According to crypto analyst Tony M, Bitcoin (BTC) is showing alarming signals behind the scenes. Also, some analysts suggest that it is high time for a deeper pullback in Bitcoin’s ‘relief’ rally. However, upside targets of $28,000 remain on the table.

“Bitcoin price at crossroads”

Bitcoin price has shown admirable price performance over the past few weeks. cryptocoin.com As you follow, BTC witnessed a low of 17,592 just two months ago. It has since hit a weekly high of $24,921. Despite the 40% rally, the trajectory has not been a smooth sailing ship. A few technical indicators and on-chain analysis tools confuse the idea of a weakening trend. Analyst Tony M shares the following analysis.

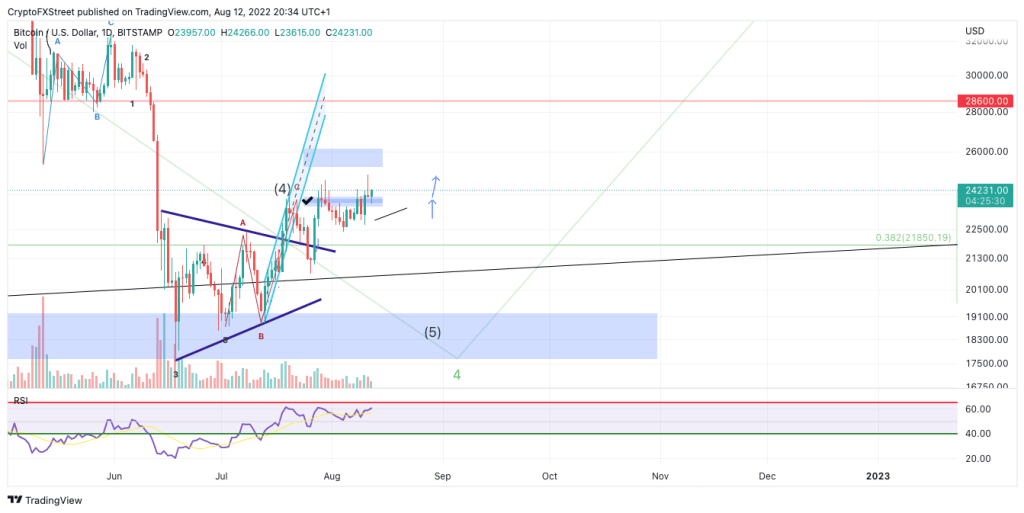

Bitcoin price is currently at auction at $24,238. A profitable consolidation is emerging near last week’s estimated target of $24,600. The Relative Strength Index shows a classic bearish trend. Also, the volume profile indicator shows the lack of interest from big-capital players.

BTC 1-day chart

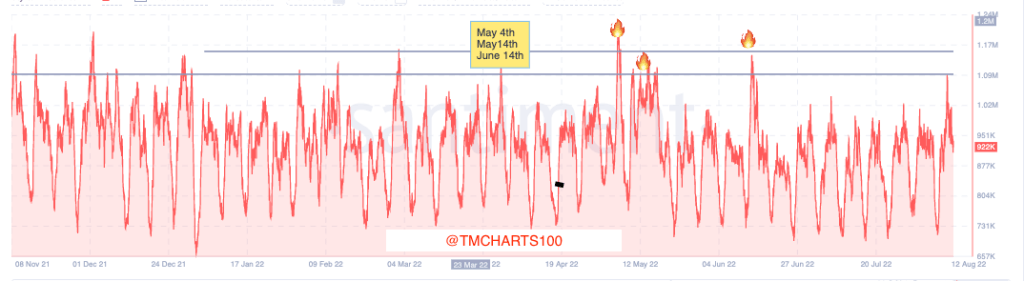

BTC 1-day chartAdditionally, Santiment’s Active Trading Indicator BTC price showed a significant increase in daily trading. On May 4, May 14 and June 24, the indicator pointed to a similar erratic rise each time. Shortly thereafter, there was a minimum 20% drop in Bitcoin price.

Santiment Active Transactions 1-hour scale

Santiment Active Transactions 1-hour scaleBitcoin price is still likely to rise to $26,800. However, there will be a daily close below $23,149 in the early hours of the bear trend scenario. If the bears can produce said price action, it is likely to cause a seller frenzy targeting $18,500 resulting in a drop of up to 20% from the current Bitcoin price.

BTC predictions by crypto analysts

According to TradingView data, BTC made a second rise near $25,000 on August 13. However, this move has so far been rejected. BTC had gained more than $1,300 overnight. However, near the critical resistance, the bulls’ momentum once again ran out. In this environment, few were optimistic about Bitcoin to avoid a deeper drop. “A final peak to blast early shorts,” said crypto analyst Crypto Il Capo.

Another trader Jibon prefers to be similarly cautious. The analyst says he will wait to rule out any trend reversal. He also notes that he will try to ‘buy higher’ at the spot price.

The more bullish Credible Crypto says any correction will still be bullish unless $20,700 is broken. With an attached chart, the analyst comments:

The relief increased much more than expected. But it seems like a clear push from local peaks. This suggests that it still makes the most sense to switch to green before continuing to 28k+. I cleaned up the chart a bit to make things clearer. Until then, the $20.7k invalidation raises the af on any dips.

BTC caption / Source: Credible Crypto / Twitter

BTC caption / Source: Credible Crypto / TwitterCrypto Tony continues a strategy with $24,500, which was a key support level from earlier in the week. “As long as we stay above the higher range, we are targeting the $27,000-$28,000 range,” the analyst adds.