Fasten your belts! According to market expert Piero Cingari, there is a certain inflation threshold that causes gold prices to skyrocket. Cingari explains Inflaggedon, which expresses inflation getting out of control. He also discusses how gold would perform in this situation.

Why should traders prepare for Inflageddon?

The global economy is now on the verge of a new ‘Inflaggedon’ or a point of no return. In this case, inflation expectations remain constant. People are desperately trying to invest their money in anything that retains its purchasing value. Everything else is falling apart like a house of cards.

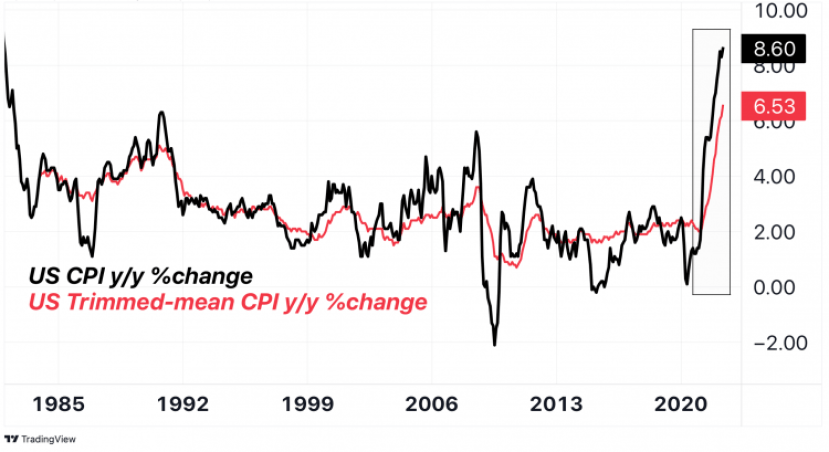

In June 2022, the US Consumer Price Index (CPI) rose to an annual rate of 9.1%, the highest since November 1981. Once again, it exceeded market expectations (8.8%). Inflation has increased for 25 consecutive months. The last time such an escape took place was during the Great Inflation of the mid-1970s. Most worrying, however, is that inflation is no longer just linked to price increases in food and energy commodities like gas and oil.

Instead, inflation is becoming more and more entrenched in services such as housing, restaurants, transportation and medical care, which are the most common components of consumption in the modern developed world. Services inflation is currently at 6.2% year-on-year, the highest in more than three decades.

The cropped average CPI is another indicator that inflation is now spreading like wildfire across the entire consumer basket. The clipped average inflation ‘clips’ the most uneven elements at the top and bottom of the distribution to get a clearer signal of inflation. Here we hit 6.5% annual rate, which is the highest since the series started. The factors that brought us here need to be analyzed comprehensively and separately. So how will Inflaggedon affect gold prices?

How will gold perform if inflation gets out of control?

cryptocoin.com As you can follow, the US inflation rate is at its highest level in over forty years. Average inflation shows alarming levels

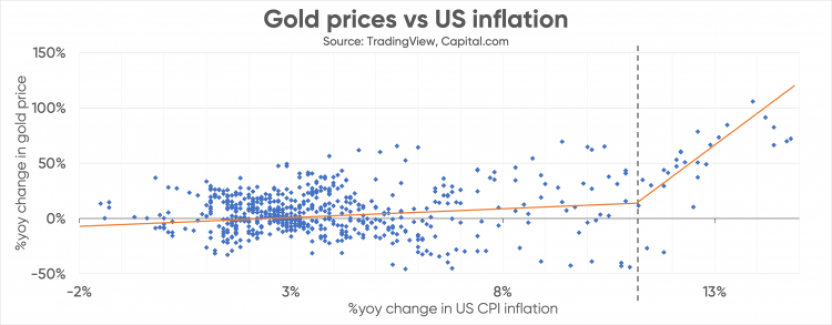

Gold is generally accepted as an effective inflation hedge. It is also said to be an asset that can protect the purchasing power of investors from the harmful effects of inflation. However, the data show that there is not always a clear relationship between gold and inflation. In fact, it is not always true that rising inflation causes an increase in gold prices and vice versa.

As we witnessed in the first half of 2022, inflationary pressures did not lead to big gains in the yellow metal. Besides inflation, there are a few things that affect gold prices. However, gold’s performance always peaked when inflation exceeded double-digit levels.

Inflation and gold: What does this shocking picture say?

The chart below shows that gold prices performed exceptionally (vertical axis) when the US CPI increased by 11% or more from the previous year (horizontal axis).

Gold jumps as inflation hits double digits

Gold jumps as inflation hits double digitsThe link between the two variables is weak when inflation remains in the single digits. Overall, gold performed inconsistently with inflation below 10%. However, inflation rates exceeding 10% triggered the great rise of gold. This has happened only a few times in history. But mostly during the Great Inflation of the 1970s. Why is the price of gold rising while inflation is so high?

Gold and inflation: insurance against loss of confidence and fear

Historically, gold has competed with government-issued paper currency. Unlike the dollar, gold cannot be printed by a central bank as it is a fixed amount in nature. On the other hand, we need to use paper dollars, not gold, to buy and sell things every day in the real economy. However, when people lose confidence in the central bank’s ability to control consumer price increases and see their currency’s real purchasing power diminish, they rush to buy gold.

As soon as inflation crosses the 10% psychological barrier, a loss of credibility is likely to be triggered. The psychological aspect of things plays an important role in how people manage their money. Naturally, double-digit inflation rates are a critical concern. What if all this was designed to artificially lower the government’s debt?

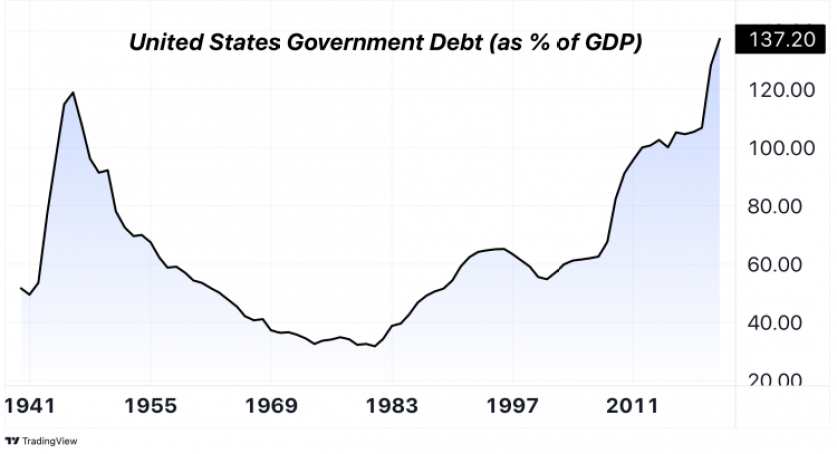

There are three ways to reduce a country’s debt. The first is to implement ‘austerity’ programs, which are difficult to achieve politically, by increasing taxes or reducing government spending. The second path is increased productivity, which drives economic growth, which requires technological progress. The third method, and perhaps the simplest, is inflation.

History shows that the idea of inflating a government’s debt has fueled increased fears of currency devaluation and depreciation. At the end of 2021, the US debt-to-GDP ratio reached 137%, the highest level since World War II. Federal Reserve policymakers are now struggling to control inflation despite aggressive rate hikes. Maybe the Fed woke up too late. Or the increase in inflation is due to factors outside the scope of monetary policy, such as the global energy crisis.

The thing is, there is a concern that inflation could spiral out of control for political reasons. In this case, the demand for gold increases rapidly as a precaution against inflation. This causes a large increase in the price of bullion. The 1970s served as evidence. Will history repeat itself in 2022?