There has been some increase after the last downturn for Bitcoin. But after the last peak, expectations are still high. That’s why there are comments for BTC. We will share with you the views of seven analysts. cryptocoin.comLet’s see what they said.

Comments from Bitcoin analysts

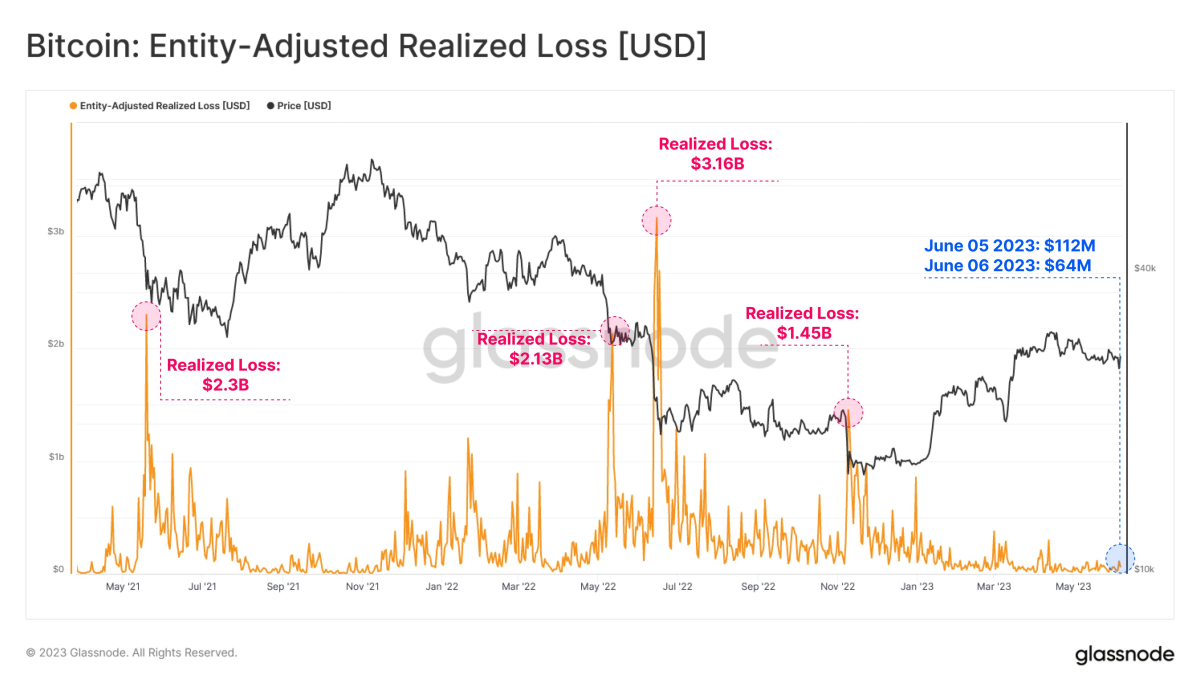

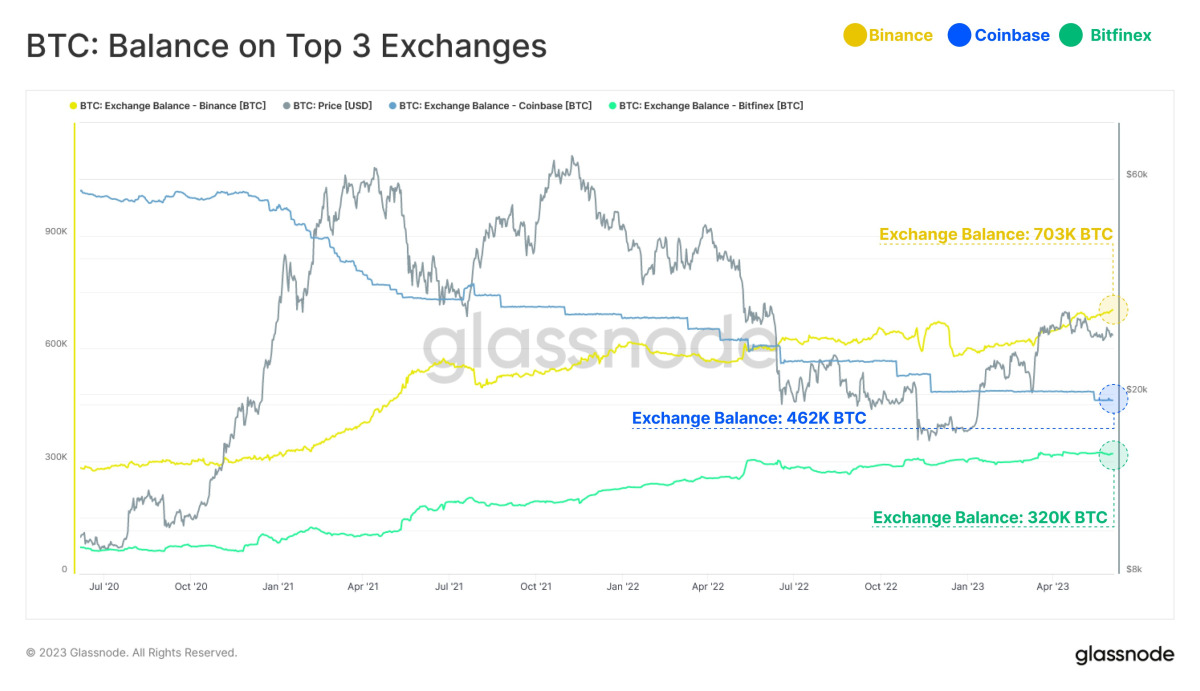

While the SEC-focused wars continued in the crypto money world, important statements came from the analytics firm Glassnode. Accordingly, Glassnode states that BTC investors ignore this war. The latest data covering on-chain transactions came amid the backlash to the Binance and Coinbase lawsuits. Accordingly, it shows that very few people are in “panic selling” mode. According to Glassnode’s monitoring tools, major exchanges experienced a modest drop in their BTC balances on June 5-6.

This drop, which reached around 12,600 BTC in total, indicates that users do not want to withdraw their funds from hot wallets. Commenting on this situation, analyst Willy Woo states that customers remain calm in the face of what happened. For this reason, he states that he has not seen much output yet.

SEC motions to freeze assets on Binance exchange.

Binance customers don't care. Not seeing much BTC leaving, not yet at least. pic.twitter.com/1zOxfV8vL3

— Willy Woo (@woonomic) June 7, 2023

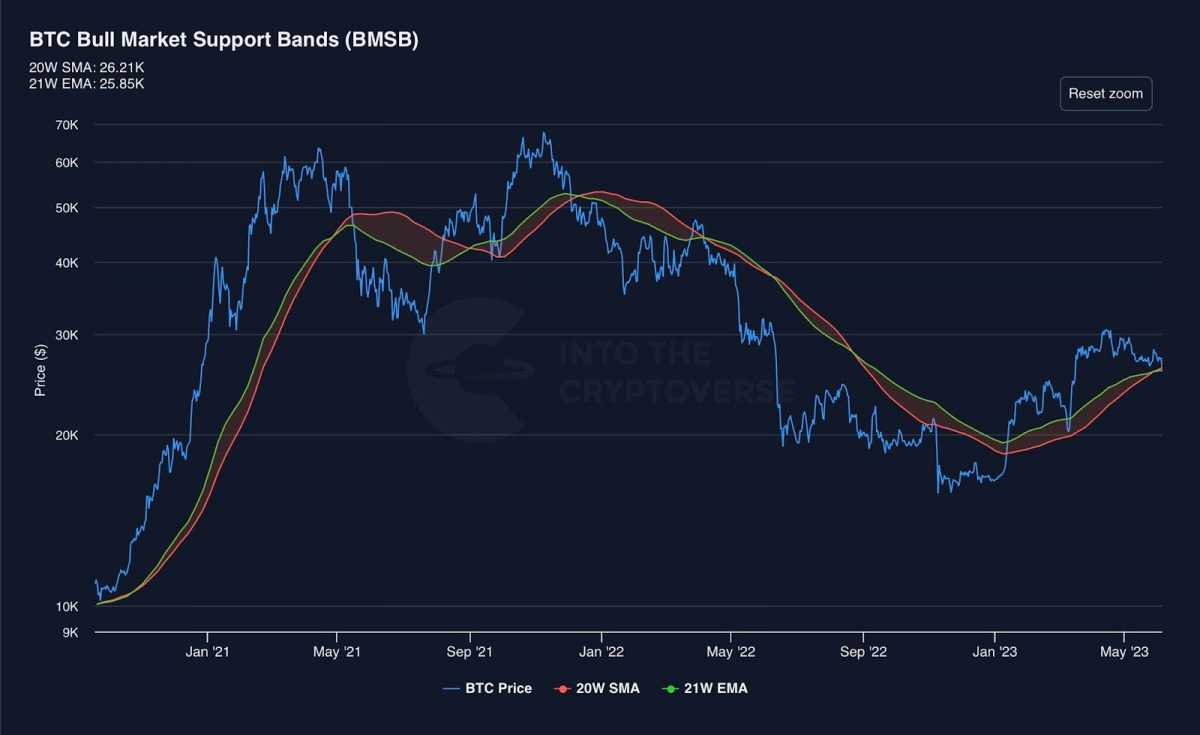

On the other hand, an analyst named @ITC_Crypto is looking at the possibility of a potential bounce. According to him, Bitcoin has returned to the so-called bull market support band. The 20-week SMA is currently located at $26,210. On the other hand, the 21-week EMA is at $25,850.

According to another analyst Kaiko, Bitcoin is in a positive state. It almost made up for the losses incurred during the recent market crash. The crypto market plummeted after reports of the SEC/Binance lawsuit surfaced. However, the lead coin’s liquidity on Binance has been volatile and below average. Bitcoin’s recent recovery has heightened the bullish sentiment surrounding the cryptocurrency. This shows that Bitcoin investors have developed a positive attitude towards the negative actions of crypto regulators. While many expected the price to drop further, this was not the case. Instead, the recovery developed a pattern that could see Bitcoin heading towards the $35,000 price zone.

#BTC market depth mostly recovered on Coinbase post near halving on Jun 5, following the SEC/Binance suit announcement.

Liquidity on Binance remained volatile and below average. #LiquidityUpdate pic.twitter.com/OTtmq9u7Wy

— Kaiko (@KaikoData) June 7, 2023

Warnings are coming

A widely followed crypto analyst predicts that Bitcoin (BTC) is heading towards a major correction based on a flashing bear signal. DataDash host Nicholas Merten tells 511,000 YouTube subscribers in a new video update that Bitcoin’s performance against the NASDAQ is weakening, which signals a downward trend for the crypto king. The levels highlighted by the analyst are $13,000. A closely followed crypto strategist outlines how Bitcoin (BTC) can regain its bullish momentum and rally to its all-time high.

Accordingly, analyst Credible Crypto calls out to his 340,600 Twitter followers. He says bitcoin bulls have successfully defended a critical $25,000 support level after Monday’s corrective move. According to Credible Crypto, a move below $25,000 will likely result from forced liquidations, which it thinks will be suitable for long-term BTC bulls.

According to crypto analytics platform Glassnode, the largest over-the-counter Bitcoin (BTC) whales have been “aggressively” accumulating the most important digital asset for the past month and a half. However, Glassnode also notes that all other sizes of over-the-counter BTC holders emptied their Bitcoin holdings in the same time frame.

The analyst firm also says stock market entries in major assets are currently near cycle lows at $1.84 billion at an “extremely quiet” level. Glassnode states that among the top three crypto exchanges, the total amount of Bitcoin held on Binance and Bitfinex has increased by 421,000 BTC and 250,000 BTC, respectively, in the last three years, while assets on Coinbase have decreased by 558,000 BTC over the same period.