Bitcoin (BTC) is gaining momentum as it approaches $24,000. The expiration of options this week could help the bulls gain $200 million, according to experts.

Bitcoin bulls target $25,000

Fifty-one days have passed since Bitcoin (BTC) last closed above $24,000. This has caused even the most bulls to question whether a sustainable recovery is possible. However, despite the lackluster price action, the bulls have the upper hand in Friday’s $510 million BTC option expiration.

Investors are reducing their exposure to risk as the Fed raises interest rates and loosens its record $8.9 trillion balance sheet. As a result, the Bloomberg Commodity Index (BCOM), which measures changes in the prices of crude oil, natural gas, gold, corn and lean pork, fell 9% over the same period. Traders continue to seek protection through US Treasuries and cash positions, as San Francisco Fed chief Mary Daly said on Aug. However, the tighter monetary impact on inflation, employment levels and the global economy is yet to be seen.

Bears mostly under $22,000

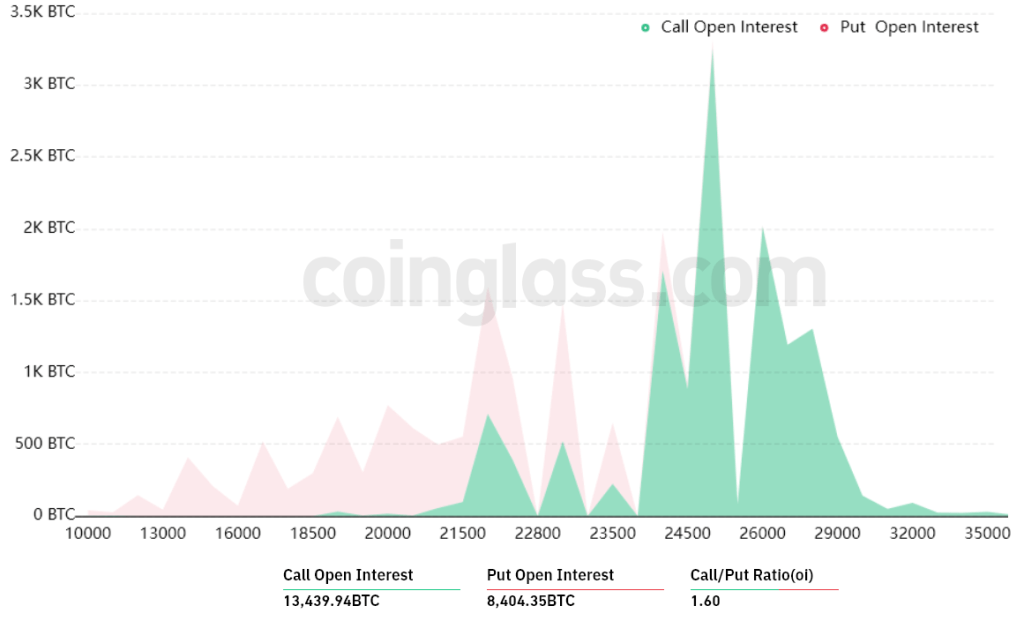

Bitcoin’s recovery above $22,000 on July 27 came as a surprise. This is because only 28% of put (sell) options for August 5 were above this price. Meanwhile, Bitcoin bulls may have been tricked by the July 30 spike of $24,500 as 59% of their bets are above $25,000.

A broader view using the 1.60 buy-to-sell ratio shows more bullishness. Because the call (buy) open interest is $315 million against $195 million of sell options. However, Bitcoin is currently trading above $23,000. Therefore, the drop will likely become worthless, according to analysts.

For example, if the price of Bitcoin stays above $23,000 at 01:00 on August 5, it will only be worth $19 million of those put (sell) options. This difference is due to the lack of the right to sell at $22,000 or $20,000 if Bitcoin trades above this level at maturity.

Bulls aim for $200M profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on August 5 for call (bullish) and put (bear) instruments varies depending on the expiry prices. The imbalance in favor of both parties creates theoretical profit:

- Between $20,000 and $22,000: 100 searches and 3,700 placements. The net result supports the bears by $75 million.

- Between $22,000 and $24,000: 1,400 searches and 1,600 placements. The net result is balanced between call (buy) and put (sell) instruments.

- Between $24,000 and $25,000: 3,800 calls vs. 100 placements. The net result supports the bulls at $90 million.

- Between $25,000 and $26,000: 0 searches and 7,900 placements. The bulls have increased their earnings to $200 million.

- This rough estimate considers bulls call options and put options only on neutral to bearish trades. Even so, this oversimplification ignores more complex investment strategies.

Bears are running out of power to suppress Bitcoin price

Bitcoin bulls need to push the price above $24,000 on August 5 for a profit of $90 million. On the other hand, the bears’ best-case scenario requires pressure below 22,000 for $75 million gains. However, too many short positions are accumulating, according to data from Coinglass. According to the firm, Bitcoin bears had 140 million short positions liquidated on July 26-27. As a result, they have less power to drive the price down in the short term. The most likely scenario would be a draw between $22,000 and $24,000.