According to crypto analyst Rakesh Upadhyay, strength in DXY could keep Bitcoin and certain altcoins under pressure in the near term. Can certain altcoin bulls, including Bitcoin and XRP, resist the bear pressure in the last week of September? The analyst analyzes the charts to find out.

An overview of the cryptocurrency market

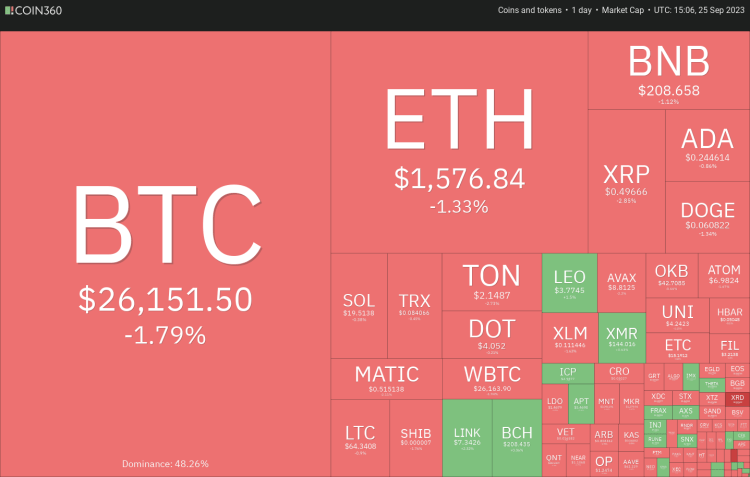

crypto to koin.com As you can see from , the market has lost its momentum. Bitcoin’s weakness on September 24 shows that bears remain in control. Sellers are trying to push the price below $26,000. However, the bulls are likely to defend this level strongly. Buyers are trying to achieve a positive monthly close for Bitcoin in September for the first time since 2016. If they manage to do this, it would be a huge sentiment booster as October is generally in buyers’ favor.

Daily cryptocurrency market performance. Source: Coin360

Daily cryptocurrency market performance. Source: Coin360According to CoinGlass data, Bitcoin has seen negative monthly closes only twice in October, in 2014 and 2018. However, if macroeconomic headwinds continue, Bitcoin bulls will have a hard time maintaining momentum. Another risk to cryptocurrencies’ recovery could come from the strength of the dollar, which has surged for 10 consecutive weeks, its longest winning streak since 2014.

BTC, ETH, BNB and XRP analysis

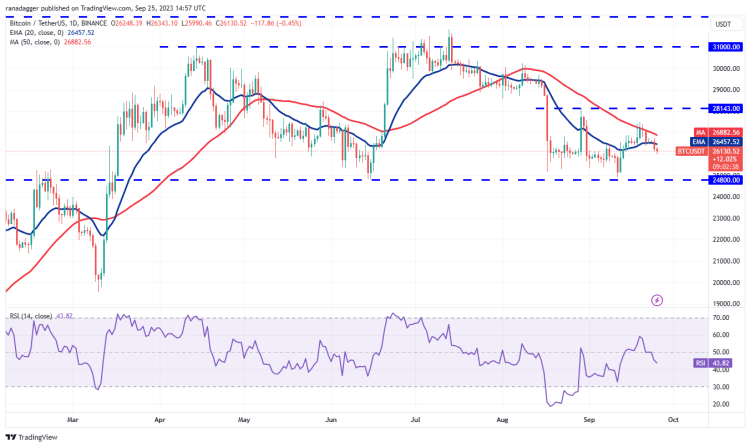

Bitcoin (BTC) price analysis

The uncertainty created by the intraday candlestick formation on September 22 and 23 was resolved downwards on September 24. This shows that the bears have established their superiority.

Sellers pulled the price back to the solid support at $24,800. Thus, they will try to further strengthen their positions. This remains a key level to pay attention to in the near term, as the bulls are expected to defend it with all their might. If it breaks the $24,800 support, it is possible that BTC could start a move towards $20,000. Meanwhile, time is running out for the bulls. If they want to initiate a meaningful recovery, they will need to push and sustain the price above the moving averages. This would open the doors for BTC to retest the overhead resistance at $28,143.

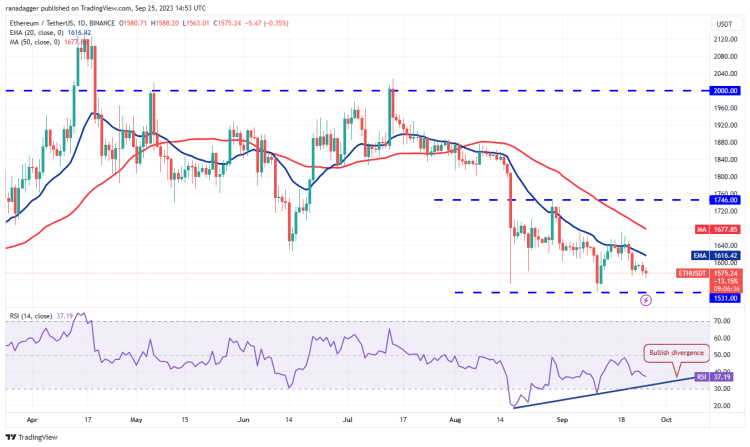

Ethereum (ETH) price analysis

ETH is gradually shifting towards the important $1,531 level. This shows that the bulls lack buying support.

Downward sloping moving averages show sellers taking advantage. However, the RSI is showing signs of a bullish trend. This means that selling pressure has decreased. It also increases the possibility of a bounce from $1,531. If the bulls push the price above the 20-day EMA ($1,616), it will signal a range-bound move between $1,531 and $1,746 for a few days. This view will be invalidated if the bears sink and sustain ETH below $1,531. It is possible for ETH to drop as low as $1,368 later.

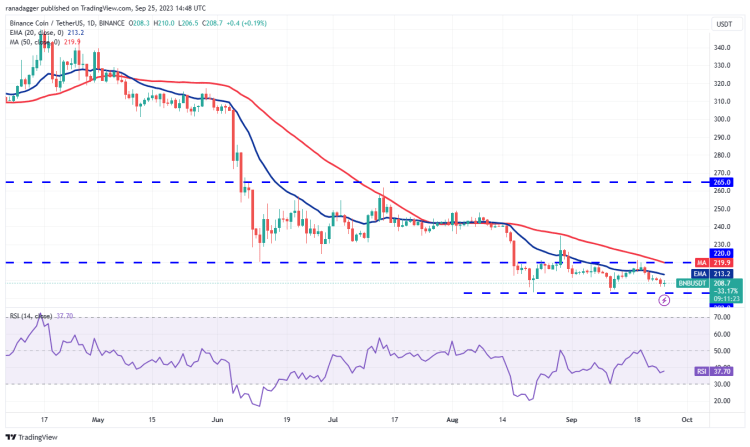

Binance Coin (BNB) price analysis

BNB has been fluctuating between $220 and $203 for the last few days. In a range, traders typically buy near support and sell near resistance.

Both moving averages are downward sloping, indicating an advantage for the bears. However, the RSI is trying to form a bullish divergence. This shows that the downward momentum is weakening. Buyers are likely to defend the $203 level strongly. If the price turns higher from the current level or bounces from $203, it will indicate that the range-bound action will continue for a while longer. Sellers will need to push the price below the critical $203 support to take responsibility. BNB is likely to drop to $183 later.

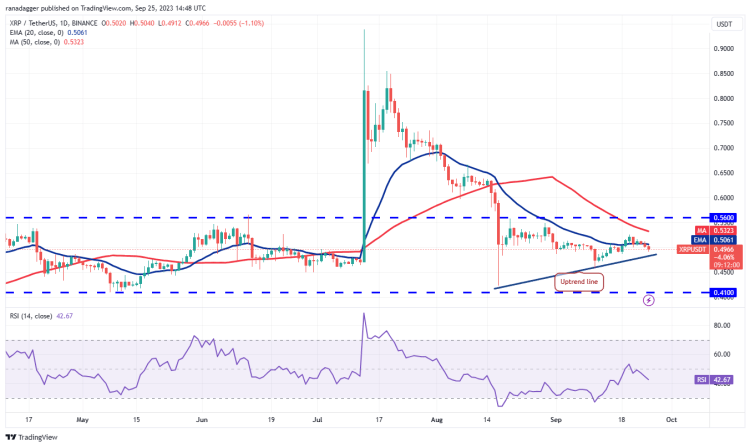

Ripple (XRP) price analysis

XRP remained above the 20-day EMA ($0.50) for several days. However, it later fell below this level on September 24. This shows that XRP bears have gained the upper hand.

It is possible that the XRP price may fall to the uptrend line, which will act as a strong support. If the price recovers from the uptrend line, the bulls will attempt to push the XRP price above the 20-day EMA again. If they do this, it will signal aggressive buying at lower levels. XRP price is likely to rise to the 50-day SMA ($0.53) later. On the contrary, if the uptrend line does not hold, XRP price will likely drop first to $0.46 and then to the formidable support at $0.41. It is possible that this level will attract strong buying by the bulls.

ADA, DOGE, TON and SOL analysis

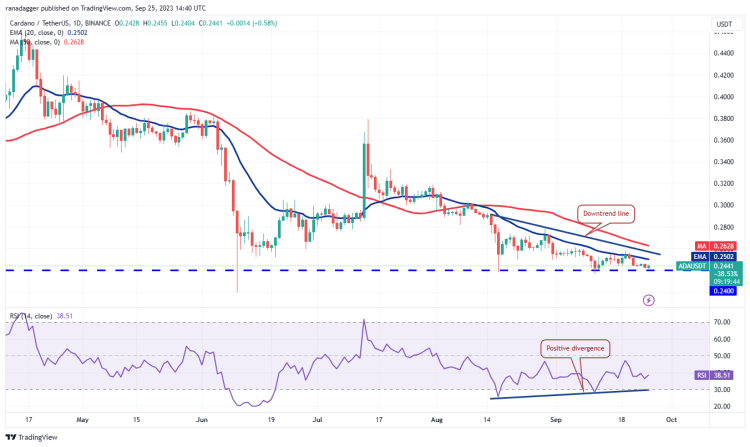

Cardano (ADA) price analysis

ADA fell to the critical support at $0.24 on September 25. Thus, it showed that the bears were continuing their pressure.

A slight advantage in favor of the bulls is that the RSI is trending upward. The bulls will need to quickly push ADA above the downtrend line to reduce the risk of a drop below $0.24. If they achieve this, the bearish descending triangle will become invalid. It is possible that this could increase the price to $0.29. But instead, if the bears sink ADA below $0.24, it will complete the bearish setup. This is likely to initiate a downside move towards $0.22 and then the $0.19 formation target.

Dogecoin (DOGE) price analysis

DOGE is stuck in a tight range between $0.06 and the 20-day EMA ($0.06). Typically, a volatility squeeze is followed by an expansion in volatility. However, it is difficult to predict the direction of the breakout.

If the price turns up from the current level, the bulls will again try to break the overhead barrier at the 20-day EMA. If they are successful, it is possible for DOGE to rise to $0.07 and then rebound to $0.08. The bears will most likely sell close to this level. Alternatively, if the range resolves to the downside with a break below $0.06, it would indicate that the bears have gained control. DOGE price is then likely to fall to the next major support at $0.055.

Toncoin (TON) price analysis

TON fell sharply from the overhead resistance level of $2.59 on September 20. It then continued its decline, indicating that the bulls were profit-booking.

Initial support on the downside is at the 20-day EMA ($2.11). If the price recovers strongly from this level, it would indicate that sentiment remains positive and traders are buying on dips. The bulls will then try to push the price back to $2.59. Contrary to this assumption, if the price falls below the 20-day EMA, it will indicate that the bulls are losing control. It is possible that TON will first drop to the psychological level of $2 and then to the 50-day SMA ($1.72). A deeper correction is likely to delay the next leg of the up move.

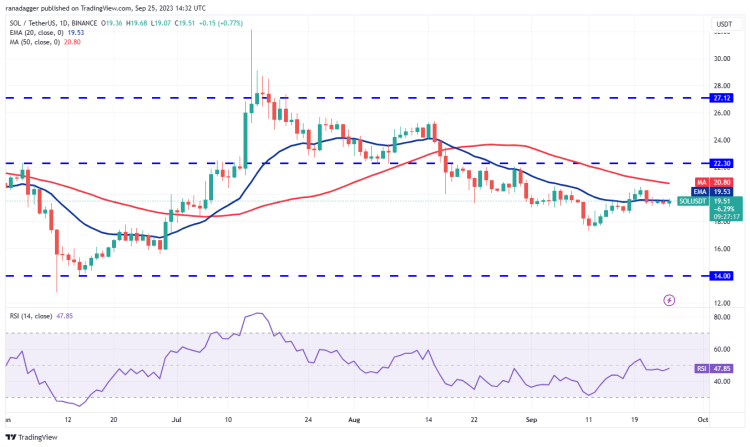

Solana (SOL) price analysis

SOL has been holding onto the 20-day EMA ($19.53) for the past few days. This indicates a tough battle between bulls and bears.

The flat 20-day EMA and the RSI just below the midpoint indicate a balance between supply and demand. On the upside, the bulls will need to push the price above the 50-day SMA ($20.80), signaling the beginning of a recovery towards $22.30. Conversely, if the price turns down from the current level, it will indicate that the bears are in command again. It is possible for SOL to retest the important support at $17.33 later. If it breaks this level, SOL is likely to drop to $14.

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!