U.S. Treasury Market Volatility Impacts Bitcoin Recovery Prospects

The U.S. Treasury market is currently facing its highest level of volatility in four months, a situation that could hinder the anticipated recovery of bitcoin (BTC) prices. Recent inflation data for February has surprised analysts by coming in softer than expected, bolstering the argument for potential interest-rate cuts by the Federal Reserve. This development has led some market experts to predict a recovery for bitcoin, possibly reaching prices of $90,000 or even higher, although it is presently hovering around $82,000.

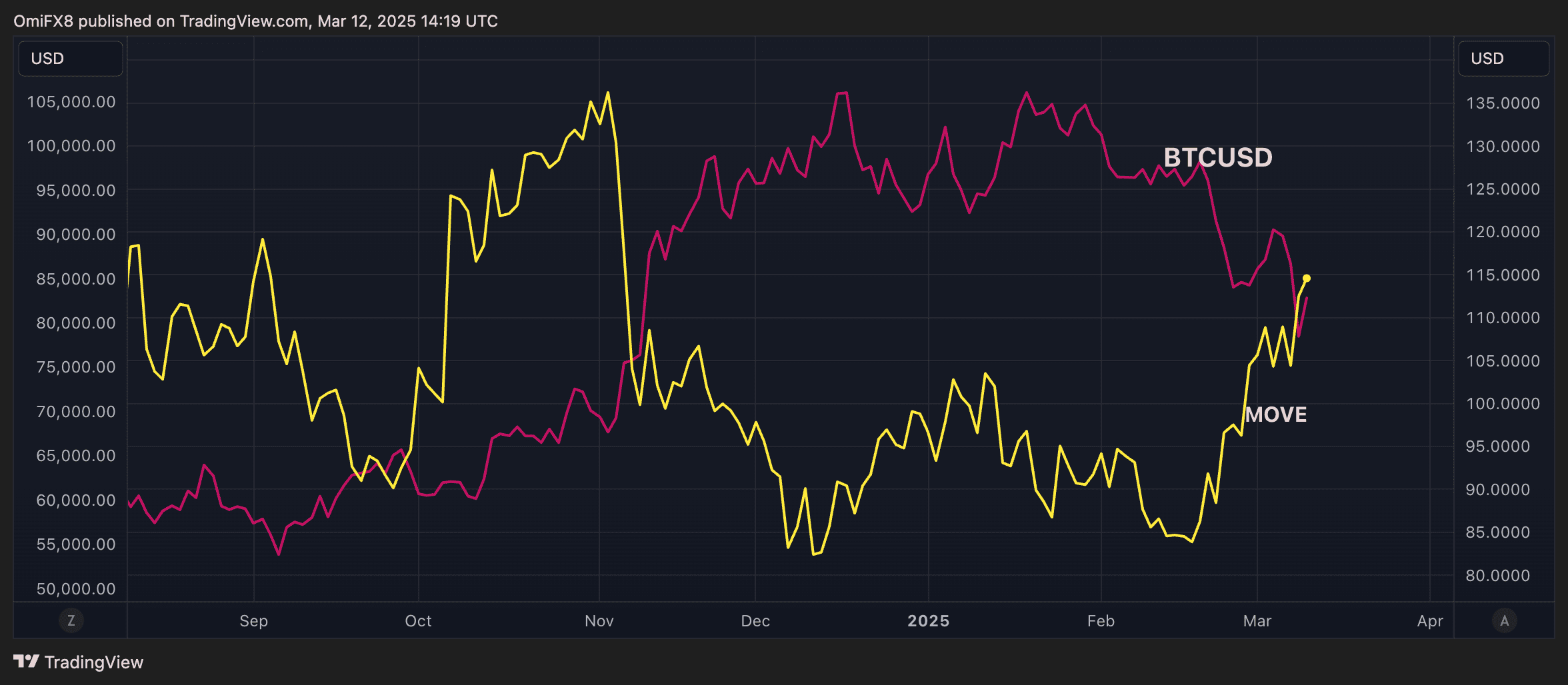

“With inflation cooling and recession fears lingering but not intensifying, Bitcoin may be on the brink of its next significant breakout, pushing beyond the persistent sub-$90K range,” stated Matt Mena, a Crypto Research Strategist at 21Shares, in an email. However, any upward movement might unfold at a slower pace than anticipated, particularly as the Merrill Lynch Option Volatility Estimate Index (MOVE), which gauges the expected 30-day volatility in the U.S. Treasuries market, has surged to 115—marking its highest point since November 6, according to data sourced from TradingView. This index has seen an alarming 38% increase over the past three weeks.

The rising volatility in U.S. Treasury notes, which play a dominant role in global collateral, securities, and financial systems, tends to have a negative impact on leverage and liquidity across financial markets. This often results in a cautious approach to risk-taking among investors. The relationship between BTC and the MOVE index is crucial; as illustrated in the accompanying chart.

The MOVE index experienced a significant drop following the November 4 election, which facilitated a more favorable financial environment that likely contributed to bitcoin’s impressive rise from $70,000 to as high as $108,000. This cryptocurrency rally reached its peak between December and January, coinciding with the low of the MOVE index.