According to crypto analyst David, Litecoin is likely to continue falling in the near future. Analyst Tomiwabold Olajide says the 14 trillion Shiba Inu is at risk. Meanwhile, traders are taking profits from the popular meme coin of recent days. According to analyst Aaryamann Shrivastava, an altcoin dips leaves investors no choice.

The price of this altcoin is likely to continue falling

Litecoin price has soared since hitting a yearly low of $41 in June 2022. It formed an uptrend structure during this period. It also hit a year high of $105.7 in February 2023. However, the price failed to break the $100 resistance level and was rejected twice. This move created a double top pattern which usually causes the trend to turn bearish.

In addition, the second rejection created a bearish engulfing candlestick. It also led to a continuation of the decline over the next two weeks. This was another bearish signal. Therefore, the altcoin price is likely to continue to decline towards the key $63 support level. The weekly RSI indicator supports this possibility as it formed a bearish divergence before the bearish move and now dips below 50.

LTC weekly chart / Source TradingView

LTC weekly chart / Source TradingViewThe daily chart also supports the possibility of further declines from the weekly timeframe. It shows that LTC price broke below the key support level of the recent uptrend at $85 and is confirmed as resistance today (red arrow). The daily RSI indicator is approaching the oversold zone. Also, it’s sloping down, which indicates that the bears are taking control. Therefore, LTC price is likely to drop to the nearest support level at $75 in the short term.

LTC daily chart / Source TradingView

LTC daily chart / Source TradingViewTechnical signals indicate that LTC price will continue to decline in the near future. The closest target is $75 and further down at $63. However, as the LTC halving approaches, the bulls are likely to buy strongly once the price drops to the $63 support level.

14 trillion SHIB at risk as price drops

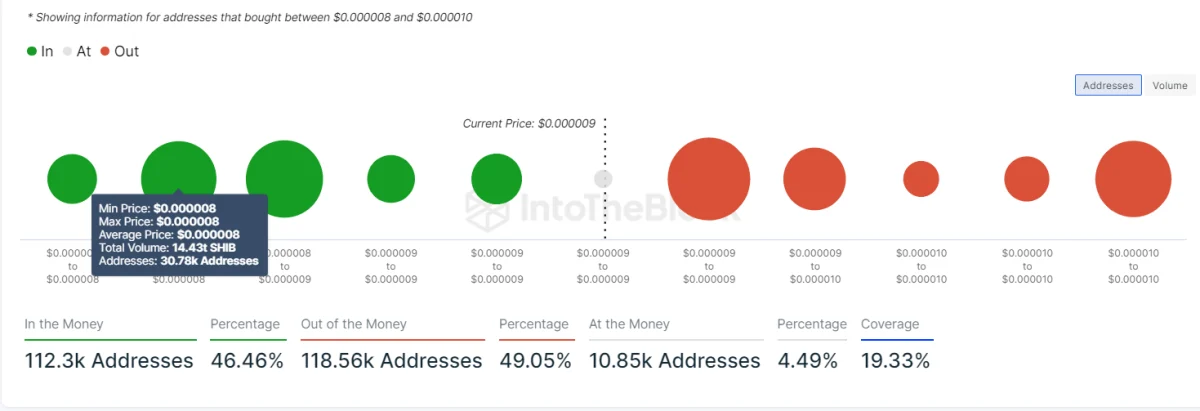

The Shiba Inu (SHIB) fell along with the rest of the market on May 8 as investors weighed concerns inside and outside the industry. At press time, the SHIB fell 4.32% in the last 24 hours to $0.000009 after hitting an intraday low of $0.0000087. According to IntoTheBlock data, SHIB is passing through a significant demand area. After the SHIB price briefly lost the $0.000009 level on May 8, the Shiba Inu faced the next significant support at $0.000008, where 30,780 addresses bought 14.43 trillion SHIB.

Shiba Inu (SHIB) IOMAP / Source: IntoTheBlock

Shiba Inu (SHIB) IOMAP / Source: IntoTheBlockThis means that 30,780 Shiba Inu addresses could be at risk of losing their positions above 14 trillion SHIB if the price drops below $0.000008. However, the bulls seem to be attempting to reclaim the $0.00009 level with 0.000008, the largest of the support clusters. According to IntoTheBlock data, more Shiba Inu owners bought in this range. It also made purchases of 31,760 SHIB addresses at a maximum price of $0.000009.

Shiba Inu prices fell steadily after hitting $0.0000159 on Feb. An attempt by the bulls to restart the uptrend faced a wall at the $0.000011 high on April 16. The Shiba Inu seems to be approaching oversold levels, as evidenced by the daily RSI dropping below the 30 level. An oversold or undervalued condition is usually indicated by an RSI of 30 or lower.

The Shiba Inu is currently trading below the MA 50 and 200-day moving averages at around $0.0000106. This represents a significant obstacle to the upward movement. Meanwhile, traders need to pay attention to the SHIB daily moving averages. Because these are expected to make a transition within days or weeks.

Whales profit from PEPE after Binance listing

cryptocoin.com As you follow, Pepe (PEPE) has recently entered Binance’s list. After that, there is a significant profit-taking wave. The token fell 50.70% from its record high of $0.00000431 after a short period of speculative frenzy. According to The Data Nerd, whales are increasingly profiting from PEPE. Also, the total PnL that took place in the last 24 hours reached $4.5 million. This acceleration coincides with the recent downtrend in Bitcoin (BTC) prices.

Meanwhile, a large PEPE whale recently transferred an enormous sum of 4.23 trillion tokens to Binance, equivalent to roughly $15.6 million. This move, which came shortly after Pepe was listed on the stock market, led to speculation about a possible price collapse in the near future. Despite concerns over the speculative nature of the token, Pepe’s market cap has skyrocketed to over $1.5 billion, according to CoinGecko data. The sudden rise attracted the attention of speculators.

Lookonchain reports that excluding exchanges and contract addresses, Pepe’s top 15 holders hold 38.07 trillion Pepe tokens, representing 9.05% of the total supply. These holders made a total profit of $92.6 million with an average purchase cost of $0.0000000853 per token.

These altcoin price drops leave investors no choice

The price of Lido DAO continues its downtrend since the end of April. In this direction, it fell below the level of 2 dollars in the last three days. This price point has been acting as an important level of psychological support since the beginning of the year. Therefore, its loss triggered a spike among investors. As a result, LDO saw a few more red candlesticks, trading at $1.7 at the time of writing, extending its monthly decline to 31%.

LDO 1-day chart

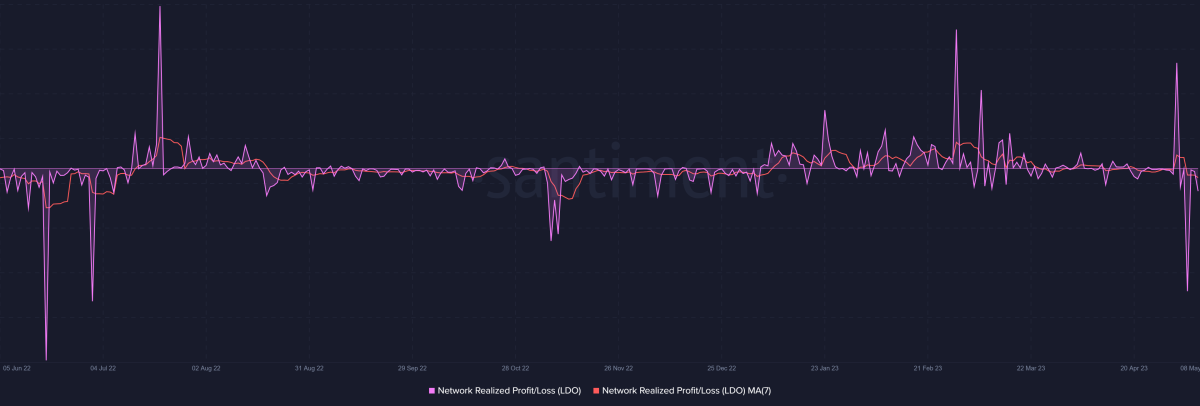

LDO 1-day chartHowever, this drop was driven by the events of May 5, when the network observed its most loyal group changing hands. Long-term holders are activated. In addition, approximately 51.95 billion days were consumed as their holdings changed hands. The number of days is the number of LDOs spent multiplied by the lifetime of these coins. The higher the number, the more downward the effect.

Lido DAO age consumed

Lido DAO age consumedIt lived up to its inference aphorism, as the network recorded the highest daily realized losses since June 2022. Nearly 21 million Lido DAO tokens were traded in just 24 hours, resulting in almost $35 million in losses

Lido DAO recovers losses

Lido DAO recovers lossesThe bearish trend continued with a 6.8% drop on Monday. This, in fact, unintentionally led to a sudden boom among investors. Supply on exchanges fell to just over 4 million LDOs, worth about $6.8 million, as the price fell to a five-month low as investors hoarded.

Lido DAO supply on exchanges

Lido DAO supply on exchangesMeanwhile, the balance of large wallet holders and whale groups did not increase much. Therefore, this supply was mostly collected by individual investors. Addresses holding 100,000 to 10 million LDOs have registered almost no change in the last 48 hours. The altcoin price has a chance to recover if it maintains the bullish appeal from its individual holders. This is because the next wave of sales will potentially occur when the recently acquired altcoin is in profit.