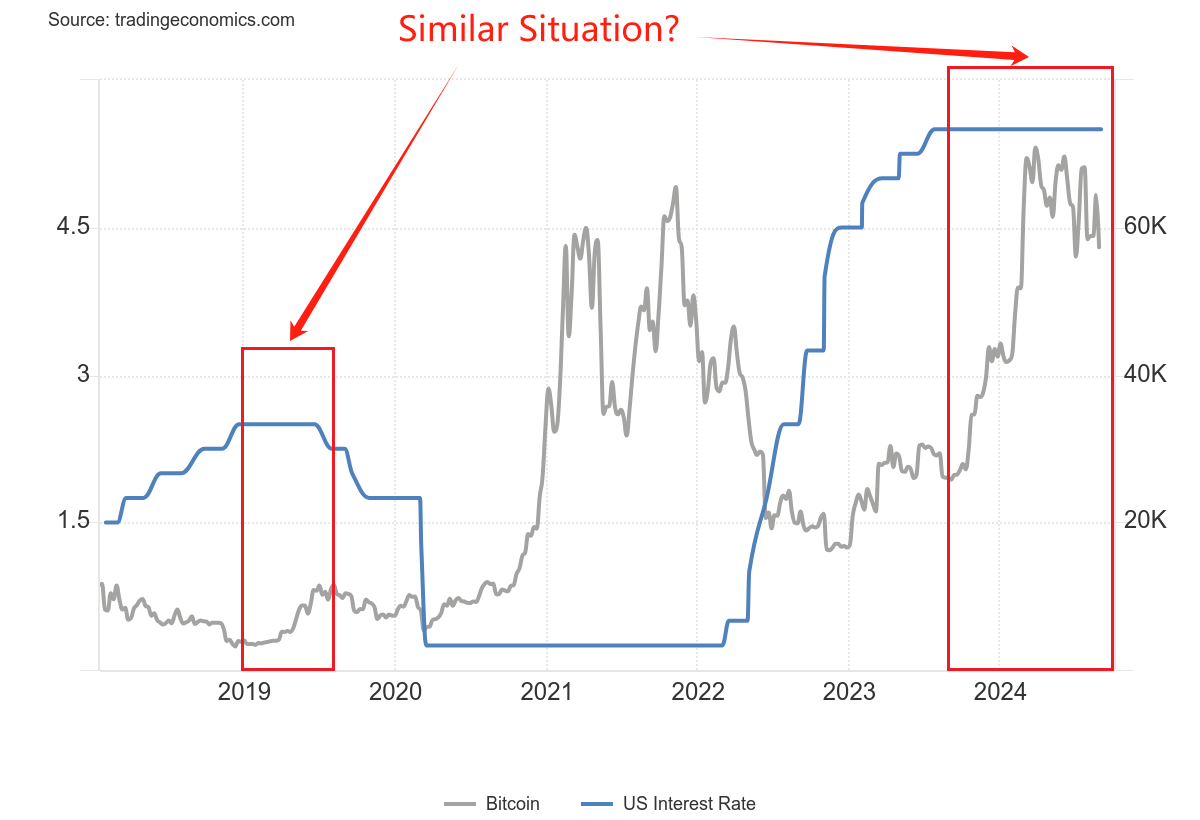

According to Defitracer, Trump’s purpose of implementing these taxes is two -way: First, facilitating the refinancing of state debts with low interest rates; Second, to revive the crypto markets in the long run.

Analyst summarizes Trump’s strategy as “Create a problem, causing panic and emerge as a hero with a pre -planned solution”. The economic crisis due to taxes will force the US Federal Reserve (FED) to reduce interest rates and this situation will trigger capital flow to assets such as Bitcoin by increasing the risk appetite.

Kriptokoin.comAs we have transferred, Trump recently brought new customs duties to automobiles, aluminum and pharmaceutical sectors.

The impact of Trump’s tax policy on Bitcoin and Altcoin sector

Based on Polymarket data, the analyst said that the probability of recession in the US increased to 52 %. He warned that with other countries, as retaliation, the global economy could be a shock similar to the COVID-19 period in the global economy. It was emphasized that the current decrease in crypto markets is similar to the great collapse in 2018; At that time, Bitcoin lost 30 %and Ethereum value. However, Defitracer predicts that this decline is temporary and the markets will recover with the Fed’s interest rate cuts.

Defitracer reminds us that low interest rates increase Bitcoin prices based on past data. In 2021, the Fed’s low interest rates and money -printing policies allowed Bitcoin to reach the highest level of all time by gaining 24 times the value. Analyst claims that a similar scenario can be repeated and Bitcoin can reach new record levels. He also says that other analysts, such as Arthur Hayes, believe that FED will have to relax their monetary policies.

Defitracer’s shares on the X platform and relevant web sources. The analyst’s claims were supported by market data and expert opinions, but personal research is recommended before investment decisions.