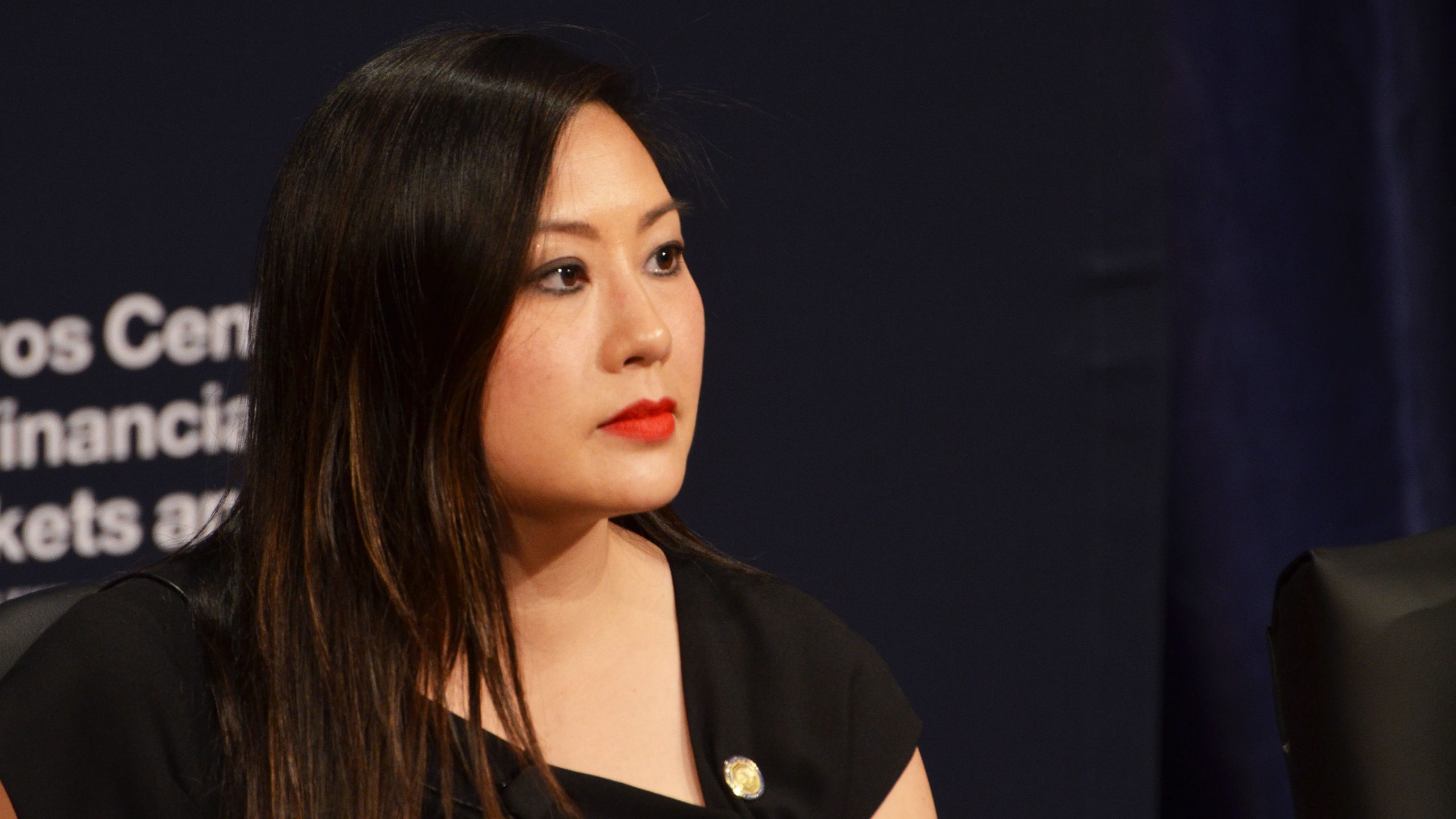

Acting Chairman Caroline Pham’s Initiative for Stablecoin-Backed Tokenization

Caroline Pham, currently serving as the Acting Chairman of the U.S. Commodity Futures Trading Commission (CFTC), is spearheading an innovative pilot program focused on the tokenization of assets backed by stablecoins. An upcoming summit will convene leaders from prominent digital asset firms, including Coinbase, Ripple, Circle, and Crypto.com, among others.

Pham, who previously proposed the concept of a regulatory sandbox for tokenization through her advisory committee—the Global Markets Advisory Committee—has found renewed support for her initiative under her temporary leadership. This idea had not been fully embraced by the CFTC’s former administration.

In her statement released on Friday, Pham expressed her enthusiasm for this transformative initiative, stating, “I’m excited to announce this groundbreaking initiative for U.S. digital asset markets. I look forward to engaging with market participants to deliver on the Trump Administration’s promise of ensuring that America leads the way on economic opportunity.”

The foundation of this initiative is what Pham describes as “responsible innovation.” It aims to enhance the utilization of non-cash collateral through the application of distributed ledger technology, which could significantly alter the landscape of digital asset transactions.

While a specific date and additional details for the upcoming forum featuring digital asset CEOs have yet to be announced, the anticipation surrounding this summit suggests a pivotal moment for the CFTC and its engagement with the evolving digital asset market.

Since stepping into the role of acting chairman, Pham has implemented substantial changes at the CFTC in a remarkably short time. These changes include a comprehensive overhaul of senior officials within the agency. Additionally, a particular personnel issue involving a former human resources chief has led to an unusually transparent response from the CFTC, wherein the agency refuted “false allegations” against Pham, which they attributed to “disgruntled individuals” linked to ongoing internal misconduct investigations.