Last week, we received the annual CPI data for October from the US, which was below expectations at 3.2 percent. Thus, annual inflation decreased from 3.7 percent to 3.2 percent in October, approaching the US Federal Reserve’s (Fed) 2 percent inflation target. As the view that the American central bank has stopped increasing interest rates continues to grow, investors will better understand the views of Fed members in the minutes of the Federal Open Market Committee (FOMC) meeting to be announced on November 21.

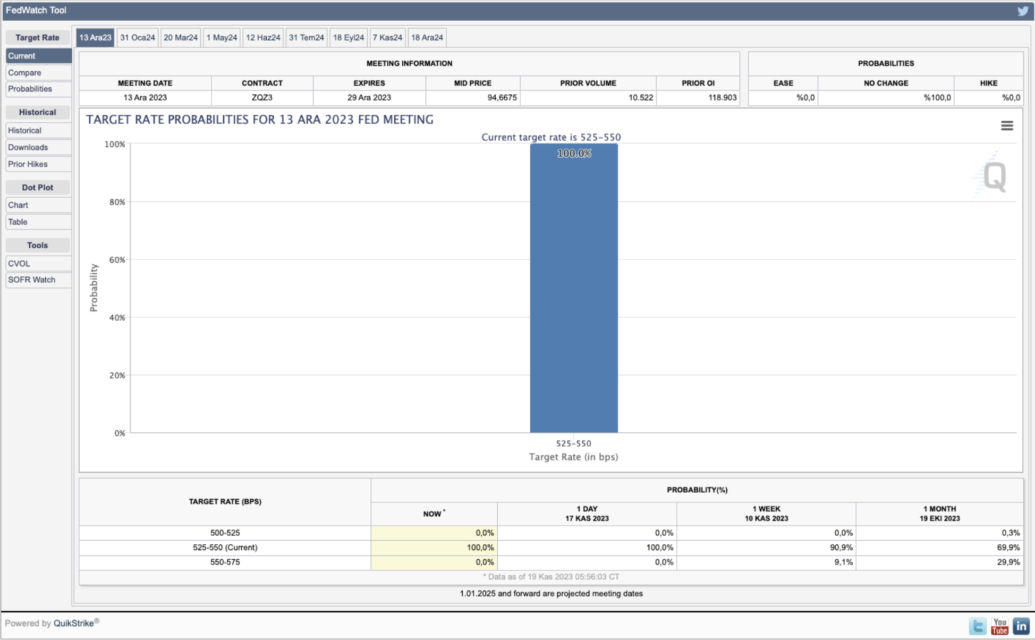

On the CME side, a new interest rate increase is 100 percent not expected at the last Fed meeting of the year, which will be held on December 13.

While inflation has reached such low levels, it is very possible that there will be interest rate cuts in 2024. There is little time left for the markets to breathe a sigh of relief. Bitcoin Halving will also occur in 2024. Thus, positive developments are listed one by one.

Another important development was spot Bitcoin exchange-traded fund (ETF) news. The US Securities and Exchange Commission (SEC) postponed the applications of Hashdex and Global X. The most important issue for us is January. Because the deadline for ARK Invest’s Bitcoin ETF application is January 10, 2024. Bloomberg analysts expect ETF approval to be 90 percent. On the other hand, BlackRock has officially applied for a spot ETH ETF.

On the Turkish side, the heart of crypto beat at Devconnect in Istanbul last week. With more than 200 events, projects came to our city and established ties with the Turkish community. We hope that many beautiful events that contribute to the ecosystem will take place in 2024.

Economic Calendar

Tuesday, November 21

USA – Federal Open Market Committee (FOMC) Meeting Minutes Will Be Announced – 22.00

Wednesday, November 22

USA – Applications for Unemployment Benefits Expectation: 225K Previous: 231K – 16.30

Thursday, November 23

USA – Thanksgiving Day and Stock Markets Closed

Turkey – Central Bank Interest Rate Decision Will Be Announced Expectation: 37.50% Previous: 35% 14.00

Bitcoin Technical Analysis

Bitcoin continues to consolidate between the $35,000 – $37,900 levels. Since the rise is strong and fast, the movement is happening as we expect. The next target for the price is to reach the $ 40,000 band. It may make a small retreat to the Range region at $ 35,000 and $ 37,900. Candle closings below the $ 32,800 – $ 33,400 levels that I determined with the black box may push us back to the $ 30,900 level, but now the trend is upwards.