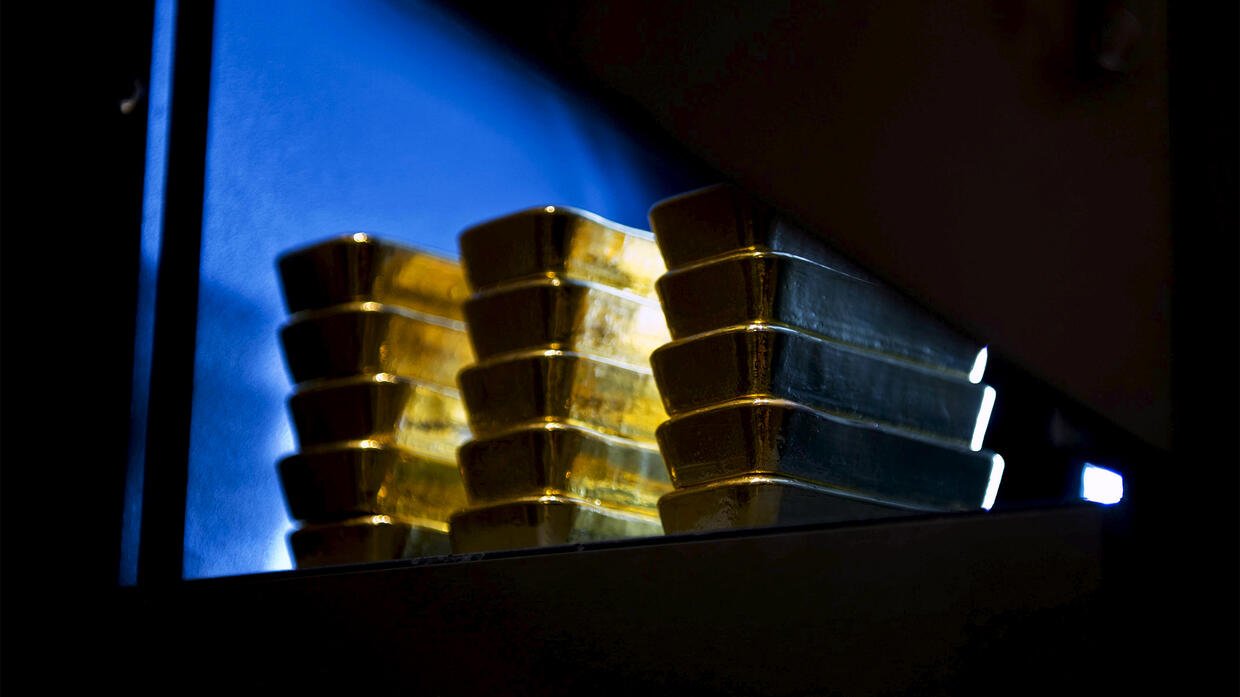

According to market analyst Anil Panchal, the price of gold feels gravity because it fell from the highest daily levels after being rejected at $ 1,790. The last decline in gold price can be associated with the increase in US treasury interest rates with the help of optimistic risk sensitivity. Analyst says that the US inflation data announced on Friday supports the interest -free gold by alleviating concerns about the FED’s aggressive interest rate hikes.

Gold focused on the FED policy decision for a new direction

From a wider perspective, the analyst says that the horizontal course of the gold price expanded between $ 1,770-1,795 last week, and that markets continue to focus on the FED policy decision for a new direction in bright metal. According to the analyst, the yellow metal benefited from US inflation data the previous day, but the market’s concern before the key Central Bank meetings and virus fears are forcing buyers late. However, the analyst says that the option market remains a decline tendency on the commodity, according to the weekly risk reversal (RR).

Kriptokoin.comAs we have reported as the US Consumer Price Index (CPI) showed the highest level of 39 years, but for November, the annual 6.8 %of market estimates matched. The stable inflation expectations described through the consumer sensitivity index of Michigan University were added to the previous relaxation rally. However, the analyst recalls that RR, an indicator of sales calls, shows a five -week decline trend with the latest -0,1000 numbers.

“Gold prices are likely to be under pressure”

Meanwhile, Consolidation on Friday helped stocks and put pressure on the US Dollar Index (DXY) as well as US Treasury interest rates. Nevertheless, the key weeks, including the US Federal Bank’s (FED) monetary policy meeting, starts cautiously.

According to the analyst, considering the increasing fears of the Fed’s hurry for faster tapering and interest rate hikes, gold prices are likely to be under pressure. However, if the analyst aims to establish more dominance, the US said that the US 10 -year treasury interest should maintain the last recovery.

Against this background, important US Treasury bill coupons rose to 1.49 %, while the S&P 500 -term transactions increased by 0.20 %during the press time. In addition to the problems connected to the FED, it is important to monitor Covid updates and the US-China struggle for the net direction of the light calendar of the day on Monday.

Gold Price Technical Analysis: Gold Receivers Waiting at Ambush

Market analyst Anil Panchal states that although the explicit breaking of the previous support line on September 30 came before the continuous trade under the 100-SMA and 200-SMA, the gold buyers are waiting in ambush around a four-month rising trend line. According to the analyst, the decreasing tendency of MACD signals and mostly constant RSI, bears probably reduce their power. Anil Panchal draws attention to the following technical levels:

However, the DMAs specified around $ 1,790-95 and the resistance line, which turns into support for $ 1,800, will keep the bulls away.

Gold price daily graphics

Gold price daily graphicsIn addition to the upward filter, the analyst recalls that the $ 1,815 level and the highest levels marked around $ 1,834 in July and September. According to the analyst, otherwise, the downward break of the multi-daily support line, which is close to $ 1,769 at the latest, will have to get approval from the 61.8 %Fibonacci correction in August-November to convince the gold vendors. Anil Panchal summarizes his analysis as follows:

To summarize, the price of gold shows the indecision of the trader at the beginning of the critical week.