The cryptocurrency market has seen additional sales in recent weeks with news of bankruptcies of lending platforms. Aside from the panic selling by miners and individual investors, the top 100 Ethereum whales are rapidly moving away from these 10 altcoin projects.

Ethereum whales have sold the most 10 altcoin projects today

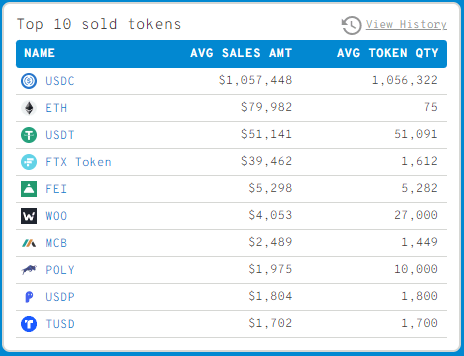

Active wallets of the cryptocurrency market have registered more than 147,000 addresses for the first time since November. Bitcoin (BTC) market cap fell another 33% in June, while altcoins are under selling pressure. Data provided by WhaleStats shows that whales are selling the most altcoins today, such as FTT, DEI, and WOO. USDC, ETH and USDT are generally at the top of this list. Interestingly, the whales also sold heavily on MCB and POLY today.

USDC, one of the largest stablecoins by market cap, saw sales of over $1 million today. On the other hand, Ethereum is in second place with $79,000. However, Ethereum has lost more than 10% since last week. Meanwhile, the Bitcoin price has also dropped by around 8%. Further down the list are USDT and FTT. Whales sold nearly $50,000 worth of USDC today. FTT, the native cryptocurrency of the FTX exchange, is in fourth place with $39,000. The general view of the list is as follows.

- USD Coin (USDC)

- Ethereum (ETH)

- Tether (USDT)

- FTX Token (FTT)

- Fei USD (FEI)

- Wootrade Network (WOO)

- MCDEX Token (MCB)

- Polymath (POLY)

- Pax Dollar (USDP)

- TrueUSD (TUSD)

As Bitcoin plummets, data shows whales are valuing

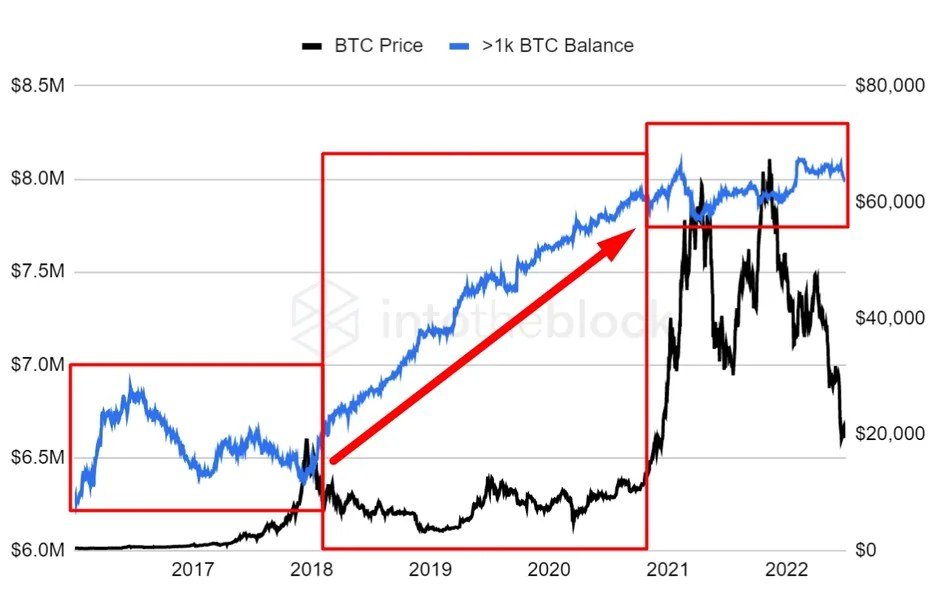

Amid the ongoing crash, on-chain data shows that Bitcoin whales are quietly packing their bags. cryptocoin.com As we reported in our analysis, Bitcoin is currently trading below $20,000. Meanwhile, ATH has lost around 70% of its price. During big sales like this, many investors liquidate their positions. However, this does not seem to be the case when it comes to those holding more than 1,000 BTC.

New data from IntoTheBlock shows that whales actually continued to accumulate during this decline.

Additionally, Juan Pellicer, research analyst at blockchain analytics firm IntoTheBlock, said, looking at this data:

In the last multi-year long bear market, Bitcoin whales took advantage of accumulating at a high rate as indicated by the red arrow on the chart.

But Pellicer pointed out the fact that although the whales’ balance continues to grow, “so far we don’t see them doing it with the same intensity as in the last bear cycle.” Earlier this week, blockchain analytics Glassnode also said that whales are aggressively increasing their balance, receiving 140,000 Bitcoins per month directly from exchanges. According to Glassnode, whales currently hold 8.69 million BTC, or 45.6% of Bitcoin’s total supply of 21 million.