Gold price outstripped the biggest weekly drop as the US dollar pulls back. However, the yellow metal posted slight gains around $1,845 as it entered the European session on Monday. Meanwhile, traders await US PMIs and testimony from Fed Chairman Jerome Powell amid recession fears. That’s why market analyst Anil Panchal views a corrective pullback as suspicious.

Gold price rebounds as US dollar pulls back

Dollar bulls are waiting for new clues from Fed policy makers. With this effect, the US Dollar Index (DXY) wiped out Friday’s recovery moves down 0.23%. In doing so, DXY is consolidating the previous three-week uptrend during a stagnant session in the US stock and bond markets. st. Louis Federal Reserve (FRED) data shows that the decline in US inflation expectations seems to have suffocated the DXY by refreshing its monthly low of 2.60%.

Falcon Fed speakers put bearish pressure on gold

cryptocoin.com As you can follow, Fed Policy makers supported the rate increase of 0.75%. When they made their last public appearance as soon as the pre-Fed blackout was over, they justified the move. Hence, the hawkish Fed speakers put pressure on the gold price in the previous week.

Among the key Fed hawks, Minneapolis Fed Chairman Neel Kashkari is backing another 75 basis point rate hike in July. Loretta Mester, Chairman of the Federal Reserve Bank of Cleveland, also dismissed expectations that inflation would be softer going forward. Additionally, Treasury Secretary Janet Yellen also touched on expectations for a slowdown in the economy. Yellen, however, ruled out recession concerns.

Powell needs to defend the hawks

On Wednesday, he will testify before Fed Chairman Jerome Powell’s Senate Banking Committee. Powell will have to justify the biggest rate hike since 1994. The semi-annual Monetary Policy Report mentions that the Gross Domestic Product (GDP) appears to be on track to increase moderately in the second quarter. According to Reuters, Powell is ready to testify about this report. His analyst comments:

Supporting more monetary policy aggression amid recession fears will be a challenge for the Fed Boss. Failure to do so is likely to extend gold’s recent recovery.

PMIs will be crucial for gold traders

We have witnessed the recent pessimistic data of the USA. According to the analyst, further softening of the data will allow gold to remain stronger. Therefore, preliminary data on June PMIs will be very important for gold traders.

On Friday, US May Industrial Production fell 0.2%, below the market forecast of 0.4. Details suggested stable Capacity Utilization and a contraction in production output. Forecasts show pessimistic data from S&P Global Manufacturing PMI for June against a slightly better service indicator for the month in question. As a result, it is possible that the Compound PMI will remain unchanged at 53.7 compared to the previous 53.6.

China is giving mixed signals

China announced that there was no change in its monetary policy. He has also witnessed the improvement in Covid conditions. However, it cannot support the gold price. The analyst explains the reason for this as follows:

Economic growth of the world’s second largest user of bullion is stagnant. It is also likely to be linked to lower 3.0% GDP growth in the second quarter of 2022.

The People’s Bank of China (PBOC) announced the 5-year and 1-year Credit Prime Rate (LPR) as 4.45% and 3.70%, respectively, on Monday. The rates remained unchanged. However, the Covid numbers in Beijing and Shanghai have improved. What’s more, it led to relaxation in activity controls throughout the week. However, Shenzhen has announced new quarantine measures due to local Covid cases.

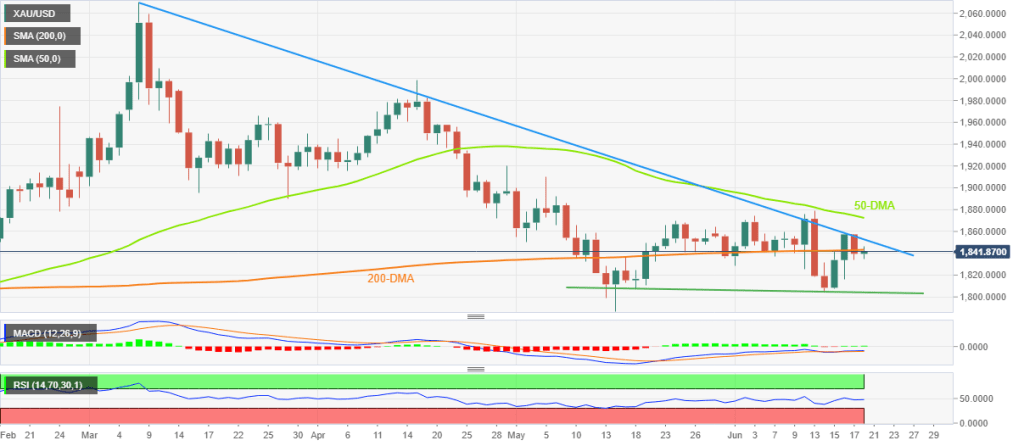

Gold price technical outlook: The overall trend remains bearish

Market analyst Anil Panchal evaluates the technical outlook of gold as follows. The gold price has not crossed a downward sloping resistance line since the beginning of March. It behaves like a seesaw around 200-DMA despite repeated failures in this region. The yellow metal has pulled back from a major short-term hurdle. In addition, the stable RSI and stagnant signals also indicate that the price is pushing further south.

However, if the price slides below the 200-DMA of $1,843, the month-start low near $1,830 is likely to offer close support. However, a five-week trendline support near $1,804 by press time is likely to precede the $1,800 threshold to challenge the entry of the bears later on.

Meanwhile, a clear break of the above-mentioned resistance line, no later than $1,855, is not an open invitation to gold bulls. Because the 50-DMA level around $1,872 and the monthly high near $1,880 will challenge the upside momentum afterwards. Overall, the gold price is likely to witness more sideways momentum. However, the overall trend remains bearish.