U.S. Bitcoin Miners Increasing Their Network Hashrate Share

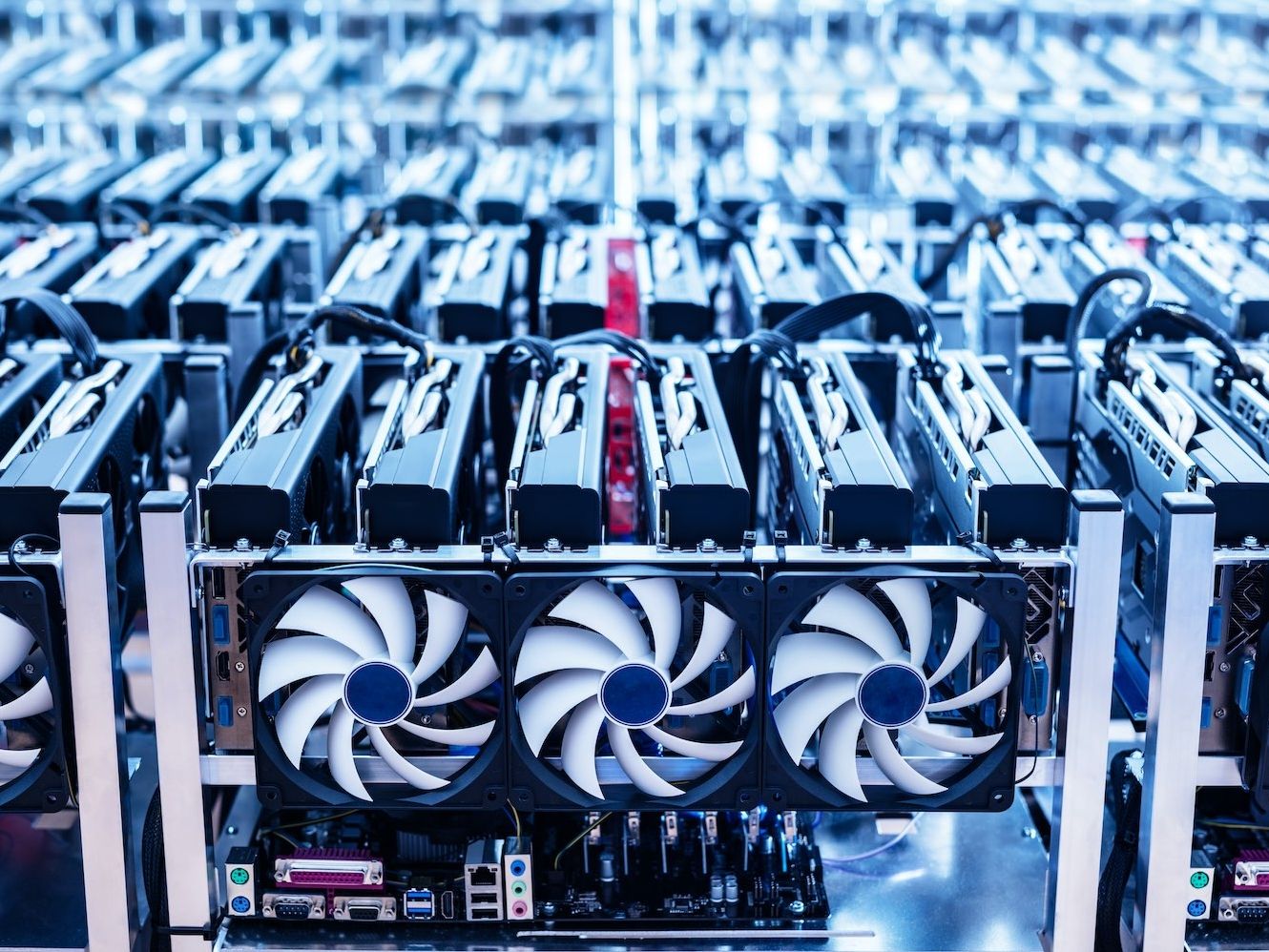

According to a report released on Monday by broker Bernstein, Bitcoin (BTC) miners listed in the United States are significantly expanding their share of the overall network hashrate. The term hashrate refers to the total combined computational power utilized to mine Bitcoin and process transactions on a proof-of-work blockchain, serving as a key indicator of competition within the mining industry and the corresponding mining difficulty.

In the report, analysts led by Gautam Chhugani noted, “U.S. listed bitcoin miners are increasing their share of the network hashrate, leveraging access to capital, land, and power.” These companies have successfully grown their share of the Bitcoin network to approximately 29% as of January, up from around 20% a year prior. The report also highlighted that major miners are aggressively ramping up their hashrate capabilities throughout 2024.

Among these miners, IREN (IREN) is experiencing the most rapid growth in hashrate, followed closely by CleanSpark (CLSK), Riot Platforms (RIOT), and MARA Holdings (MARA). Bernstein has assigned an outperform rating to IREN (with a price target of $26), CleanSpark (price target of $30), and Riot Platforms (price target of $22). In contrast, MARA Holdings holds a market-perform rating with a price target of $23.

The report further emphasized that IREN, MARA Holdings, and CleanSpark have all demonstrated strong performance in terms of power efficiency and uptime. In a separate note, Wall Street bank JPMorgan (JPM) indicated that January was a relatively quiet month for hashrate growth, contrasting with the aggressive expansions noted among U.S.-listed miners.