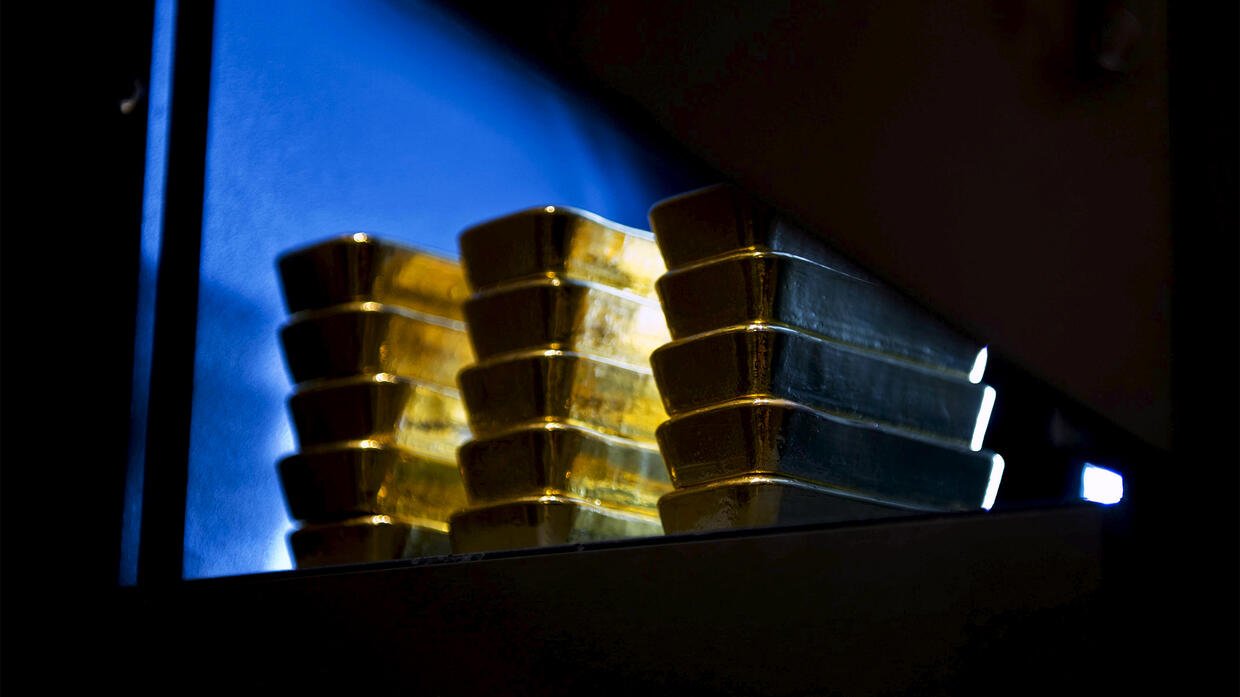

Gold rose marginally at first as US Treasury yields fell on Friday. But a rising dollar has slashed demand for bullion, setting prices for the biggest weekly drop in eight weeks. Analysts interpret the market and share their forecasts.

“Golden bulls hope for some delay from Fed”

Two of the Federal Reserve’s loudest hawks on Thursday said they would support another 75 basis point hike later this month. However, they noted that they would later switch to a slower speed. Stephen Innes, managing partner of SPI Asset Management, comments:

Given the market’s shift from inflation fears to growth concerns, gold bulls are hoping for some delay from the Fed. But a dove appeared.

“Gold is likely to have problems crossing $1,750-60”

Spot gold was up 0.2% at $1,744.07 at the time of writing. U.S. gold futures rose 0.1% to $1,740.50 a barrel. Benchmark US 10-year Treasury rates, declining after gains in the previous two sessions, revived non-yielding gold.

Stephen Innes says gold may have trouble breaking past $1,750-60 with stronger Treasury rates as it enters next week’s heavy US data list led by the consumer price index.

Suki Cooper: $1,690 key level for gold

cryptocoin.com As you follow, bullion has lost about 3.7% this week. It’s in its biggest weekly drop since May 13. It is also likely to drop in its fourth week. The dollar, on the other hand, is hovering near its highest level since 2002. That pushed dollar-priced gold to nine-month lows on Wednesday. In a note, Standard Charted analyst Suki Cooper highlights:

Gold is stuck amid rising inflation risks and growing concerns about a recession. The yellow metal has turned to take its cue from the dollar, which benefits from safe-haven flows rather than gold. Gold is also vulnerable to a weaker price base during a period of seasonally slow demand. The key level for bullion is $1,690.

David Meger: We’re seeing old-fashioned bargain hunting

David Meger, director of metals trading at High Ridge Futures, comments on the developments as follows:

After the dramatic sales of gold, we see old-fashioned bargain hunting. After yesterday’s drop towards $1,700, there is a clear interest in buying on the dips. The dollar, which did not increase further today, allowed gold to recover.

Fawad Razaqzada: Needs extra attention under short term

Gold has lost more than $300 since the Fed began raising interest rates in March to curb unruly inflation. This increased the opportunity cost of holding the non-returnable bullion.

The dollar emerged as the safe-haven of choice amid rising recession risks. It reached a level close to two decades in the previous session before easing on Thursday. City Index market analyst Fawad Razaqzada assesses the market as follows:

It is possible that the selling will easily continue in the environment of strong US dollar and rising interest rates. So any strength we might see underneath in the short term needs to be handled with extra care.

The next catalyst for the market is likely to come today, when the labor market report is released. The data showed earlier in the day that weekly jobless claims rose in the past week. In addition, it is seen that demand for labor has slowed and layoffs have reached the highest level in 16 months in June.