A blockchain transaction that contributed to the collapse of Terra’s UST stablecoin has been linked by a South Korean analysis firm to the ecosystem’s chief developer, Terraform Labs.

CoinDesk Korea reported the findings by the blockchain analysis firm Uppsala Security earlier this week.

Uppsala, in its report, did not venture to provide a possible motive or rationale for the transaction, and officials with Terraform Labs did not reply to requests for comment.

But the findings have been shared with legal authorities in South Korea, where Terra enjoyed a huge following partly due to its Korean founder Do Kwon. The Seoul Southern District Prosecutors’ Office is “tracking the flow of problematic wallets and coins” and is aware of the wallets flagged in the report, according to CoinDesk Korea.

“We compiled our report based on publicly available on-chain and online data, with the goal of providing evidence and leads to get closer to the truth that the impacted members of the community deserve to know,” Uppsala CEO Patrick Kim told CoinDesk in a WhatsApp message.

Who is behind ‘Wallet A?’

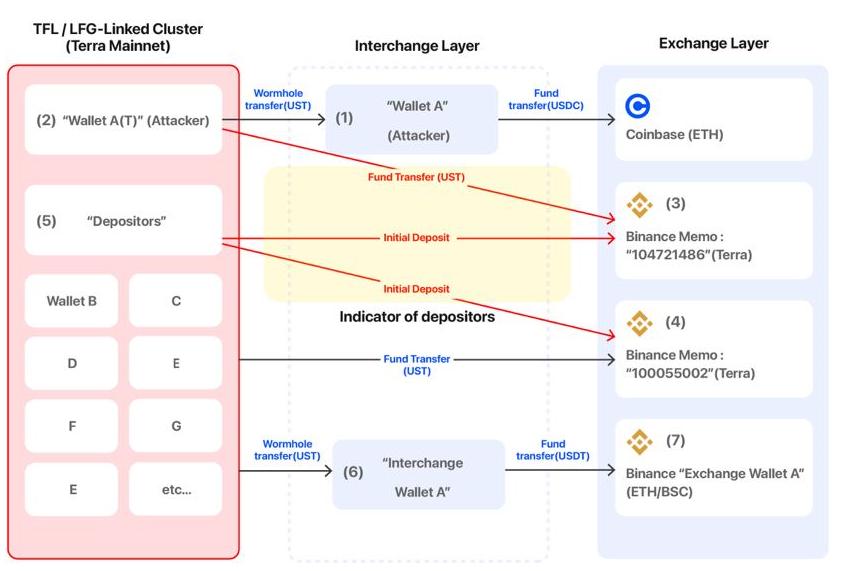

Uppsala Security conducted an analysis of Terra wallets and flagged the Ethereum wallet “0x8d47f08ebc5554504742f547eb721a43d4947d0a” (referred to as “Wallet A”) as one of the main addresses whose actions helped pushed prices of UST off of its intended $1 peg.

Blockchain data shows Wallet A swapped over 85 million UST for another dollar-linked stablecoin, USDC, on May 7 – just minutes after Terraform removed over 150 million UST from a liquidity pool on the lending platform Curve in a planned move.

Prices of UST fell under $1 almost immediately following these trades, which Uppsala said was a result of the lower liquidity on the Curve pool. Meanwhile, Wallet A’s newly-acquired USDC was sent to Coinbase, one of the biggest crypto exchanges by trading volume.

“There’s no telling what happened to the funds transferred to these Binance and Coinbase wallets, whether they’re still there or have since been transferred somewhere else,” Uppsala wrote in the report.

Schematic showing fund transfers by Terraform Labs-linked wallets to Coinbase and other exchange addresses. (Uppsala Security)

On further investigation by Uppsala, Wallet A’s transaction history showed it had received the 85 million UST from “terra1yl8l5dzz4jhnzzh6jxq6pdezd2z4qgmgrdt82k,” a wallet address on the Terra blockchain. The UST on the Terra blockchain was converted into UST on the Ethereum blockchain via Wormhole, a swap service for exchanging tokens from one chain to another.

The transactional history of that wallet showed it regularly sent huge amounts of UST to crypto exchange Binance. Uppsala showed that the wallet transacted with several other Terra wallets such as “terra1gr0xesnseevzt3h4nxr64sh5gk4dwrwgszx3nw” (referred to as terra1gr). This aroused suspicions at Uppsala – since terra1gr was one of the official wallets of the Luna Foundation Guard (LFG), which was set up by Kwon and other Terraform Labs officials to create a reserve for the “algorithmic” protocol behind UST.

According to Uppsala, apart from terra1gr, another Terra wallet “terra13s4gwzxxx6dyjcf5m7” (referred to as terra13s) exchanged funds recently with wallets on the Binance exchange that can be linked to Wallet A. The terra13s wallet is now one of the official wallets of the LUNC DAO, a validator of Terra’s new Terra 2.0 blockchain, Uppsala said.

Investigation of all these wallets, their connections and their repeated transactions with each other led Uppsala to conclude that the wallets either had the same owner or were managed by a single entity.

Uppsala says the findings mean the actions of Terraform Labs may have ultimately resulted in UST’s implosion. “It means that Terraform Labs or LFG made a financial transaction that caused Terra to collapse on its own,” the team said in its report.

“Not only Wallet A but also the wallet connected to it were managed by Terraform Labs and related companies,” Uppsala’s Kim told CoinDesk in a WhatsApp message.

Read more about

Save a Seat Now

BTC$20,681.60

BTC$20,681.60

ETH$1,084.43

ETH$1,084.43

BNB$216.26

BNB$216.26

XRP$0.322035

XRP$0.322035

BUSD$1.00

BUSD$1.00

View All Prices

Sign up for Valid Points, our weekly newsletter breaking down Ethereum’s evolution and its impact on crypto markets.