ETF Outflows Signal Market Uncertainty for Bitcoin

The U.S. spot-listed bitcoin (BTC) exchange-traded funds (ETFs) faced significant turbulence on Monday, witnessing the second-largest outflows of the year, amounting to a staggering $516.4 million, as reported by Farside data. This marks the ninth net outflow in just ten days, highlighting a growing sense of unease among investors regarding the largest cryptocurrency. Throughout most of this month, bitcoin has been confined within a narrow trading range between $94,000 and $100,000. However, the situation took a turn on Tuesday as bitcoin broke free from its three-month trading channel, plummeting below $90,000 and hitting a low of $88,250.

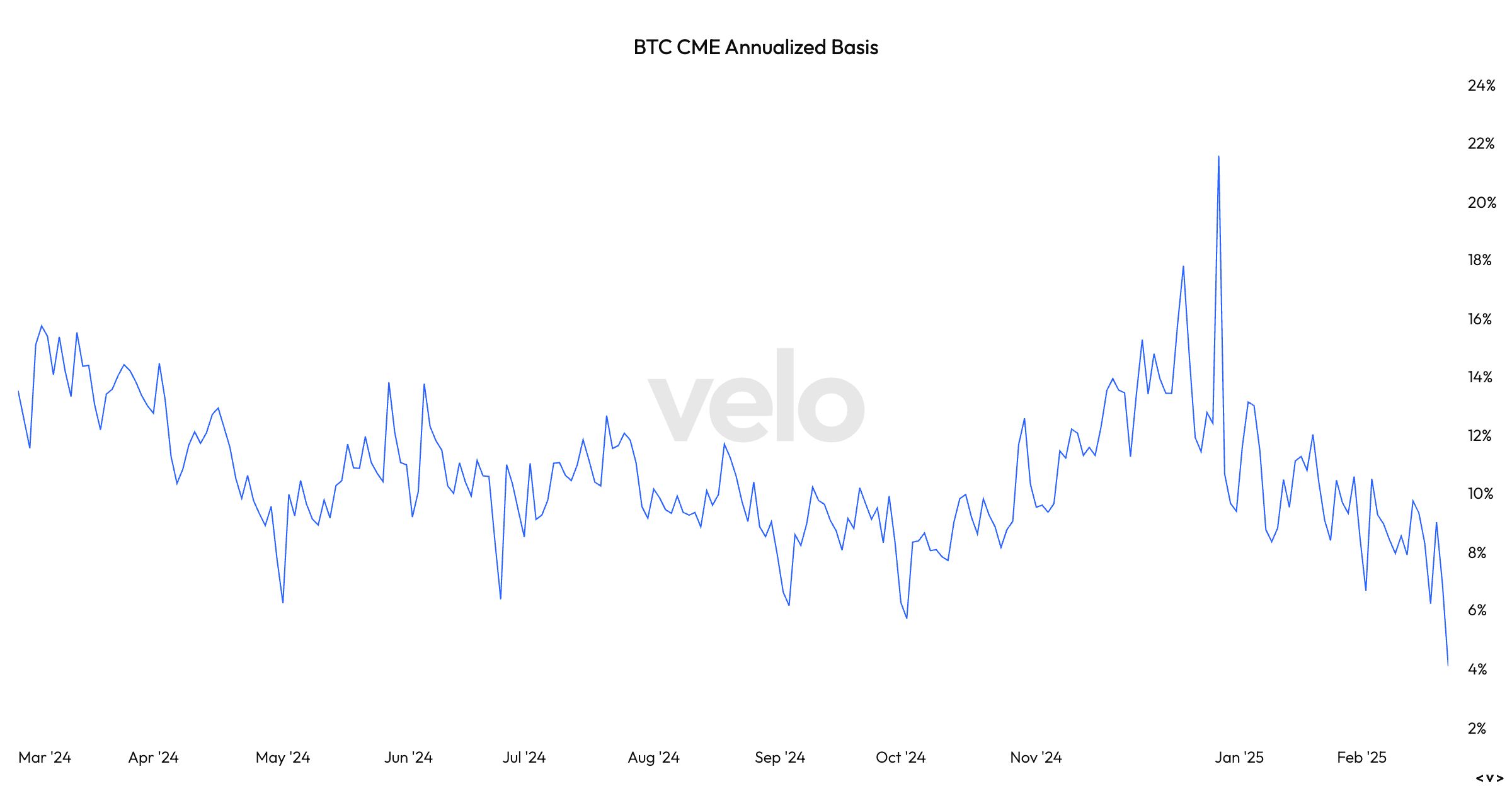

Further insights from Velo data reveal that the bitcoin CME annualized basis—the disparity between the spot price and futures—has dipped to just 4%, marking the lowest level since the ETFs commenced trading in January 2024. This phenomenon, often referred to as the cash-and-carry trade, is a market-neutral strategy designed to capitalize on mispricings between spot and futures markets. This strategy involves establishing a long position in the spot market while simultaneously taking a short position in the futures market. Velo data indicates this applies to a one-month futures forward contract, enabling investors to collect a premium from the spread between spot and futures pricing until the futures contract reaches its expiry date.

Currently, the basis trade is now below the so-called risk-free rate, which is represented by the yield on the U.S. 10-year Treasury, currently at 5%. This discrepancy may encourage investors to unwind their positions, opting for the higher returns available elsewhere. Such a shift could lead to additional outflows from the ETFs. Since this is a neutral strategy, those investors will need to close their short positions in the futures market as well.

Arthur Hayes, co-founder of Bitmex, alluded to the potential unraveling of the basis trade in a recent post on X. He stated, “Many IBIT holders are hedge funds that took long positions in ETFs while shorting CME futures to achieve yields that exceed those of short-term U.S. Treasuries,” he explained. “If the basis continues to decline as bitcoin prices drop, these funds are likely to sell their IBIT holdings and repurchase CME futures. Since these funds are currently profiting and the basis is nearing UST yields, they will likely unwind their positions during U.S. trading hours and realize their profits. $70,000, I see you, mofo!”