A new bipartisan bill has been introduced in the US that requires DeFi projects to comply with KYC (Know Your Customer) regulations. If a DeFi protocol does not have a defined controller, people who have invested over $25 million in its development will be held liable. US lawmakers from both parties are fed up with terrorists and criminals using decentralized finance (DeFi) platforms to launder money. If this bill becomes law, DeFi will have to start taking money laundering seriously. This measure taken for the DeFi field is closely related to DeFi coins such as AVAX, LINK, UNI, LDO. Here are the details…

New bill is coming in the USA

The crypto ecosystem has had to comply with strict anti-money laundering (AML) requirements in recent years. Criminals are known to look for easier ways than ever to clean up their dirty money. However, crypto has experienced an influx of money with questionable origins. One sector of Web3 that has so far escaped without much scrutiny has been DeFi. But now that seems to be changing. The new bipartisan bill, S.2355, is called the Cryptoasset National Security Enhancement Act of 2023. Senator Jack Reed, a member of the Senate Banking Committee, introduced the bill on Tuesday. Co-sponsors include Senators Mike Rounds, Mitt Romney and Mark Warner.

The aims of the bill are very clear. It aims to “clarify the applicability of sanctions and anti-money laundering compliance obligations against U.S. persons in the decentralized fintech sector and cryptocurrency operations.” As a result of the bill, DeFi organizations in the US will no longer be able to claim their ignorance if suspected breaches are revealed. The legislation sets out strict rules on compliance with anti-money laundering (AML) laws. If no one owns a DeFi operation, then anyone who has invested more than $25 million will be in focus for any breach.

Are the restrictions too strict?

According to a statement from Senator Warner’s office, the bill will force DeFi firms and individuals to meet the same requirements as centralized exchanges, casinos and pawn shops. The bill also aims to “modernize” the Treasury Department’s AML resources and functions. S.2355 will force DeFi protocols to more carefully scrutinize and report on their operations. Given the decentralization of DeFi, this imperative places a heavy burden on many market players.

The bill sounds solid, but money laundering has been a growing concern in the crypto world. The latest annual Crypto Crime Report by Chainalysis also supports this. According to the report, cryptocurrency laundering reached an all-time high in 2022. cryptocoin.com As we reported, the figures, which were 14.2 billion dollars in 2021, reached 23.8 billion dollars in 2022. Especially in the UK, crypto firms have reported a notable increase in this practice. A full 28 percent of crypto firms said they had an increase in Suspicious Activity Reports (SARs) within six months.

How will AVAX and these coins react?

Even the big companies of the sector do not escape scrutiny. In June, French authorities launched a money laundering investigation against Binance, the largest crypto exchange. Binance denied any wrongdoing. However, Binance soon faced more regulatory issues in Belgium. Authorities acted on allegations that malicious people were using the platform from outside the European Economic Area. In other words, the stock market allegedly violated Belgian legislation.

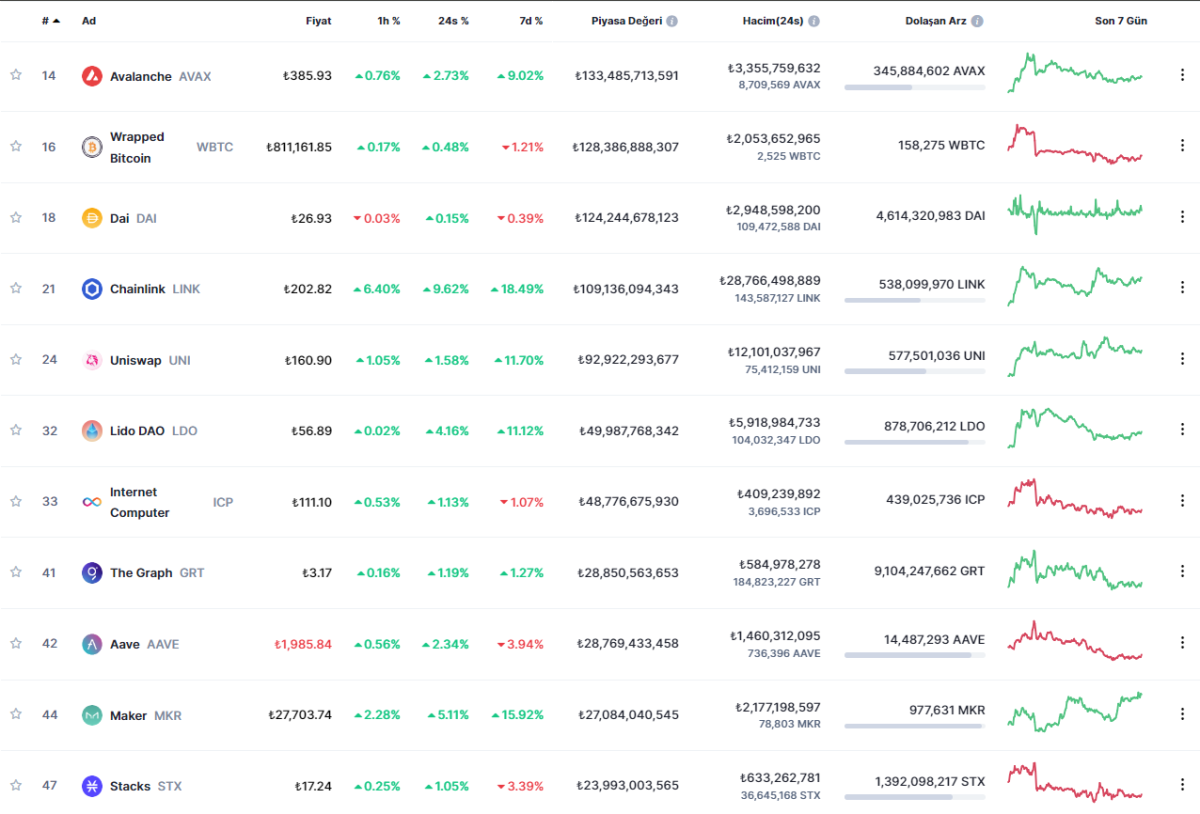

The arrival of regulatory clarity marks a positive development for DeFi coins like AVAX. However, it is critical that regulations bring centrality to the fore. In other words, going against the free spirit of cryptos carries the risk of alienating some investors from the field. The most popular cryptocurrencies in the DeFi space are as follows: