Employment data, which is followed closely by the US Federal Reserve (FED), came yesterday.

Weakening economic data on the manufacturing side for a while and rising oil prices after the surprise OPEC+ decision, the banking crisis and the sticky inflation, increased the expectation of recession and led to a suppression in the risk appetite.

On the other hand, in every speech, Powell emphasizes that employment is progressing strongly and that this is an important criterion for reducing inflation to the desired target.

Earlier this week, the USA – Job Opportunities and Staff Change Rate was below expectations with 9,931M.

So what were the details of the data that came this week?

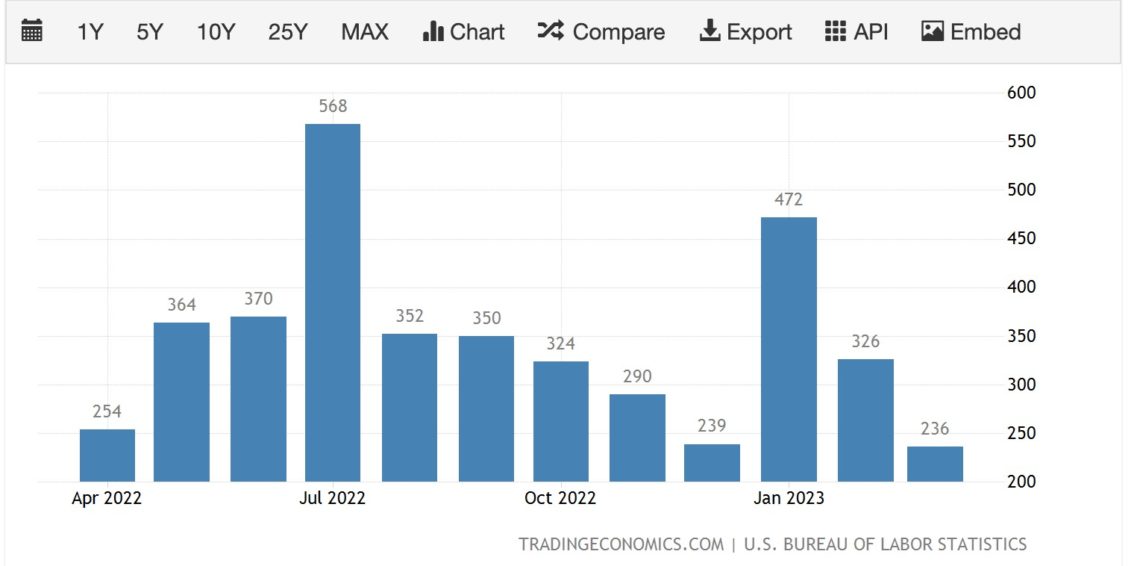

While the Non-Farm Employment data came in above expectations for the 12th time in a row, the upward trend on the employment side also triggered inflation concerns. Non-agricultural employment was slightly lower than expected, increasing by 236 thousand people.

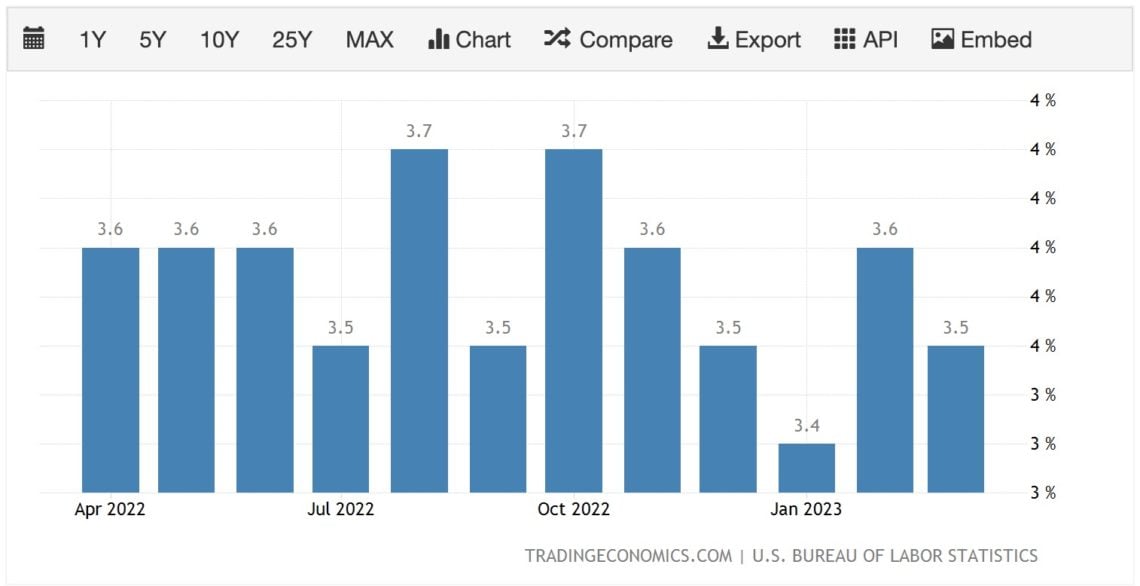

The unemployment rate rose to 3.6% in February after falling to 3.4% in January, the lowest level in recent years. In March, however, it fell to 3.5%, slightly below the expectations. The number of unemployed persons decreased by 97 thousand to 5,839 million, while the employment level increased by 577 thousand to 160,892 million. The labor force participation rate rose from 62.5% in February to 62.6%, the highest level since March 2020. Average hourly earnings rose 0.3% in March.

According to the announced data, although the US labor market still maintains its strength, we can also see signs of slowdown.

US and European markets were closed for the Easter holiday. On the cryptocurrencies side, we did not see a harsh reaction to the announced data. We can see a reaction when the stock markets open on Monday and we can see a strengthening in the dollar.