Trading ranges within bitcoin (BTC) markets continue to narrow, a sign that uncertainty remains the order of the day for the largest cryptocurrency by market capitalization. Simultaneously BTC’s share of overall crypto markets continues to rise, an indication that it remains the safe haven digital asset for investors.

The average true range (ATR) for BTC has fallen 12% over the most recent 4 days and 31% since March 23rd. The ATR of an asset is a measurement of volatility over a prescribed period of time. ATR takes the greater of the differences between current and prior highs and lows, with declines indicating a contraction in volatility and increases indicating an expansion.

When the trading range of an asset compresses, it can signal that markets feel the asset is appropriately priced. During times of lower volume however, it can also imply uncertainty among market participants. BTC volume remains below its 30 day average by approximately 30% across exchanges.

The reduction in volatility coincides with a recent decrease in the aggregate amount of stablecoins being added to exchanges. This decline in available risk capital, in conjunction with uncertainty, has led to relatively flat trading, illustrated by the ATR compression.

BTC’s current $27,000 price level sits approximately 4.5% below a high volume node, representing an area of potential short term upside.

High volume nodes are displayed using the Volume Profile Visible Range indicator, and represent areas of significant agreement between buyers and sellers.

Prices can often move slowly near high volume nodes, as the greater degrees of agreement lends itself to orderly price action. This stands in contrast to low volume nodes, where the lower levels of liquidity can lead to more dramatic price swings.

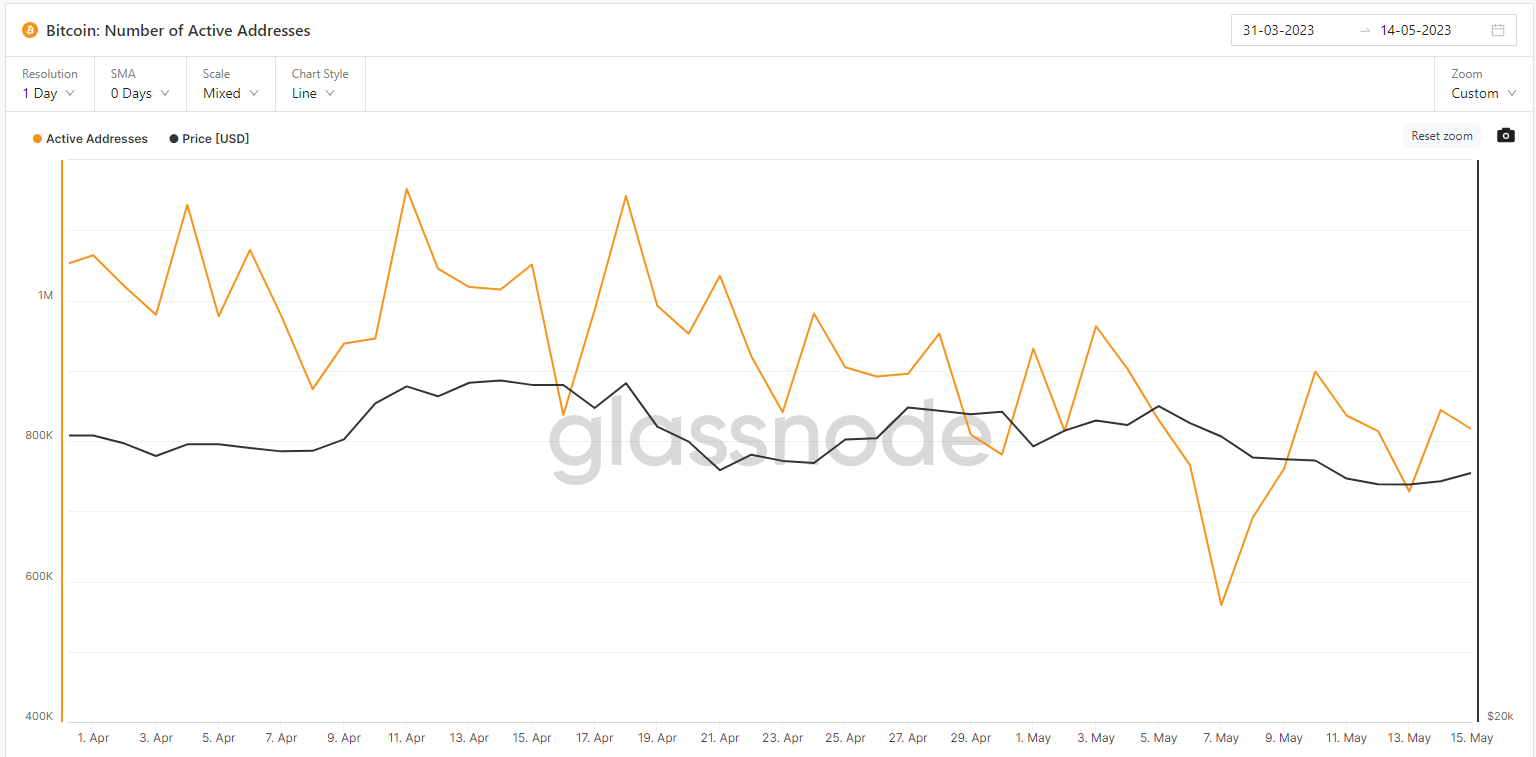

Investors would be keen to watch the decline in active addresses on the Bitcoin network as well. The number of unique addresses actively transacting in BTC has declined 33% since April, leading in part to the contraction in volatility.

While volatility has waned, BTC’s market share has increased, with the crypto’s dominance up 5% year to date. At a market capitalization of $523 billion, BTC represents 45% of the $1.6 trillion market cap across all cryptos.

Recommended for you:

- Crypto Investors Can Rely on ‘Frankly Nothing’ in Current Regulatory Environment, Says Former FDIC Official

- Ethereum’s Mainnet Tenth ‘Shadow Fork’ Goes Live Ahead of September Merge

- 4th Quarter Market Outlook: The CoinDesk DeFi Index (DCF)

Despite the 63% increase in BTC prices year to date, investors appear reluctant to look for additional alpha in smaller altcoins, using bitcoin instead as the safe haven asset within crypto markets.