The USDC stablecoin regained its peg to the U.S. dollar, according to CoinGecko, after falling below the $1 value it was supposed to hold as the federal banking and finance regulators said on Sunday that all depositors in Silicon Valley Bank will be made whole and have access to their funds on Monday.

The Circle-issued stablecoin fell in value late Friday as holders rushed to redeem their tokens upon learning that Circle kept some portion of the funds backing USDC in Silicon Valley Bank, which state and federal regulators took over on Friday morning.

Circle later acknowledged that about $3.3 billion – or about 8% of the overall funds backing USDC – were held in Silicon Valley Bank. The Federal Deposit Insurance Corporation announced on Friday that insured SVB depositors would regain access to their funds by Monday, but said uninsured depositors would only get an advance sometime this upcoming week. As the FDIC sells off SVB’s assets, these uninsured depositors would receive a dividend. More than 90% of the funds held in SVB were uninsured.

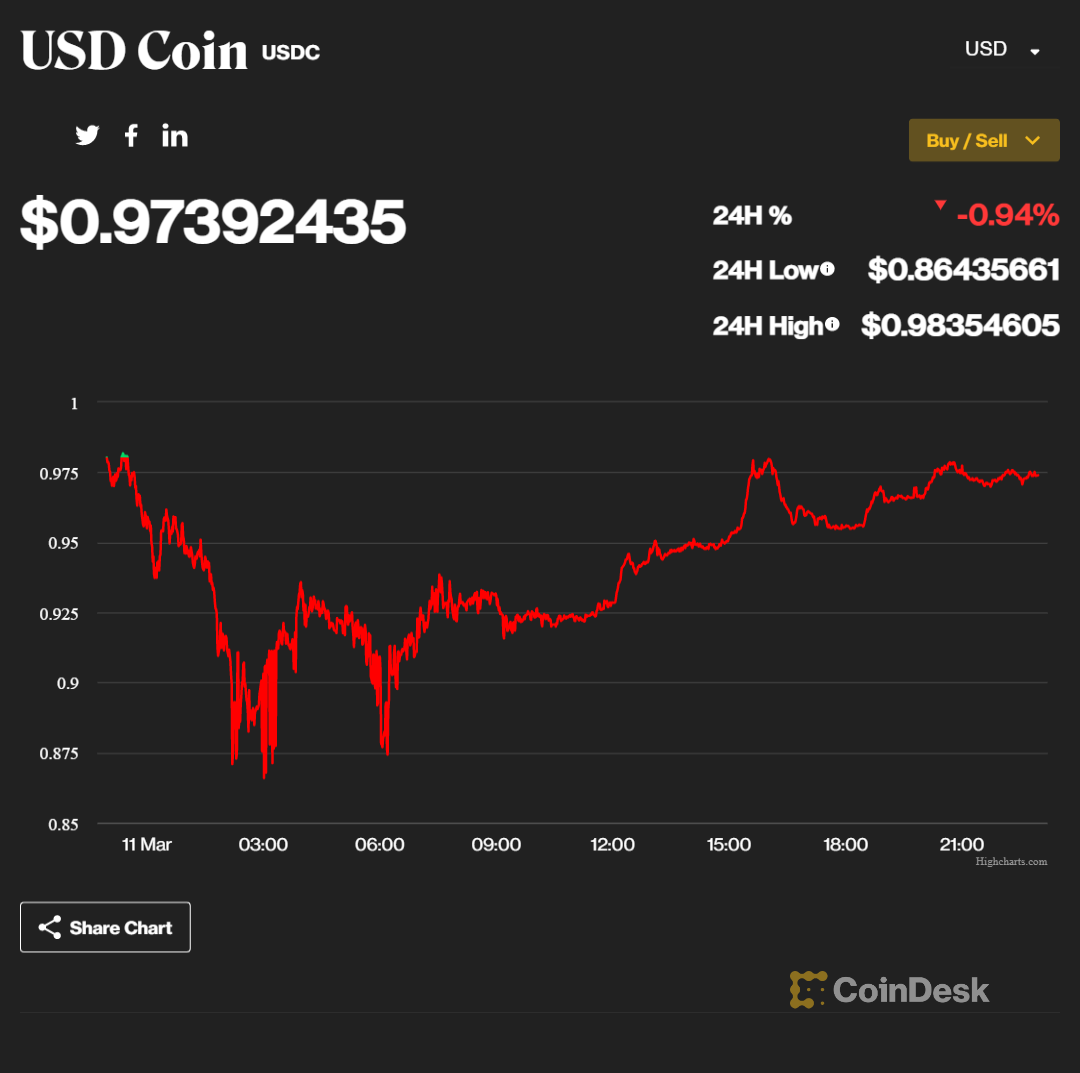

USDC fell to as low as $0.86 at some points, a staggering collapse for the world’s second-largest stablecoin, but began recovering somewhat by midday Saturday.

USDC’s price action on March 11, 2023 at 11:00 p.m. ET (04:00 UTC) (CoinDesk)

Circle assured investors it would “cover any shortfall” in USDC reserves using corporate funds should it not recover the full $3.3 billion, which helped it rebound to $0.97.

The announcement came after a number of major crypto exchanges suspended or paused USDC-related transactions. Coinbase (COIN), the largest exchange in the U.S., paused conversions from USDC to U.S. dollars late Friday. On the other hand, the world’s largest exchange, Binance, announced Saturday it would resume trading certain USDC trading pairs it had previously suspended.

Circle said Friday it was waiting for further information from the FDIC on what it would actually do about SVB’s deposits. It’s a key question that lawmakers and regulators are grappling with.

U.S. Rep. Maxine Waters, the ranking member on the House Financial Services Committee, met with officials from the FDIC, Federal Reserve and U.S. Treasury Department on Friday to discuss the situation.