Gold prices rose on Friday and are poised for their first weekly gain since mid-April as the dollar pulls back from a two-year high and deepening concerns over US economic growth bolster the yellow metal’s safe-haven appeal. We have compiled analysts’ market comments and price predictions for our readers.

“Gold consolidates in $1,850 to $1,810 range”

According to a Reuters poll on Friday, the US central bank will cut interest rates until the end of this year just a month ago. higher than expected and will keep the already significant recession risks alive. Seen as a safe store of value in times of economic crisis, the yellow metal tends to become less attractive to investors when U.S. interest rates rise, as it does not yield returns.

GoldSilver Central dealer general manager Brian Lan says that after the recent rise in prices, gold is consolidating with resistance at $1,850 and support around $1,810.

Stephen Innes: Helping the US under growth fears

Cryptokoin.com As you can see, gold priced in the US dollar has gained nearly 1.9% this week, putting the US currency on track for its first weekly loss in seven weeks after the dollar’s slide. Stephen Innes, managing partner of SPI Asset Management, comments:

Recession fears are now driving US growth fears and the latter is helping gold. However, US Federal Reserve policy and an aggressive outlook for quantitative tightening (QT) still pose a major challenge for gold.

“Gold continues to struggle, but technical stance is not appropriate”

Gold is down 6.9% in May so far. DBS Bank Strategist Benjamin Wong says gold is now trading below a previous triangle breakout and testing the 200-day moving average (DMA) at $1,838, indicating that the technical stance is not favorable. The strategist illustrates the following technical view:

200-DMA Announcing dips below $1,838 necessitates a reconsideration of this corrective decline in the broader medium-term ranges. The downside is strengthening as gold prices remain below the Ichimoku cloud amid the persistence of the negative moving average convergence divergence (MACD) signal.

According to the strategy, the recent negative performance of gold is accelerated by both the steady increase in US 10-year real interest rates and the decline in fund assets traded on the gold exchange. Benjamin Wong states that the US real interest rates are an issue that should be considered because gold is a non-interest bearing asset, which is important only in a negative interest rate environment, and draws attention to the following technical levels:

Intermediate resistance point is $1,836 and temporary channel resistance is 1.842. First levels broken to restore confidence, marked in dollars. At $1,885, 100-DMA is equally solid. A sustained breakout turns the 38.2% Fibonacci retracement from $1,726 to $1,160-2,075 as the first visible target.

Jim Wyckoff: Low DXY and US rates favor gold bulls

Gold futures for US stocks on Wednesday It closed higher on Thursday and held its altitude on Friday, posting its best daily gain in nearly a month as the yellow metal capitalized on risk aversion after its worst day in two years. Senior analyst Jim Wyckoff assesses the current situation as follows:

The economic recession in the US is already fraught with other concerns, including the Russia-Ukraine war and the Covid cases in China causing major cities to be locked down and disrupting global trade. currently on the minds of traders and investors involved. A lower US dollar index and a drop in US Treasury yields today are also working in favor of the yellow metal market bulls.

“Yellow metal behaves differently than more cyclical commodities”

Analysts at HSBC Global Private Banking say that the current environment is quite low for gold. He says he’s confused. Analysts interpret the current situation as follows:

Gold, of course, behaves differently from more cyclical commodities. Rising real interest rates and a stronger dollar are creating headwinds for the precious metal, while mixed risk appetite is a tailwind. In the second-half investment outlook, we expect the dollar to rise while the yellow metal is neutral.

Pablo Piovano: Gold capped at $1,850

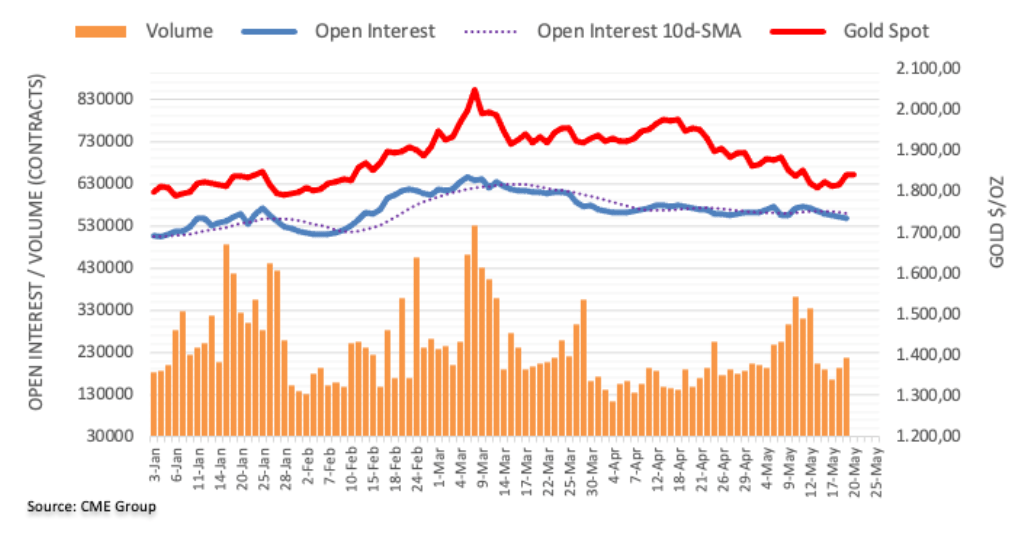

Given CME Group’s preliminary data for gold futures markets, open interest expanded the downtrend on Thursday, reaching around $2.50 .4 thousand contracts shrunk. Instead, volume rose for the second consecutive session, this time up by around 25.5k contracts.

According to the analyst, strong gains in gold prices on Thursday were behind the declining open interest and suggest that further recovery is not favored, at least in the very near term. However, the analyst states that the $1,850 area has emerged as the first hurdle for now.