A total of 1.29 billion stablecoin burns were voted in the DAO of an altcoin project. The vote ended in favor of token burning. On top of that, the price of the project’s altcoin increased by over 10,000%. Here are the details…

This stablecoin has lost its stability

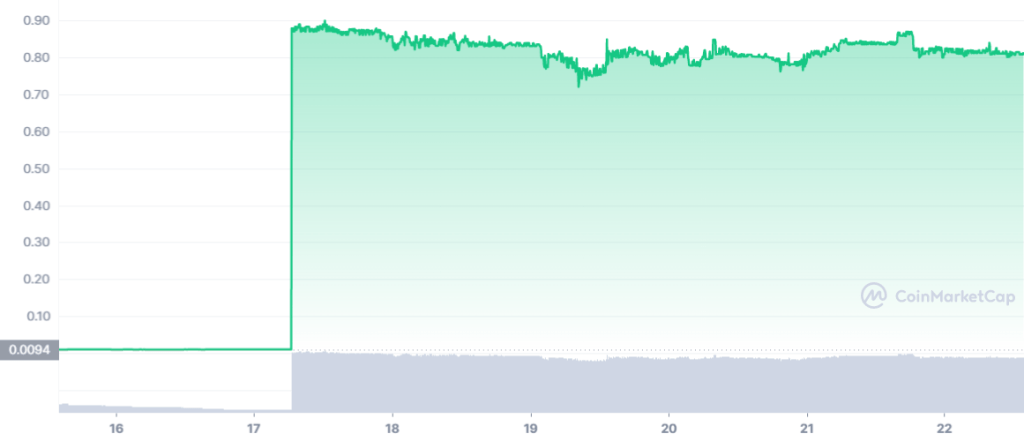

PeckShieldAlert shows in a tweet today that the stablecoin named Acala Dollar (aUSD) has dropped to $0.81. aUSD is a cryptocurrency that should be fixed at a ratio of 1:1 to the dollar. Accordingly, the price of $ 0.81 reveals that the token has moved away from its stability to the dollar. In fact, an aUSD first lost its peg to the dollar on August 13. The dollar-pegged altcoin formed new lows below $0.1 on August 14.

The team confirmed that the incident was caused by a misconfiguration in the newly launched iBTC/aUSD liquidity pool. This configuration error allowed bad actors to print money. According to the latest data, these actors have circulated over 3 billion aUSD in total. This caused the token’s stability to the dollar to deteriorate. After the exploit, the team behind the altcoin project decided to pause the Acala parachain.

The price of the altcoin project rose 10,000 percent in one week

The developers, who stopped Acala parachain, then took action to save the project. First, they tracked altcoin assets minted by bad actors. Accordingly, they discovered 1.29 billion aUSD with oversupply in 16 wallets. They then started a community vote to burn these tokens. The vote was critical, so the decision was made quickly. The community quickly accepted the proposal with 95% of the votes in favour.

On top of that, a total of 1.29 billion aUSD went out of circulation by being transferred to a dead wallet. This move by the community caused the token to rise over 10,000% within 24 hours. The altcoin, which was trading under $ 0.1 in the morning, rose above $ 0.9. Thus, it was possible to approach its stability to the dollar, even if it did not reach it. Also, the community tracked one of the 16 accounts on Sunday and approved to burn $1.68 billion USD in excess supply. Thus, the number of surplus aUSD in circulation fell into the millions.

Crashes in algorithmic altcoin projects

In particular, algorithmic stablecoins that hold their stable through math and arbitrage incentives have come under further scrutiny following the Terra debacle in May. cryptocoin.com As we reported, the deterioration of Terra USD (UST) resulted in over $40 billion in investor funds being wiped out of the market. Thus, he went down in history as the catalyst for the subsequent collapse of several crypto lending firms.

It’s worth noting that Acala Network was the first chain to win a Polkadot Parachain auction. The network has two tokens. These are the governance token ACA and the algorithmic stablecoin aUSD for DeFi activity. In particular, unlike the Terra fiasco, the loss of stability of aUSD does not seem to affect the DOT significantly.