With former US President Donald Trump’s continuing plans to increase tariffs, the famous investor Robert Kiyosaki predicts that there may be a major decrease in the price of Bitcoin. Bitcoin was traded for $ 102.222 by losing 2.17 %in the last 24 hours, while the daily transaction volume increased by 14 %and exceeded $ 44 billion. BTC has been fluctuating around $ 101,000 – $ 106,000 for a while, and breaking these levels can significantly affect price movements.

Warning for Bitcoin price from Kiyosaki

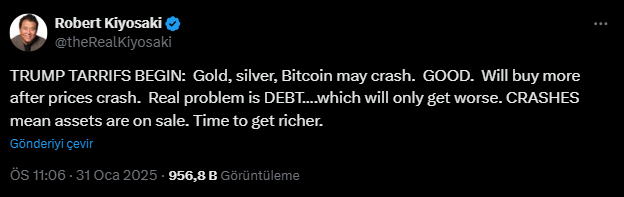

Famous finance investor Robert Kiyosaki said Trump’s tariffs could lead to a harsh decline over beings such as gold, silver and Bitcoin. However, Kiyosaki stressed that he saw this as a purchase opportunity. He used the following statements in his share in the social media platform X:

Trump tariffs started: Gold, silver and Bitcoin may fall. BEAUTIFUL. I will buy more when prices fall. The real problem is debt… And that’s just getting worse. Collapses mean that assets are discounted. It’s time to enrich.

On the other hand, Analyst Arthur Hayes expressed the expectation of a “mini financial crisis” at the beginning of the week. Hayes predicted that the price of Bitcoin could decline to $ 70,000 before a large rally.

What does On-Chain data point to?

In addition to Robert Kiyosaki’s evaluations, the Blockchain analysis company Glassnode set an important price set for Bitcoin. In the last 45 days, a large amount of BTC has changed hands in the range of 94,000 – $ 101,000. This made the level of $ 98,000 a critical support point. As long as the price of Bitcoin remains above this level, the rise momentum may continue. However, the price of below $ 98,000 can raise 90,000 dollars and lower levels.

Macroeconomic developments are being followed

Trump’s tariffs are expected to enter into force as of February 1, while fluctuations in the markets are expected to increase. In addition, the direction of the crypto currency market can be shaped depending on US employment data to be announced next week. Although Trump acknowledges that tariffs can lead to fluctuations in the markets in the short term, he said he trusts his long -term benefits. In particular, the threatening the US superiority in the field of artificial intelligence by Deepseek caused the Trump administration to plan to bring additional taxes to chip exports to China. Trump, “finally we will put a tariff on chips,” he said he is determined.

The US Federal Reserve (FED) has decided not to change interest rates due to strong labor market and increasing inflation pressure. Although Trump demanded that interest rates should be reduced immediately, the FED President Jerome Powell opposed these pressures. Despite all these developments, Bitcoin managed to stay above $ 100,000.