So, there was a deal resolving the U.S. debt ceiling battle in Washington, D.C. Now what? First, let’s look at where we are.

The words “crypto” and “cryptocurrencies” don’t appear at all in the initial version of the deal. I wrestle with whether that’s good or bad. The Digital Asset Mining Energy (DAME) excise tax wasn’t included, so I’ve landed on the former since the omission is positive for the industry.

The proposal would’ve levied a 30% tax on any firm using computing resources to mine digital assets. The premise was driven by concerns about the consumption of fossil fuels in mining, and subsequent environmental harm.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Ironically, the debt ceiling agreement may be viewed as a win for fossil-fuel advocates. It includes a provision for the expedited completion of a natural-gas pipeline between West Virginia and Virginia (the Mountain Valley Pipeline). That is expected to transmit natural gas from the Marcellus and Utica shale gas fields to markets in the Mid- and South Atlantic regions of the U.S.

At first glance, this provision may actually be a positive for bitcoin (BTC) miners. Since some of them use excess natural gas as an energy source, several have previously set up operations near the Marcellus and Utica Shales to accomplish this.

Increased infrastructure for natural gas may lead to increased production, and thus increased excess gas, resulting in increased sources of energy for miners in the region. I would label this as an indirect benefit, and definitely one that was unintentional.

Indirect benefits notwithstanding, bitcoin reacted favorably to the agreement, with prices increasing 4% on Sunday. The move higher seems related more to increased certainty, and at least a sigh of relief that nothing antagonistic towards crypto was included.

(CoinDesk)

The price increase ranked 10th in daily moves for 2023.

Where do we go from here? A quick look at the schedules for both the House and the Senate indicate nothing currently planned as it relates to hearings.

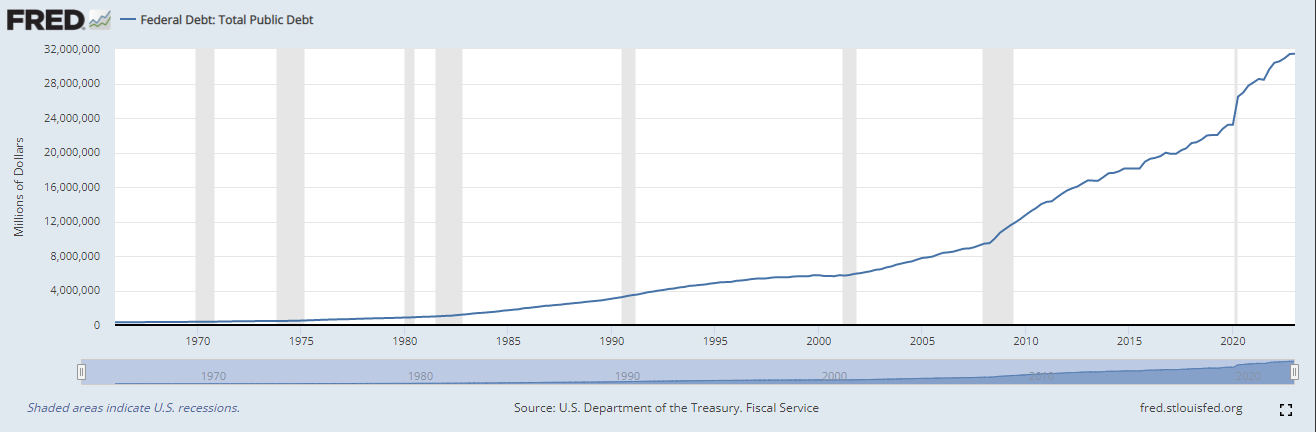

Total public debt will undoubtedly rise, as will the amount of interest payments being made by the U.S.

(St. Louis Fed)

The spread between 2- and 10-year Treasury yields remains negative, as short-term debt rates remain higher than longer-term debt. The problematic nature of the inverted yield curve can’t be ignored. It’s the equivalent of telling someone that you have more faith that someone will be able to pay you back in 10 years than in two – not exactly a ringing endorsement of present economic strength.

An increased issuance of bonds could occur, as the U.S. looks to rebuild its balances within the Treasury General Account – the result of which could be a withdrawal of liquidity from financial markets, and a potential headwind for bitcoin prices.

Another interpretation could be that the latest chapter of borrowing and spending will be viewed as exactly the reason why cryptocurrencies hold value. Particularly those with hard monetary supply caps like bitcoin. Advocates for ether (ETH) will likely trumpet its deflationary nature.

What will be interesting to see is the extent to which cryptocurrencies become a political football in 2023 and moving forward. Both sides of the aisle include individuals both for and against digital assets. Admittedly, it’s taken a decidedly more partisan turn over the last year, which I view as problematic.

The exclusion of a crypto mining tax allows the current administration the latitude to state that they took no negative action versus bitcoin, avoiding an issue that still appears to be very much up for grabs.

It will be important over time to keep an eye on who says what about crypto assets in the political realm. But as it relates to this most recent debt deal, not much was said at all.

Takeaways

From CoinDesk Deputy Editor-in-Chief Nick Baker, here’s some news worth reading: