According to a recent crypto report, our best days are yet to come. Here are the details of Andreessen Horowitz (a16z)’s report titled “The State of Crypto” which refers to altcoins, non-fungible token (NFT) space and web3…

How the concept of web3 is handled in the report ?

report a16z primarily covers the web3 domain. It’s crucial to understand exactly what web3 we hear so much about can do. Web 1 was about open protocols on the internet. In this network, anyone can use it while value is attributed to users and developers. In the Web 2 domain, most of this value is from Google, Facebook, Amazon, etc. It is owned by some large technology companies such as Web 3 is where the early internet values come back. Most of the functionality of the Web 2 application provides the community governance values of a decentralized internet.

a16z further illustrates why the current internet has flawed dictatorships developing central bank digital currencies (CBDCs), social credit system on the one hand, and giant technology oligopolies for no profit on the other.

The next section of the report covers the so-called “innovation cycles”. It can sometimes be difficult to separate technology from price because they are inextricably linked, whether we like it or not. This takes the concept to another level where they compare different volumes of market cap, developer activity, startup activity and social media activity. As reflected in the market cap, the idea is that price drives other components in the crypto space. These include education on GitHub, the amount of funds raised from private investors, and people talking about crypto on social media. This is the innovation feedback loop.

Popular altcoins and the Blockchains behind them: Here’s the comparison

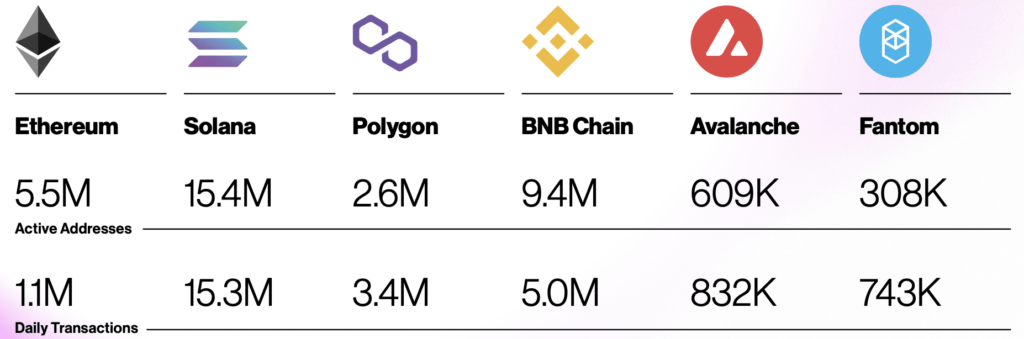

Later in the a16z report, various Blockchains seem to be mentioned. It is about these Blockchains that networks such as Solana (SOL) and BNB Chain exhibit much more users and daily transactions than Ethereum. On a seven-day average, Ethereum users pay more than ten times the prices paid on the next closest Blockchain BNB chain. Some may cite this as proof that the Ethereum blockchain is unsustainably expensive.

Ethereum usage demand is claimed to indicate some centrality in the crypto space, while the low fees of other layer-1 networks are also noteworthy. In the report, Ethereum, Solana, Polygon, BNB Chain, Avalanche and Fantom networks were compared in terms of daily transactions and number of active addresses. The only other blockchain that appears to be moving on a similar trajectory at this stage is Solana. Avalanche also seems to be growing pretty well since launch.

What’s next for DeFi, NFTs, stablecoins?

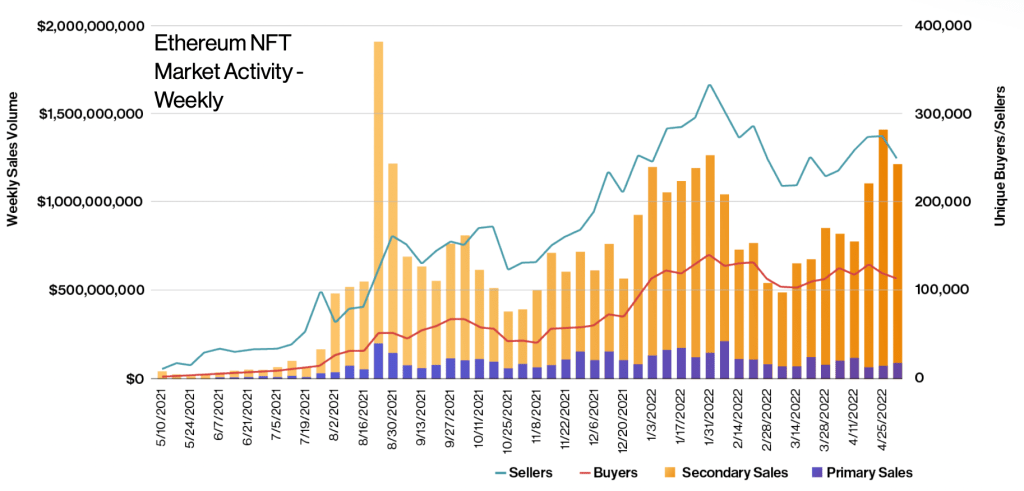

report a16z mentions that non-fungiable tokens are in the early stages. The chart below showing the weekly variation of NFT volumes on the Ethereum network is published, noting that secondary and main sales have not been able to peak for almost a year. However, the decline in the number of sellers and buyers seems to be picking up again.

In the field of decentralized finance (DeFi), the institution compares this area with the central finance area and states that DeFi can be among the big banks in terms of total locked amount. As for stablecoins based on an asset, the organization identified algorithmic stablecoins as the most decentralized, while those based on reserves were more reliable. As we reported on Kriptokoin.com , Terra USD (UST), an algorithmic stablecoin, spread shock waves to the field with its collapse.