During a congressional hearing hosted by the Senate Committee on Banking, Housing and Urban Affairs, US Treasury Secretary Janet Yellen pointed to the recent collapse of a stablecoin-focused altcoin project.

Janet Yellen says the collapse of the IHR illustrates risks to financial stability

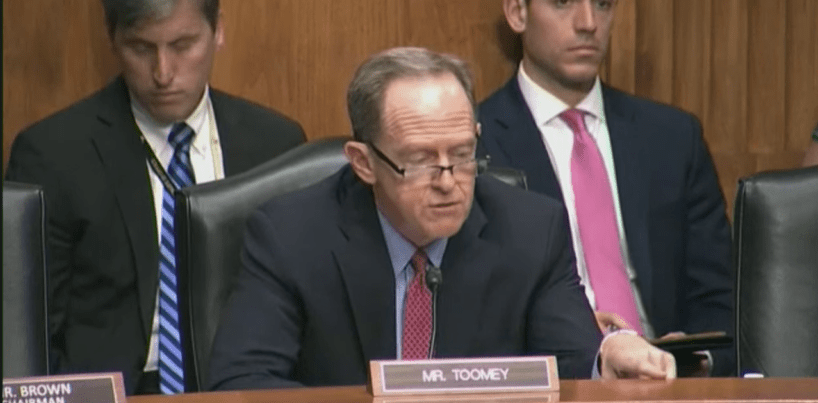

U.S. Treasury Secretary Janet Yellen, at a congressional hearing by the Senate Banking, Housing and Urban Affairs Committee, said:

A stablecoin known as Terra (UST) has risen and its value has plummeted… I think this shows that this is a rapidly growing product and there are risks to financial stability and we need an appropriate framework.

In response, Senator Pat Toomey (R-PA) stated that UST is an algorithmic stablecoin, meaning it is not backed by cash or securities.

In November, a regulatory agency led by the US Treasury Department released a report calling for tighter surveillance of stablecoins. He warned that leaks could spread “contagiously” across the industry, exposing the wider financial system to a higher level of risk.

US Treasury Secretary proposes regulation for stablecoin-focused altcoin projects

Additionally, Yellen thinks it would be “very appropriate” for the regulation to come into effect later in the year. She adds that the outstanding stock of stablecoins is growing so rapidly that there is a need for a “coherent federal framework.” As quoted by Kriptokoin.com , last month Yellen voiced her skepticism about stablecoins, claiming that “no one” can assure users that their tokens can be easily exchanged for dollars. These statements have turned eyes back on Tether company…

While Tether (USDT) often sparks controversy due to lack of transparency, its decentralized rival UST lost 0% in early Monday after its decentralized rival UST lost price stability. It fell below $70. Terra’s largest stablecoin saw below $0.70 without rebounding to $0.90 accompanied by a massive injection of liquidity. Still, there are no signs of stability as the LUNA is down 50%. We covered the UST price action in this article.