The $1 trillion crypto crash led to serious Bitcoin and Ethereum price warnings. This prompted regulators to act faster. The SEC’s war on crypto is only just beginning, according to one crypto expert.

SEC prepares to sue Paxos

Bitcoin, Ethereum and the cryptocurrency market have been stunned by the shocking regulatory pressures over the past week and some fears that it is part of a plan to ‘quietly’ ban the cryptocurrency. Bitcoin price has dropped from year-to-date highs, surpassing $24,000 per BTC last week. This dragged down the Ethereum price and other major cryptocurrencies. Furthermore, the combined pushed the crypto below the closely watched $1 trillion level.

Now fears are growing, an impending war against crypto is ‘just getting started’ as a legendary trader makes a surprise Bitcoin, Ethereum and crypto U-turn. The US Securities and Exchange Commission (SEC) is preparing to sue Paxos, one of the largest (alleged) stablecoins, for selling BUSD as an unregistered security, the Wall Street Journal reported on Sunday.

“SEC’s cryptocurrency war is just getting started”

The New York Department of Financial Services (NYDFS) on Monday ordered Paxos to stop issuing Binance-branded BUSD, the third-largest stablecoin boasting a market cap of nearly $15 billion. Binance has warned that the market cap of BUSD will now ‘only decrease over time’.

“The SEC’s crypto war is just getting started,” said Marcus Sotiriou, a market analyst at digital asset broker GlobalBlock. cryptocoin.com Last week, major crypto exchange Kraken was forced to shut down its US staking service after being fined $30 million by the SEC. SEC chairman Gary Gensler, who previously said he views nearly all cryptocurrencies as securities that require registration with his agency, said the accusation against Kraken “should draw the attention of anyone operating in the crypto market.”

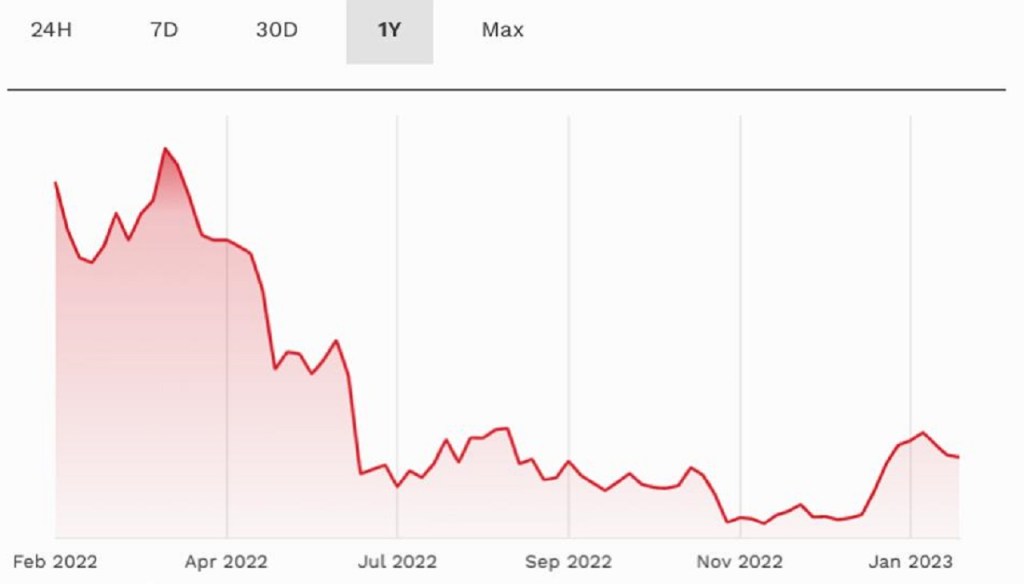

Bitcoin 1-year price chart

Bitcoin 1-year price chartKey considerations for the cryptocurrency market: Fed and regulation

However, some crypto market watchers remain optimistic about the prospects of Bitcoin, Ethereum, and other cryptocurrencies, estimating that they will be tested in the coming days and will be driven mainly by the Federal Reserve’s interest rate hike program. BitBull Capital CEO Joe DiPasquale comments:

While Bitcoin has shown some general resistance in this rally that started on Jan. 1, we are looking at an important level in the coming days that should show if the rally continues or if we see a steeper correction. After losing both the $23,000 and $22,000 levels, BTC is now doing a subtest that could see it attempting to retrace $23,000. If that fails, we could see BTC drop to $20,000 pretty quickly. As always, the market is also tied to macroeconomic developments, and given December consumer prices were higher than previously expected, the market may begin to consider a larger rate hike at the next Fed meeting.

Meanwhile, Brian Armstrong, CEO of Kraken rival Coinbase, said the exchange would “happily” defend its own crypto staking service in court if needed. “Coinbase’s staking services are not securities,” Armstrong said on Twitter. Joe DiPasquale comments on this:

Regulations are also a concern for the crypto space, especially after the SEC’s $30 million fine imposed on the Kraken exchange. However, we believe that it is better to achieve regulatory clarity in a slow market as opposed to more rigid developments during a full-fledged bull market.